Low-code, limitless possibilities

Flexible, end-to-end insurance software for MGAs and insurance companies.

Globally trusted by

Deliver better products, service, and profitability at scale across the entire insurance lifecycle

Low-code system can be implemented in a matter of weeks

No need for costly development time thanks to our flexible platform and team of experts

Modular approach is highly customisable and scalable

Start small or digitise end-to-end. Platform scales with your business, integrating through open APIs

Achieve fast ROI through operational efficiency

Insly customers can handle on average double the GWP as with previous systems by automating manual tasks

Mix and match from our suite of insurance software solutions:

Product builder

Build any non-life insurance product in weeks, rather than months, without writing code or involving developers.

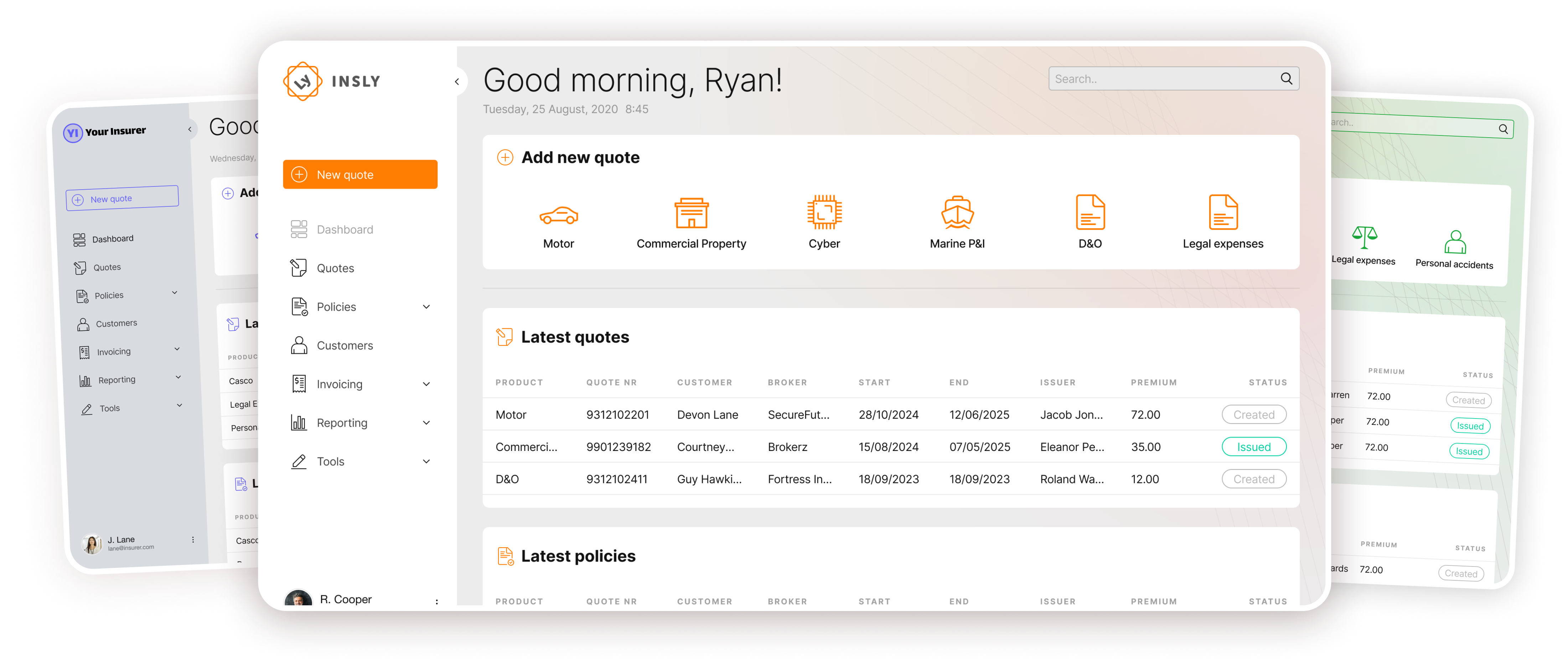

Product distribution

Create a seamless broker, direct to customer, or embedded insurance workflow, optimising the sales cycle and maximising conversions.

Insurance accounting and reporting

Automate your entire accounting function to reduce manual processes and aid compliance. Generate reports on any data point in the system.

Claims management

Our end-to-end claims management product suits any line of business and can be used standalone or integrated with other Insly modules.

What our customers are saying

It's never been easier to get set up.

Build and iterate quickly.

1. Identify scope

Make a plan and create your first product draft in a test environment in 2-3 weeks.

2. Build your ideal solution

Add and combine key elements such as underwriting rules, templates and automations to create your ideal solution in 1-3 months

3. Start selling insurance

Your platform can be fully operational and ready to transform your business in 3+ months.