The insurance market in 2024 is hugely competitive. Premium inflation means that customers are shopping around for the best deals and the most suitable cover for their evolving needs. Insurance providers need to do everything they can to offer the best products and customer experience, while also streamlining processes and costs.

Thankfully, there are now a host of insurtech providers that can help insurance businesses, large and small, to digitise how they work. Insurance software can now automate processes across the insurance lifecycle, from product development to distribution, underwriting, claims, accounting, and finance, bringing a host of business benefits.

Benefits of implementing insurance software

- Enhanced customer experience: The right software makes buying insurance as easy as possible for customers.

- Streamlined processes: Automating inefficient manual tasks means faster and more accurate policy sales and administration.

- Reduced costs: Digitising inefficient manual processes will deliver significant return on investment for the business.

- Stronger broker and carrier relationships: Better processes will also make life easier for brokers and carriers, ensuring they have all the information they need to do their jobs.

- Faster product development: The latest technology enables you to innovate faster, through rapidly developing and testing new products.

There has been an explosion in insurance technology solutions in recent years, but how do you choose the best one for your business? We’ve done some of the hard work for you, by scouring the most popular review and comparison sites and testing out the best insurance software products in 2024.

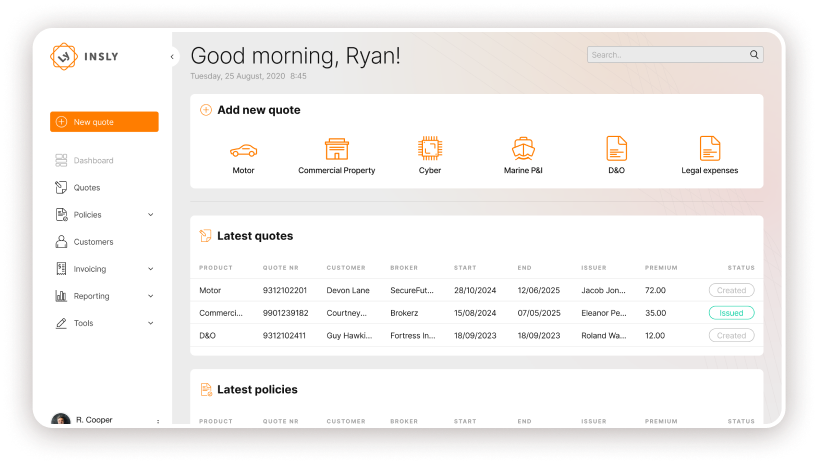

1. Insly

Founded in 2013, Insly provides full-cycle low/no-code MGA insurance software. Insly aims to make insurance technology easy to implement and use, enabling insurance companies to increase efficiency, optimise customer experience, and reduce unnecessary costs.

Top features:

- A no/low-code platform, it can be customised to your business needs without lengthy and costly development time.

- It is cloud-based, so no hardware or complex installation necessary.

- It covers the whole insurance lifecycle, from quote right through to claims, plus accounting, and reporting.

- It can be tailored and scaled to suit insurance businesses of all sizes, from a few to hundreds of people. Insly’s modular approach means you can start small and add functionality as your needs grow.

What we love:

- Super-fast implementation: the system can be up and running within weeks rather than months.

- It can be easily tailored to the needs of any insurance business, from very niche to more generalist providers.

- The automated underwriting system is fantastic for removing the manual work from generating quotes, while also alerting teams when cases need deeper analysis.

- The system looks and feels very slick, with an intuitive interface.

- We were very impressed with Insly’s reporting capabilities. Any data point captured by the system is available for reporting. So insurance providers can stay fully on top of their book of business and customer base.

Pricing: Varies based on number of users and modules required.

