A blockchain is a public ledger of all Bitcoin transactions that have ever been executed. It is constantly growing as ‘completed’ blocks are added to it with a new set of recordings. The blocks are added to the blockchain in a linear, chronological order. Each node (computer connected to the Bitcoin network using a client that performs the task of validating and relaying transactions) gets a copy of the blockchain, which gets downloaded automatically upon joining the Bitcoin network. The blockchain has complete information about the addresses and their balances right from the genesis block to the most recently completed block.

Source: bullfax.com

Blockchains and insurance?

Blockchain technology is said to have potential for financial services application, including insurance, through distributed applications hosted on decentralized platforms, such as: Bitcoin, the first blockchain protocol released in 2009; Ethereum, an open platform which could host distributed applications; or, BitNation, a more recent project which aims to provide financial services applications including insurance (though not much information is yet available).

Distributed applications appear particularly promising in the short term. First, applications could support the automation of insurance products based on betting like insurance products and financial derivative contracts. Crop insurance is often quoted as an example of hedging mechanism against adverse consequences of bad weather on a farmer’s harvest, which could be automated through a smart contract hosted on a blockchain protocol and using an oracle, in this case a trusted weather data feed.

Second, blockchain technology and distributed applications open up the range of assets and information that can be managed and stored on and from the blockchain, some of which can be relevant to insurance. Interesting models include applications to create universal digital IDs (e.g. World Citizenship Passport) or to store genetic and medical record data using for example Genecoin, which allows individuals to securely back up their own DNA by recording it on the blockchain or, DNA.Bits which aims to provide access to large samples of anonymised medical records and genetic data through the blockchain.

Third, new insurance solutions could emerge to handle risks arising from blockchain technology usage (e.g. account hacking on exchange where individuals can buy AltCoins to participate on a blockchain), digital asset protection or even in relation to the security of Internet of Things solutions, depending on demand (i.e. the extent to which individuals want to outsource emerging risks to third party providers) and feasibility.

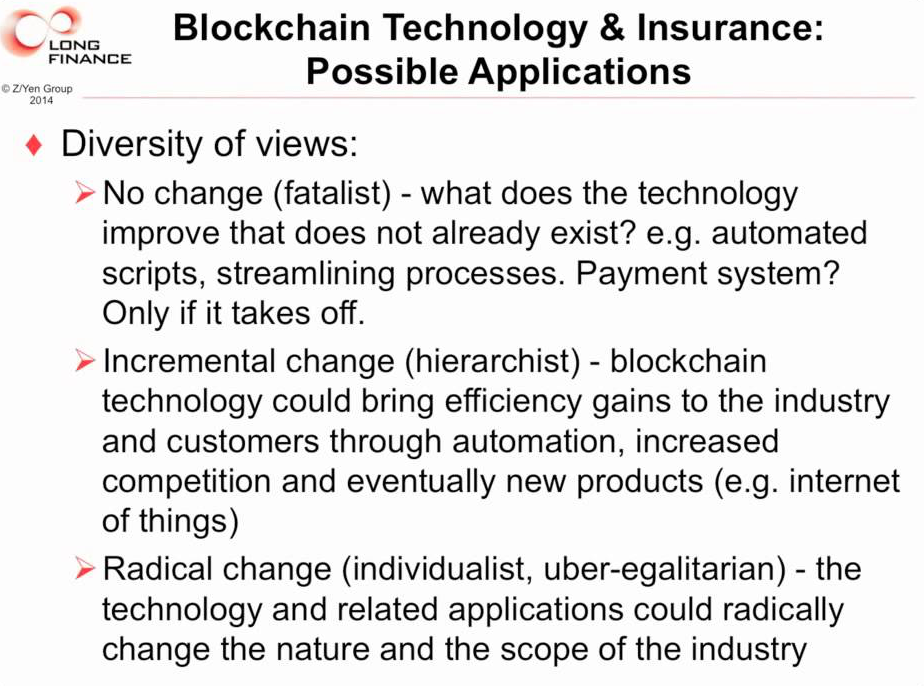

Blockchain technology and related applications could have implications for insurers in different ways (read more).

Source: longfinance.net

Changing the role

Blockchain technology may not revolutionise the way insurance operates. Nonetheless, it is likely to support wider trends of financial inclusion and new models of interactions between individuals and service providers including insurers. As a result, the technology and its applications could eventually contribute to changing the role and function of insurers in society. Blockchain technology and distributed applications could for example support access to affordable and quality insurance products through distributed micro-insurance solutions combined with mobile technologies; or, by extending insurance product coverage to previously excluded populations, provided that adequate identity and information management functionalities (e.g. notary or personal data management function) are in place.

Taking the concept of decentralised blockchain operated platforms further could lead to the emergence of decentralised marketplaces where insurance companies compete to meet the needs and requirements of clients or groups of clients whether in terms of insurance products or risk management expertise and advice. Such blockchain-based marketplaces could also emerge for other types of services including healthcare i.e. with doctors and health facilities competing to meet the needs of clients-patients in terms of treatment. Distributed identity and reputation systems (e.g. distributed ratings) could add useful functionalities to this type of platforms for example by improving transparency both ways, in terms of accurate disclosure from individuals to insurance companies and the other way around by enabling greater accountability of insurance companies to customers and regulators.

