There are a number of benefits that implementing insurance software can bring to Insurers and MGAs. In fact, we suggest finding out what these benefits are for Underwriters, Managers, and CFOs. But what are the options for using extra time saved, thanks to insurance software?

Before we dig in, we want to encourage you to not just take our word for it, but try it out yourself. Find out your time and cost savings in quote and bind if you have a rough idea of how much time you spend per quote and policy today. This calculator will also tell you the total cost to bind a target number of policies per year and the number of working hours required to do so.

Design New and Better Insurance Products

One of the best ways to use the time saved, thanks to insurance software is designing new and better insurance products.

Customers are expecting a smooth experience when buying insurance online. Even more, they are expecting insurance cover that meets their needs – purpose-built products that they can purchase on-demand.

To serve this growing number of customers, Insurers and MGAs must take on innovative approaches and create modular products based on micro-insurance and automation. That allows customers to purchase insurance on a per-item, per-use, and per-period basis. For example, insurtechs like Zego, Metromile, or Cuvva have unlocked innovation by offering products for the gig economy. Companies like Bought By Many or Sugar have made insurance more accessible and brought it to underserved segments.

To be able to create such offerings, Insurers and MGAs need to go to the grassroots level and redefine the way they build and deliver insurance products. There are several tools to help Insurers and MGAs achieve that.

Looking at Insly insurance platform as an example, the main drivers to help design better insurance products are low-code product builder and supporting tools like endorsement libraries, datasets and workflows, but also the rating engine and document editor. These unfold the following benefits:

- launching products is much quicker compared to legacy software and custom coding;

- you can see the latest iterations instantly;

- Insurers and MGAs can make changes and build products themselves.

Low-code design makes it much easier to create products and implement changes to processes, because basic IT knowledge is enough to build a fully functional insurance product. This gives access to product building to business users, and Insurers and MGAs can implement changes in-house, which can of course be a massive time-saver.

Deliver Non-Standard Products

Let’s take a look at how Insurers and MGAs can use the time saved to deliver innovative and non-standard products to their customers.

Underwriters looking to innovate in the B2C space are usually faced with a challenge: the user experience they seek to create requires a lot of flexibility from the insurance software in order to scale. A great example of using Insly product engine for non-standard B2C products is OneClickCover, which simplified the customer journey in home insurance in the UK.

The common benchmark in the UK home insurance is that customers have to answer 40-60 questions in order to get a quote, but OneClickCover changed the game to a point where the customer had to answer virtually no questions at all. This was achieved by smart use of property and occupants’ data to price the risk. Coupled with a policy fulfilment ecosystem, this allows the customer to get a quote and buy a policy, receiving the full policy documentation within 60 seconds.

Enter New Markets and Segments

Thanks to using insurance software, the time saved lays perfect grounds to expand your business and enter new markets and segments.