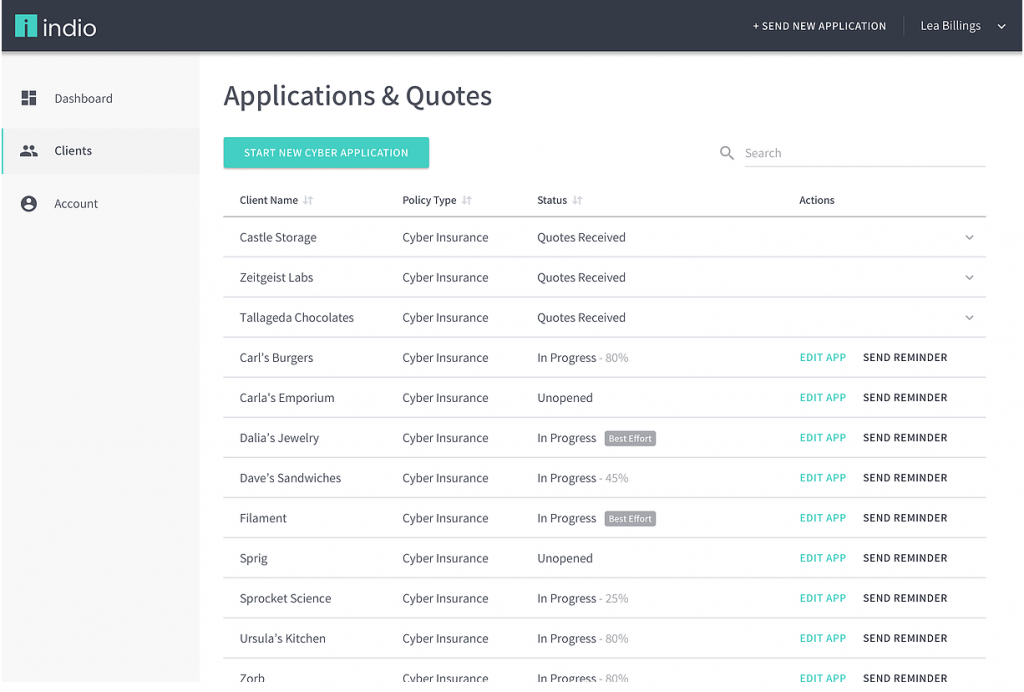

2. Indio

Indio is a cloud-based solution which focuses purely on insurance application and renewal processes, rather than the entire insurance lifecycle.

Top features:

- Cloud-based, so no hardware required.

- It has a huge library of more than 10,000 customisable insurance forms covering the whole range of insurance processes. If they don’t already have it, they will create it.

- Indio’s “smart form” technology makes filling out forms super easy, for example it will automap from one form to another.

- Data can be uploaded in spreadsheets, forms or AMS exports and the system will clean and sanitise it, so it is structured, standardised and ready to use.

What we loved

- The Intelligent Activity Tracking functionality is useful for notifying users when customers sign in, update their information, complete forms, or submit documents.

- Indio is very simple to use, and we found the platform easy to navigate around. We also found identifying and then working with the various template documents very straightforward.

- The signature function is helpful, enabling multiple documents to be sent to customers for signature in a streamlined way. It makes life easy for customers.

- Indio is a good option if your insurance business only needs application and renewal automation, although there are better systems out there if you need a more holistic solution.

