Automated insurance distribution via brokers, D2C and embedded channels, for a seamless customer journey

Founded by insurance brokers, knowledge of the broker channel is in Insly’s DNA and our suite of broker-distributed solutions is the most comprehensive on the market…

Insly’s portal gives brokers everything they need. Highly customisable user permissions provide precisely the right amount of control, from sending submissions to binding inside-the-box cases, plus handling MTAs and renewals. Product variations can be co-branded or completely white-labelled.

Reduce manual input by automating simple inside-the-box cases, with referrals flagged to your underwriting team. Workflows can be tweaked for each product, saving time through automated renewal quotes and mid-term changes.

Insly’s API-based rating service makes it easy for your broker partners to plug in and see your rates. Design your rater in Excel and seamlessly add it to your product to support a high volume of transactions per minute. Automated underwriting rules are easy to add on top of the rating criteria.

Excelling at D2C means standing out from the crowd with a seamless digital experience. But what if you want an engaging customer journey, and full control of your data, but don’t want to build an in-house system? Then Insly might just be the perfect partner for you. We handle the whole process spanning a powerful rating and underwriting engine to professional documents, and policy admin.

Automated data capture, processing, and storage are essential for more personalised underwriting, pricing, and long-term business growth. Insly ensures all your risk, premium, and claims data is securely stored, organized, and reportable from any angle.

Fully API-based rater brings multi-channel capabilities out of the box and can handle a high volume of transactions per minute. Easy to integrate and use, it works for e-commerce and offline sales alike.

Open APIs allow you to integrate your front end with policy admin functions, spanning document generation, policy changes, claims notification, and beyond. So your customers can access everything they need in one place.

Embedded insurance is at the forefront of distribution innovation, but backend reporting and compliance challenges are very “traditional”. Building new distribution partnerships and finding new market niches are vital for business growth, but traditional e-commerce solutions aren’t designed for selling insurance. That’s where Insly can help.

Our API-first design facilitates seamless interaction between your physical distribution sites and e-commerce frontends.

If a new market opportunity comes along you want to capitalise on it. Equipped with all the low-code tools you need including forms, workflows, endorsement library, capacity management and much more.

Our API-native rating engine provides multi-channel capabilities out-of-the-box. Increase your company’s agility in capturing both e-commerce and offline sales.

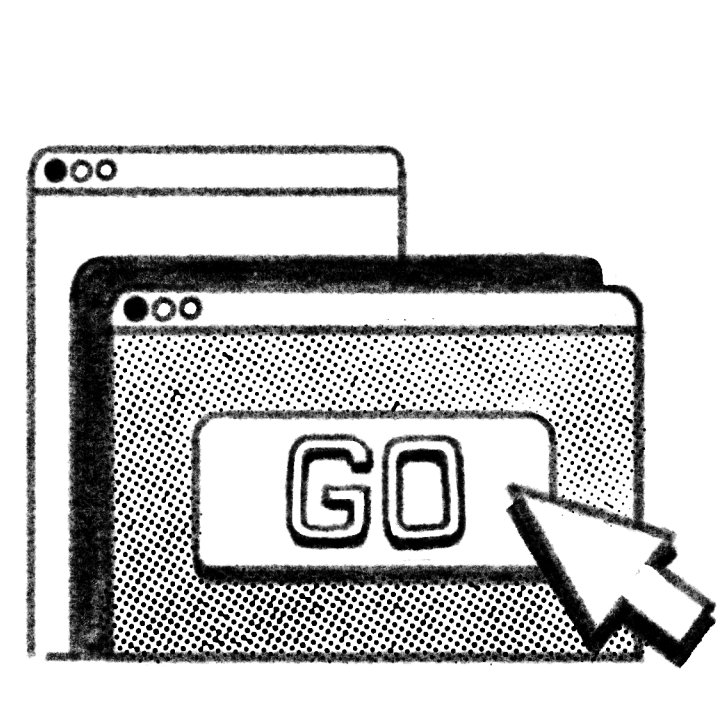

Make a plan and create your first product draft in a test environment in 2-3 weeks.

Add and combine key elements such as underwriting rules, templates and automations to create your ideal solution in 1-3 months

Your platform can be fully operational and ready to transform your business in 3+ months.