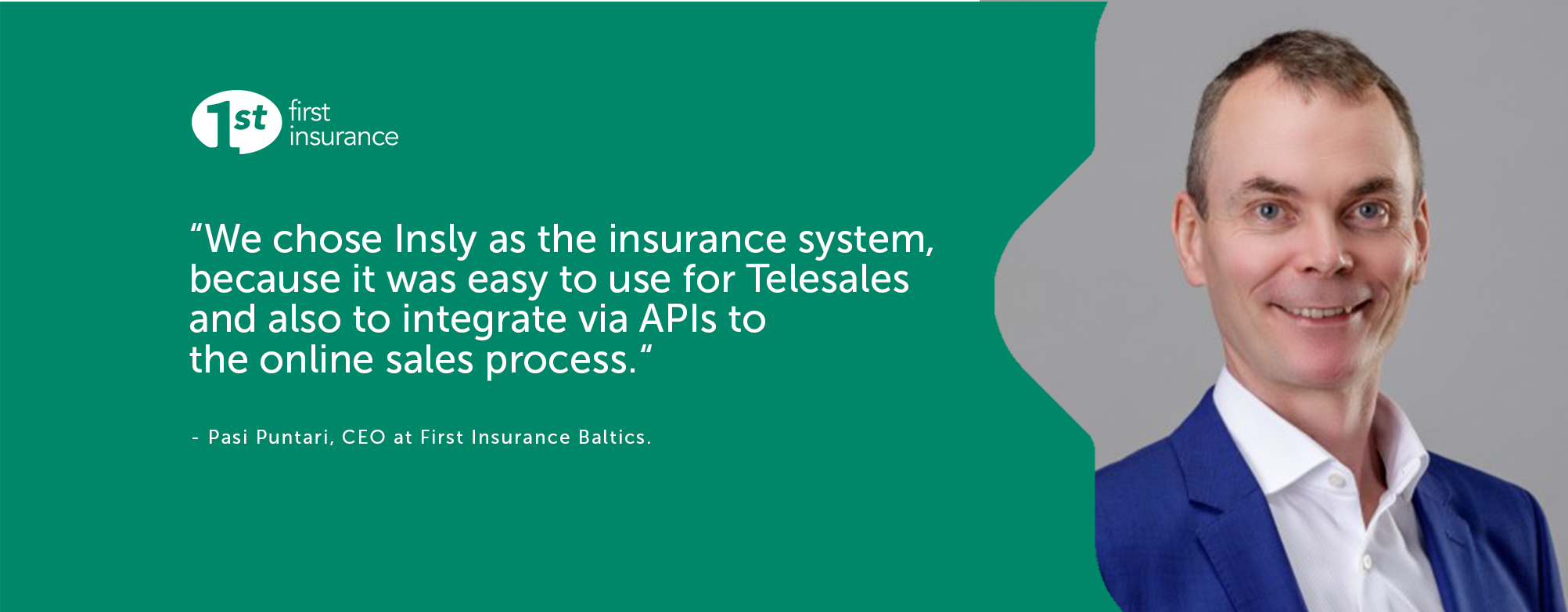

A great example of this is how First Insurance Baltics and Lenders launched an innovative income protection insurance product in Lithuania. Income protection insurance was previously not available in the Lithuanian market. To be able to launch the new product quickly and smoothly, they needed insurance software that would be flexible, easy to use, and integrate into both companies’ systems with no hassle. That is how they ended up using Insly.

The product was designed for multi-channel distribution from the start. Telesales channel was created instantly using Insly out-of-the-box functionality, and online sales was set up using APIs plus a small additional module for customer billing communication. Thanks to the modular build of the Insly platform and the use of APIs, all integrations between the two companies help streamline the customer experience. As a result, customers can buy income protection hassle-free both online and offline.

Develop New Distribution Channels and Partnerships

With some additional time on your hands, you can develop new distribution channels and partnerships. But let’s take a look at how to get to the point of having that time.

Brokers are the main distribution channel for 80% of Insly underwriter clients, so let’s explore this first. Ease of doing business is a big factor for Brokers who consider your ability to provide a quote and respond quickly against that of the competition. Creating a Broker portal with self-service capability is one way to solve that problem. If executed well, it can create a nice user experience for the Broker to get necessary information and documents to their client quickly, and provides great efficiencies for your Underwriters as they don’t have to spend their time looking at vanilla cases.

Not all products fit into a box and not all Brokers like portals, especially if they have to key in the same information to multiple portals for a standard cover. This is probably why we see a desire from many established Brokers to integrate directly into their markets via APIs. It comes at an IT investment to both parties, but API driven underwriting platforms like Insly can make it painless to integrate to most modern Broker software and the potential rewards for MGAs certainly outweigh the initial setup.

Ease of Broker onboarding is also something that varies from company to company. Insly makes it easy to add new partners to your network, manage their TOBAs and commission levels. Adding users to your Broker portal is also as easy as clicking a button.

There are several efficient ways to use the additional time you get thanks to insurance software. We’ll continue with suggestions on how to use that time in our upcoming post.