Pricing: Contact Indio for pricing

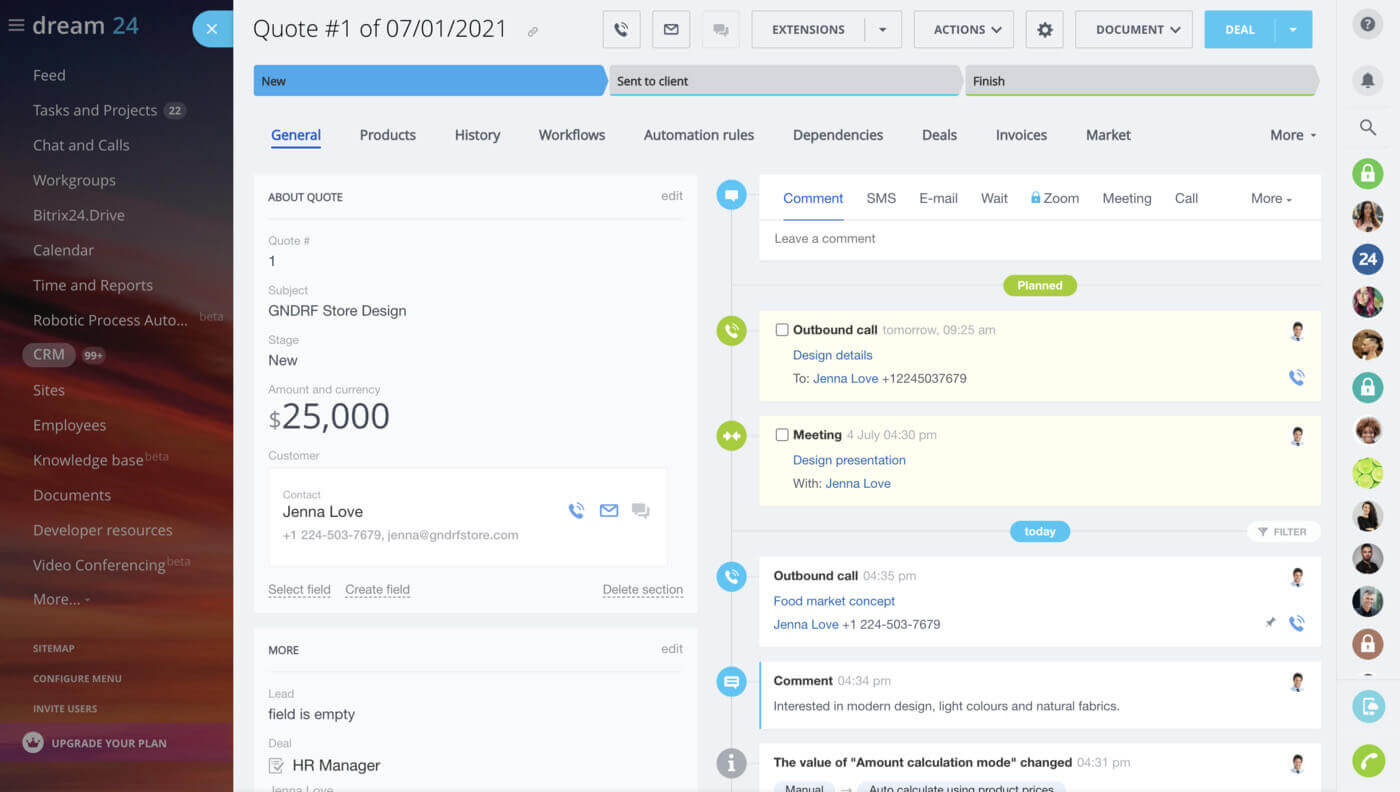

3. Bitrix24

Bitrix24 is an open-source, free collaboration platform incorporating various tools, including CRM, document, task, time, and project management systems. Bitrix24 aims to provide a practical solution for managing a company online. Although it isn’t designed specifically for insurance businesses.

Top features

- Incorporates collaboration tools such as video and conference calls, a chat feature and time tracking.

- Comprehensive CRM system, spanning lead acquisition, lead management and sales automation.

- Contact Center functionality enables companies to manage all their customer communication from a central dashboard, including social media, email, telephony and beyond.

What we loved

- Great value for money, making it a good first solution for small or startup insurance providers.

- It can be scaled up easily, including an on-premise solution which can be customised for businesses with more complex requirements.

- Its interface will feel familiar to social media users, featuring user profiles, likes, and comments functionalities within its insurance management toolkit.

