No matter how much work an insurance business puts into acquiring clients and streamlining underwriting or sales, the customer claims experience will always be the most pivotal factor in bolstering your brand’s reputation.

From an MGA and insurance company perspective, claims costs make up the largest share of an insurer’s outgoings and influence their risk selection and premium pricing decisions. So, business owners need to ensure that they are not overpaying or making mistakes in this area, as it could lead to them becoming less profitable.

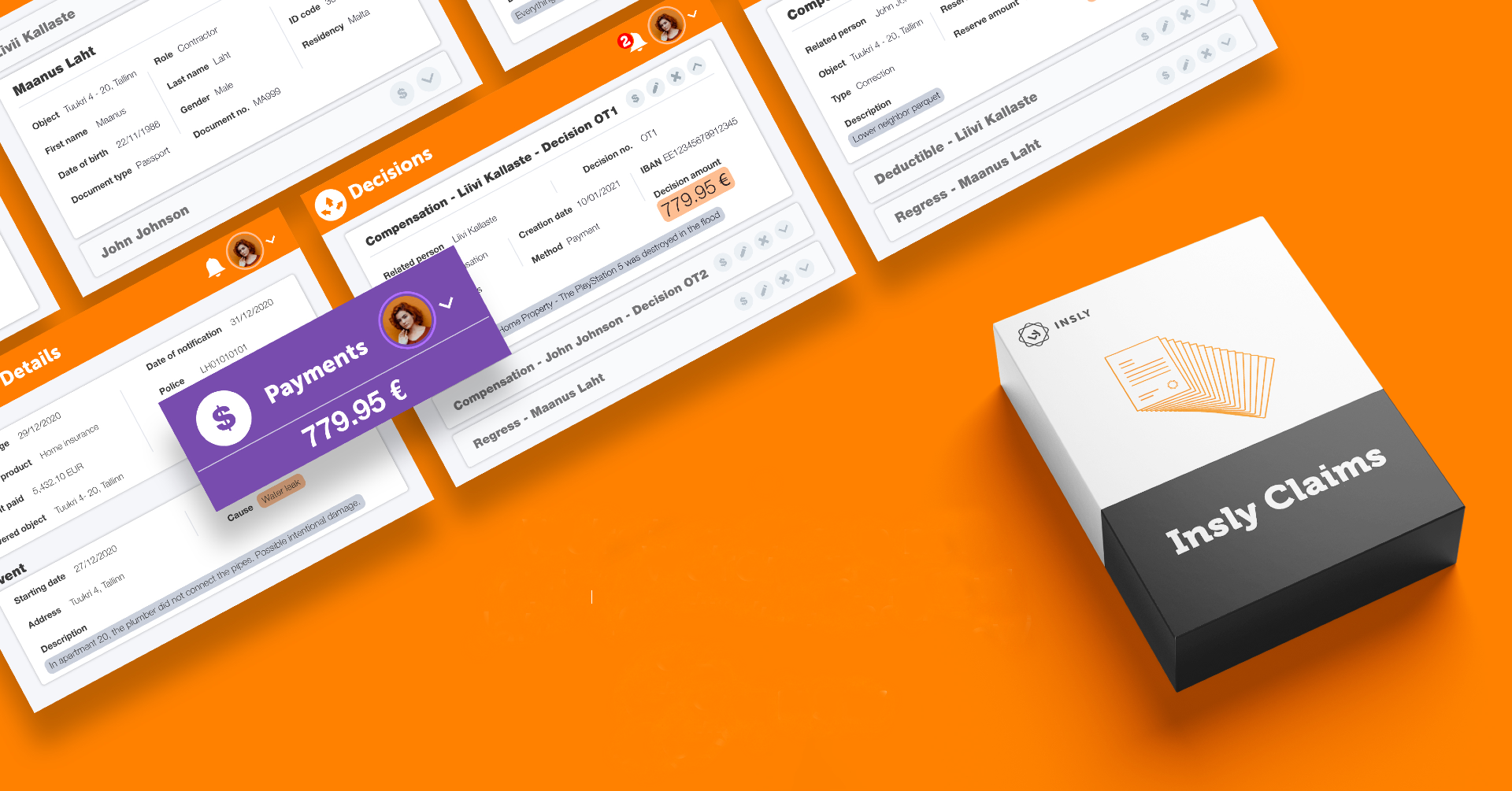

In this post, we spoke to Eero Link, Insly’s Claims Product Manager to outline Insly’s latest insurance document management software update. Here, Eero explains how it can help insurers streamline claims handling protocols and plug claims leakage expenses so companies can remain cost-effective in the long term.

