While the founder of Lloyd’s might be amazed by how far Lloyd’s of London has come in a little over 300 years, the insurance market is no longer the pioneer of the industry that it once was. It is now lagging behind in this age of constant insurance technology innovation.

In the 1600s, Edward Lloyd made sure that his coffee house (coffee houses served as business centres throughout London at that time) had the best and most information to offer. Today, the reality is that the London insurance market is operating with a surprisingly low amount of information. Big Data holds the power to dramatically improve the market, and the market knows this. In a 2014 global survey by The Economist of insurance executives, 86% of respondents said they are currently or will soon make more use of their data. These are positive signs of change, but many risks are still insured based on gut feelings and very basic tariffication, and it is not rare when an insurance policy is renewed and all the data is rekeyed into the system. Some brokers simply keep all their data in folders on their computer hard drives. This outdated mode of operating cannot sustain Lloyd’s prominent position, as the study released by London Market Group and The Boston Consulting Group last year made very clear. So why is it like this? There is no excuse for the insurance market’s refusal to innovate, but there are a couple of reasons to explain the lack of insurance technology innovation so far:

1. The market is heavily regulated

The insurance market – and especially the London insurance market – is quite heavily regulated. I am quite certain that the average insurance broker or MGA pays more money to compliance consultants than they are spending on software. Difficult regulation creates several problems:

- It complicates the process (innovation requires simplification).

- It absorbs time and money.

- It makes us hesitate to change the way we work (change creates risk of not doing correctly).

The paradox of regulation is that it is supposed to protect clients, but extensive regulation actually deprives clients of good service. In PwC’s 18th Annual Global CEO Survey, over-regulation is cited as the main threat to growth.

2. Lack of innovative minds

The challenge is also to find innovative young talent for the insurance broker industry, which is currently dominated by very experienced (but complacent) insurance professionals. The problems mentioned above combined with the unsexiness of the insurance industry and a completely boring work environment (compared to what many startups and coworking spaces in London are offering) just does not attract innovative minds. (It is no coincidence that Insly and the new insurance startup Worry+Peace are located in the Rainmaking Loft, which is still close to the insurance centre but full of inspiring young startups.)

In light of these hindrances, is there any hope for Lloyd’s to change? I have to respond with an enthusiastic YES. Lloyd’s is in the perfect position for technology innovation because the London market has several elements that the traditional insurance market does not possess:

- Small is able to innovate

Hundreds of small brokers and agents (MGAs) are logically much more likely and able to innovate than very big insurers. The London market is well known for innovative underwriting practices — here you can place risks and create products that are not accepted by traditional insurers. The groundwork for technology innovation is already in place. Now the sector needs to take that same approach with IT. Big traditional insurers have huge IT budgets which are mostly spent on upgrading old IT systems. MGAs can change the way insurance is distributed without the need for huge budgets.

- There are not a lot of incumbent IT systems

Most London brokers are working without IT systems, or they are working with IT systems that are rather easy to replace. That is exactly why the banking system in Estonia is much more technologically advanced than the banking system in London. Estonian banks have been able to create completely new, flexible IT systems instead of replacing or updating old ones. The London insurance market can do the same.

- London is the home of FinTech innovation

Everything the insurance market needs to innovate is available right here. They just need to take themselves out of the comfort zone of Lime Street pubs and instead visit some FinTech events. That is how they can tap into the technology, skills and innovative spirit of London’s FinTech revolution and create change in their own industry.

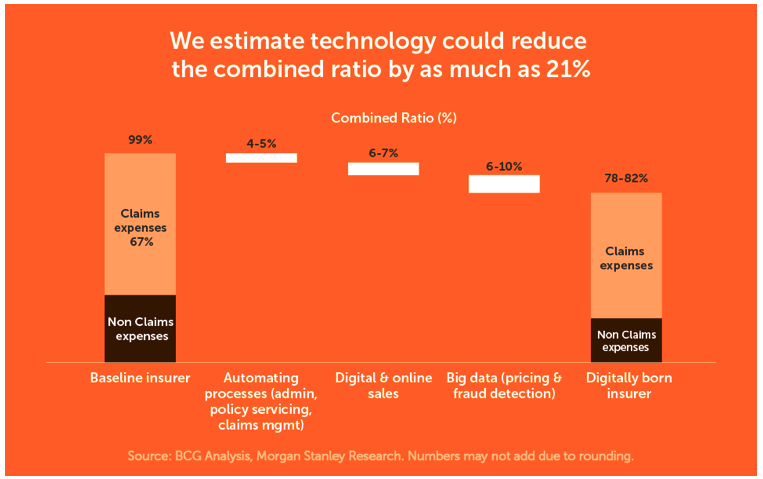

With the help of a good technology partner, an MGA operating on the Lloyd’s of London market can become an innovative digital insurer in a matter of minutes. According to a report from Morgan Stanley and the Boston Consulting Group, such an insurer is able to reduce the combined ratio by as much as 21%. But beyond the many benefits of technology innovation is the serious fact that London’s position as the insurance centre is threatened. A look back through Lloyd’s history shows us that the insurance market has been in this position many times before, and each time innovation has provided the way forward.

In our next post, we’re planning to reveal our hard-learned lessons for introducing as well as switching to new insurance software and for reducing the pain of the transition. Subscribe below to get the insider view of the industry.