Pricing: From free to £299/month depending on plan/size of organisation

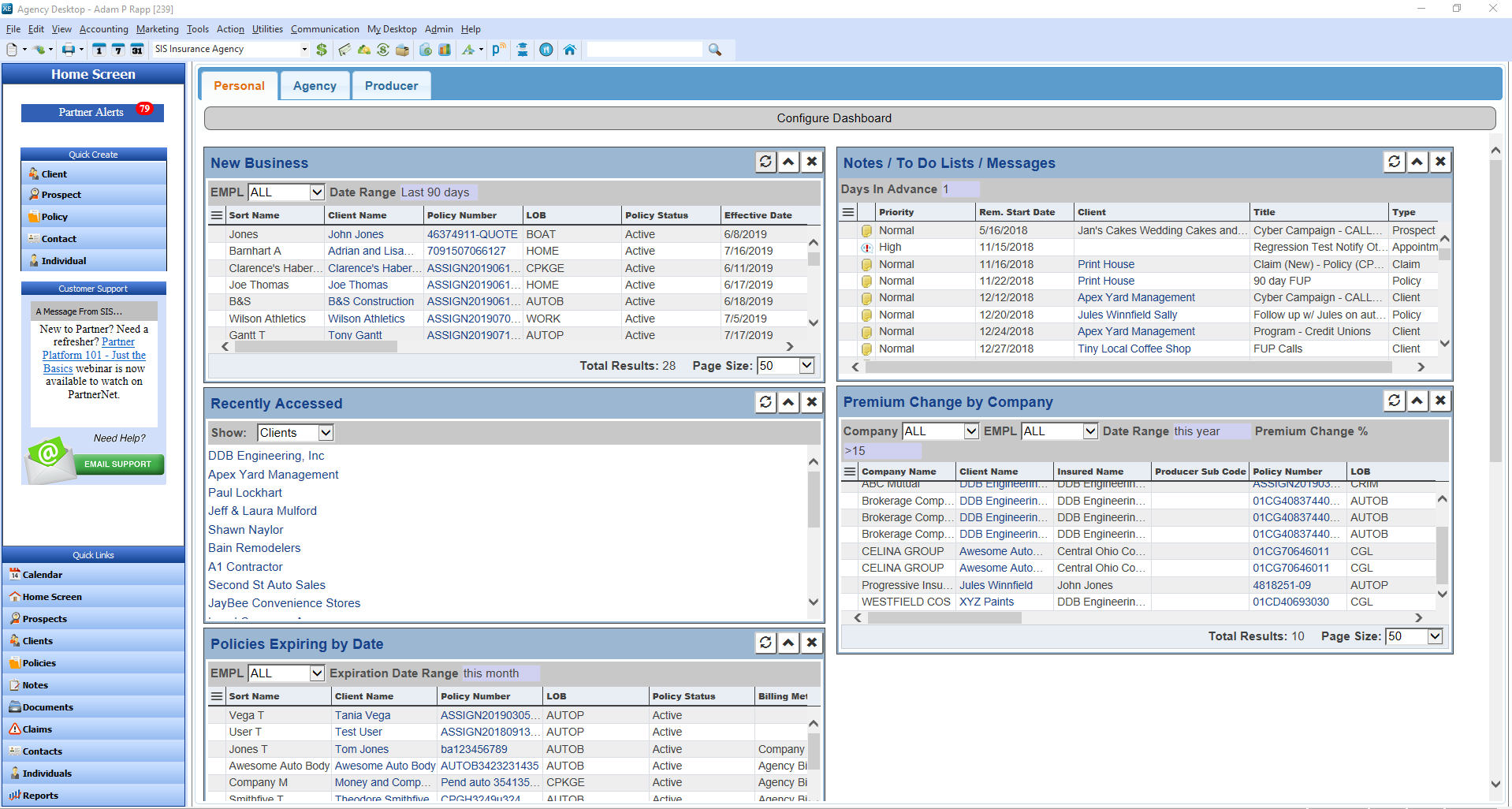

4. Partner XE

The Partner XE Agency Management System from Partner Platform is an insurance and claims management platform that enables insurance companies to manage documents, proposals, client information, accounting, and data analytics from a centralised dashboard.