Why plugging claims leakage is vital

Claims leakage describes the gap between the settlement amount an insurer pays out and the amount that could have been paid if the claims procedure had been optimised to its fullest extent.

Last year, experts in the UK estimated that 5-10% of the total amount paid in insurance claims settlements could be classified as leakage. However, the problem only becomes apparent to insurers after the money has been paid out. Therefore, the most reliable method for controlling these costs is to ensure that your claims management procedures are as efficient as possible, preventing claims leakage in the first instance.

Once a company knows its claims procedures are optimised, claims data analysis tools can then help companies make sense of their risk selection, claims, and premium pricing structures. From there, business leaders can work on strengthening their protocols to ensure they are driving maximum value for both their customers and capacity providers.

Obstacles in manual claims handling processes

In this previous post, we outline some bottlenecks in claims processing that result in lower customer satisfaction scores, such as wasting time on manual processes. Customers are used to fast service delivery thanks to internet technologies. With this being the case, insurance claims handling should also follow suit, handling cases from First Notice of Loss (FNOL) to settlement as soon as possible.

Failure to optimise these processes risks insurers’ loyal customers who may choose to shop elsewhere for cover from brands that can assure more streamlined claims services. Additionally, with the loss of customers, it can then become difficult for insurers and MGAs to adjust their premium prices to stay competitive in their market.

How Insly’s Insurance document management software helps you plug claims leakage

Our brand new claims management platform can be used to enhance your firm’s claims management procedures in the following ways:

Speeding up the claims management process

“It’s quite common for MGAs to use different external teams to handle their claims, and usually it goes through different call centres,” says Eero. “But now, Insly makes it possible to cut off the call centre fully. Cost-wise it’s a huge saving for the client. Customers can make FNOLs directly into our claim webform, and the claim data will be collected from there. Also, guidance can be given automatically. For example, the claimant can be notified to send additional information, if needed. And this is a huge time and cost save for companies.”

Manually verifying this data is labour-intensive and vulnerable to human error. Tasks that don’t add to your value chain but form a necessary part of your due diligence can be handled using Insly’s new claims management tools. For simple claims cases, our Fast Track claims tools can also be used to automate the entire claims cycle. “Basically, it is possible to handle the claim without human intervention at all,” says Eero.

Alternatively, Insly lets you establish claims processing rules for more complex claims decisions. Insurance document automation can handle more straightforward aspects of the process while leaving claims teams open to use manual processes, where needed, to ensure that the settlements are agreed upon in alignment with best business practices.

Eero believes that Insly’s tools can help lower your claims processing costs by around 20% – a significant saving that can help you stay competitive in an increasingly digitised economy.

Streamlining fraud detection and prevention capabilities

Claims fraud is a huge issue in the insurance industry. To illustrate, last year insurers in the US paid out $30 billion in fraudulent property and casualty insurance claims.

Implementing automated fraud detection tools helps teams quickly review documentation and highlight any areas of concern. For example, Insly’s tools can match data from policy and claims forms, check against dates, and policy deductibles information.

“We have plenty of different rules coded into the system, which will help discover fraud. Also, it’s possible to add/change rules in the system that can be set according to the client needs,” explains Eero.

Integration with existing insurance document automation systems

For many MGAs and insurance companies, reliance on legacy systems holds company bosses back from getting the most out of their insurance IT systems. For instance, a specialist MGA may rely on spreadsheets to help them make claims settlement decisions and manually update accounts teams on the sums they have paid out semi-regularly. Insly’s claims management tools can automate these tasks for you, as its modular setup can integrate with your existing Bordeaux reporting and accounting tools.

Insly’s low-code, modular design allows you to add features (like document generation and underwriting systems) when needed. We offer a truly unique and easy-to-use platform that will enable you to customise your procedures. “You can choose different functions specifically for your business. So, yes, Insly is very different. There is no comparison in the market when it comes to claims management functionality versus price,” Eero concludes.

Insly’s low/no-code platform is your ideal partner in claims handling

We have over two decades of experience within the insurance industry and operate within an extensive network of Insurtech experts. With our combined skills and deep knowledge of the insurance sector, we’ve created a highly customisable and intuitive document automation for insurance platform that can align with your business’ digitisation needs.

Whether you are just starting to move away from legacy systems or are looking for easy-to-integrate tools that align with your existing technologies, our team can help you build your ideal-fit solution.

Get in touch with us for a free demo of our claims management platform and other underwriting and insurance admin features.