As people become more educated about risk (e.g. through Internet-based resources), technology, such as blockchains, can contribute to empowering them to manage certain risks directly. Should this materialise at scale, the shift in insurers’ role from risk handler to expert advice and knowledge provider in relation to direct risk management (including preventive measures) is likely to be reinforced.

Blockchains and London insurance market

Fundamentally corporate parties currently bring a snapshot of their exposures (schedule items) through their brokers to insurers, who retain some risk and transfer the rest to co-insurers and/or re-insurers and the latter may retro-cede part of it further. The entire process of each party taking its portion (and layer) of the risk occurs in a multi-phased manner essentially creating/augmenting and operating a network of contracts, getting premiums, paying brokerage, incurring capital allocation costs and claims including claims adjustment costs and making recoveries based on this network of contracts. During the quoting phase, where the corporate party details and exposure details need to be mapped and validated for fitment into the acceptance criteria of preexisting contracts and the exposures need to be processed using relevant models to make risk selection and pricing decisions within the guidelines of existing contracts, guidelines and best practices to generate, review and approve the quote. During the bind phase, each party setups up the contract and links it to the existing contracts between various parties. During the post-bind phase each party processes its exposures using catastrophe models to estimate its aggregate exposures and decides capital allocations by each party. During the claims phase, each party evaluates the claims adjustment data to approve claims/recoveries. At renewal the cycle repeats.

Blockchain is fundamentally a technology which eliminate the need for a centralized ledger (including ALL transaction data) for settlement and downward distribution purposes and it provides a means for ensuring integrity of distributed copies of the ledger (and ALL transaction data). Due to this, it offers a different way of doing the commercial insurance business in London market which can bring the following benefits.

Based on good quality slip and exposure data capture (through PPL? or P2P), Blockchain technology can facilitate setup and management of all insurance contracts (primary insurance contracts, co-insurance contracts, secondary re-insurance contracts, tertiary retro-cession contracts). This can ensure proper payment and settlement of premiums and brokerage, commissions between all parties much faster than the current slow manner without the need for a central bureau (i.e CSRP?). Each party in these contracts (customer, broker, insurer, co-insurer, reinsurer, retroceder) can get an identical copy of the exposure data related to these contracts between the parties. Based on good quality initial data capture, this will resolve the data quality issues and help each party to leverage appropriate catastrophe models to measure aggregate exposures and make capital allocation decisions.

From (PPL based? or P2P) good quality loss data capture during FNOL and later during claims life cycle in compliance with the criteria agreed in the network of contracts, Blockchain technology can help all parties to get a copy of the relevant data to make their claims, recovery decisions and settle the related payments without need for a central bureau (i.e CSRP?).

This can also extend to ensure that each party gets identical incremental exposure or loss data based on IoT/IIoT for each schedule line-item in the exposure.

Read more about London Blockchain Conference 2016.

Blockchain on Lime Street

Early in 2015 Lloyd’s of London had over 100 people in a room on the fabled Gallery 11 listening to five industry experts, with a focus on how insurers should understand and price those companies mining or holding bit coins.

The focus is now moving on from Bitcoin as a source of insurable risk to blockchain as a technology that might support (or replace?) the insurance contract. The intrinsic properties of the blockchain – a decentralised, secure ledger that tracks all related transactions – should be immediately recognisable to an insurance practitioner as a means of storing the agreement of cover between the carrier and the insured.

The challenge – as ever – is to take the new technology and both prove it is genuinely fit for purpose and identify in what way it is superior to the current way of working. In addition, in an industry where physical paper is still an accepted norm, it has to break through the barrier of general technology aversion and Luddite tendencies.

Blockchain technology with a wide range of insurance use cases by Riskebiz:

Lots of good examples, such as:

– using a prediction market such as Augur to collect hard to determine actuarial data

– a community/consensus-based mechanism to underwrite and manage claim by leveraging local individuals to verify situations and payout events and making use of a blockchain to record them

– using smart contract to automate certain parts of insurance process such as payment of claim once approved

– real-time remote auditing by regulators to ensure solvency

Dynamis App

Another example is a project that is creating an insurance smart contract DAO with the aim of making it an “insurance company/community/mutual on a blockchain” with as many parts automated or crowdsourced as possible.

As one would expect, most of the above are still in their infancy with many practicalities to iron out, but I can see the likely full benefits of blockchain impacting firstly index-based insurance (such as microinsurance where there is less need for underwriting and loss assessment and there is a sense of community), and then slowly impacting indemnity-based insurance (underwriting and loss assessment will be done through engaging networks of self-employed underwriters/loss adjusters selected through reputation and voting systems and disputes solved through arbitration systems such as Bitrated).

Sources:

instechlondon.wordpress.com, LinkedIn Pulse article written by Pratap Tambay, longfinance.net, Wikipedia

Read more innovation news from Insly BLOG.