Key features:

- It is particularly targeted at companies that focus on large and complex accounts, so might not be as well suited to more straightforward policies.

- The software connects policy information to accounts and reporting tools, allowing businesses to retain complete control of their financial KPIs.

- Client portal enables customers and brokers to access policy information or documents, make claims, request service, view auto-IDs, and more.

- It has a sales analytics dashboard with a wide range of reporting capabilities on finances, client retention, growth, and other KPIs.

What we loved:

- The mobile app is a handy addition, enabling users to access key information when they’re out and about.

- Integrations with other apps such as Outlook are incredibly easy to set up and enable seamless connectivity.

- The system is very easy to navigate. We soon got the hang of how to create documents, emails, and update activities.

- We also loved how it will automatically send text messages to let clients know about actions needed regarding renewals, payments etc.

Pricing: Contact the vendor for details

5. Jenesis Software

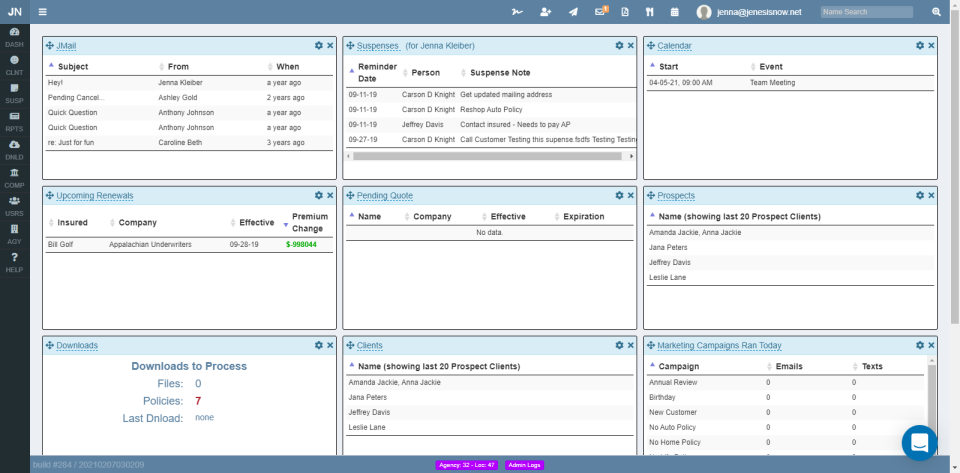

Jenesis Software is an insurance agency management solution that connects insurance companies with prospective clients and manages client and policyholder relationships.

Key features

- It is primarily aimed at small and mid-sized businesses, but less well suited to large insurance providers.

- Document management, cancellation monitoring, renewal management, and marketing automation are amongst the standout features.

- Client portal gives clients 24/7 access to their documents.

What we loved:

- It is very intuitive and easy to use, particularly the dashboard from where you can navigate anywhere on the platform.

- The dashboard can also be customised so that it suits your business and team needs.

- The search functionality is really helpful, as you can look up a client by using any of their unique details, e.g. phone number, email etc.

- Customers regularly praise Jenesis Software’s personal and attentive customer service.

Pricing: Starts from $60/month/user. There are two different packages to choose from based on feature needs.

Most holistic insurance software solution

Overall, Insly offers the most comprehensive insurance software on the market. It’s no/low-code foundations mean that it can be configured to suit MGAs of any size across any sector and policy type. Plus, the user-experience is second to none, explaining why it receives an average 4.9 star-rating across leading insurtech comparison sites.

If you would like to learn more about Insly’s capabilities for optimising your operations and driving growth through easy-to-configure no/low-code tools, please book a demo with us now.