The best way to achieve this is through a mix of the right staff, with technology in place geared to making their job easier. With these in place your company can enjoy an overall increase in sales, better customer service, happier clients, new business and higher profits.

Many firms boast they have a wonderful team of staff in place, but do they have the technology in place to support them well? 60% of world insurance agents and brokers use Excel as their main management system to track their sales, policies and risks. Although Excel is an excellent tool it was not created to run an insurance broker or agent business.

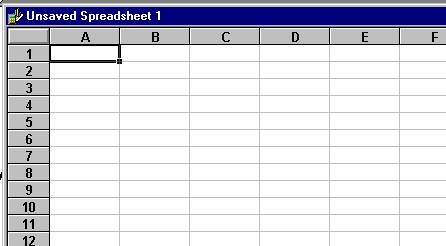

Fundamentally Excel is an electronic spreadsheet programme, used to store, organise and calculate data, manipulating it for the purpose of the particular spreadsheet. It has numerous features, including graphing tools, macro programming, pivot tables, and complicated calculation and statistical abilities.

The Result

What it is not is a personalised management system for insurance purposes. The result is that if you rely purely on Excel you will have no backup of your data, and no control over renewal process. It is easy for brokers to forget to renew policies, and the first indication that there is an issue is when a client makes a claim in the misguided belief that his policy stands current and firm. All that is available is a forgotten Excel file in a computer hard drive.

The Traditional Broker

What is the Alternative?

The alternative for insurance brokers and agent is use technology based insurance software. With a product such as Insly, managing clients, policies, objects and payments becomes straightforward and uncomplicated. The workflow is made easy not just for the broker, but for the client as well.

It is easy to customise your interface, and with reporting features as standard, you can track, cross-sell and up-sell, ensuring you offer excellent customer service and customer retention. All your account and billing management is held within the system, with automatic invoicing and e-mailing. Never miss a renewal again.

As technology progresses, insurance companies are investing in marketing and technology, in order to keep abreast of the competition. In today’s fast moving world of business, keeping ahead of the pack puts you at the forefront of the game. So maybe it’s time to ditch Excel and look to the future by installing insurance software.