Geert Matthys from Deutsche Bank points out three fundamental trends about fintech: connectivity, simplification and personalization. Connectivity is about anyone or anything being able to interact, trade or exchange information anywhere and anytime. Technologies such as APIs and the Internet of Things are enablers. Simplification is about reducing complexity.

There are many processes and technologies that can result in simplification, of which blockchain is only one. Personalization is about making services easier or more relevant for the user through technologies such as big data, cognitive computing, or machine learning.

What about InsurTech trends for 2016?

InsurTech Trends for 2016

Rick Huckstep, an InsurTech thought leader, has pointed out some InsurTech predictions for 2016:

P2P insurance

The P2P insurance business model will struggle to reach scale in its current form. This will drive the P2P insurers to find new ways to replace the traditional carrier model and we will see signs of the emergence of a completely new business model for insurance. That will scale.

New sources of data

Much greater levels of personalised rating will become widely available using new sources of data from tech such as wearables, Internet of Things, smartphone apps. This will lead to variable premiums over the policy term to incentivize better behaviour (although insurers will hold back and not introduce corresponding punishments in 2016).

Data modeling

New entrants will come into the market with highly sophisticated data modeling and predictive analytics solutions. They will exploit mass-scale technologies, high performance computing and techniques developed in high frequency trading.

Turn insurance cover on and off

Convenience and the ability to digitally turn insurance cover on and off as needed will be steadily accepted and adopted. As will microinsurance, sharing insurance and pay per mile. Unit premiums will be higher but this will be outweighed by Millennial attitudes towards insurance cover and paying a price for convenience.

Blockchain in insurance

2017 will be the year of Blockchain and Insurance. No list of predictions would be complete without reference to Blockchain, but IMHO it is going to take all of 2016 for the insurance industry to get to grips with what Blockchain is, what it can really do for insurance and (most important) why they should do it with Blockchain as opposed to any other database or enabling technology. Don’t get it wrong but “Blockchain is the next Internet”. And we will continue to see a lot of Blockchain insurance activity throughout the year. But adoption in insurance won’t take hold until we’ve seen 2016 out.

Read also our latest blog post about blockchain in insurance.

The Contribution of InsurTech

#1 – It’s all about the customer!

And so it should be! If insurance is to become a bought, not sold purchase of value then it starts with the customer. And this is not just about selling to a disinterested millennial generation; this is a theme that spans demographics and all classes of insurance.

Making policies simple to understand. Making them relevant to an individual’s needs. Personalizing the cover to take account of unique customer circumstances. Pricing them to be competitive.

#2 – The emergence of “Engagement Insurance”

When insurers connect with customers throughout the life of the policy, not just at renewal or claim. We’re seeing insurance becoming a lifestyle product through digital engagement.

And the emergence of on/off insurance.

And putting claimant’s first. After all, the value of insurance is realized through the claims process and yet satisfaction rates are woefully low. New tech and new business models that engage with claimants so that they feel they are getting value are emerging.

#3 – Show us the data!

Insurers need data. And continuously too! Instead of a single point in time assessment of a risk based on static data points, InsurTech is giving insurers real time, meaningful data specific to an individual risk.

Wearables, Connected Homes, Connected Cars, Internet of Things, Smartphone apps. All providing new sources of data to complement, and maybe one day, replace traditional underwriting data.

9 Insurance Tech Startups to Watch in 2016

An increasing number of technology startups are targeting the insurance industry with new approaches to industry problems. Here are 9 to watch next year. Everywhere you look these digital days, clever techni-preneurs are attempting to harness the Internet and social media to launch peer-to-peer (P2P) alternatives to traditional economic models, whether through online marketplaces such as eBay, car sharing services such as Uber or vacation rental portals such as Airbnb.

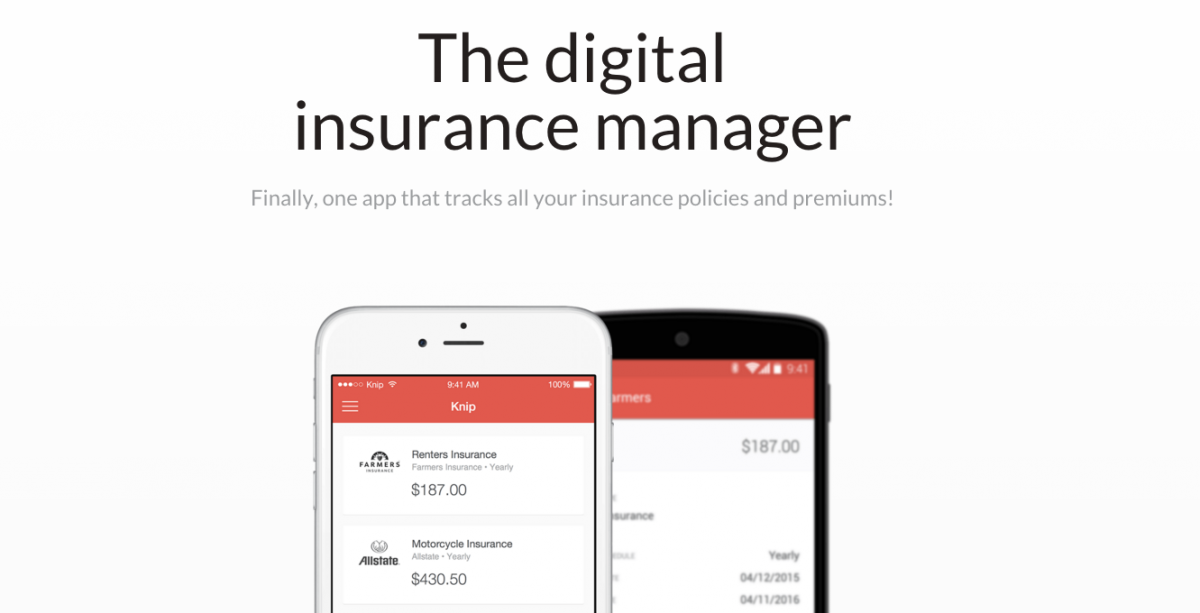

1. Knip

The Swiss ‘mobile-first’ digital insurance broker. The Knip app for iOS and Android, which has seen 330,000 downloads in Germany and Switzerland, essentially moves the insurance brokerage and policy management process onto mobile phone. Interestingly, Knip also employs a team of brokers — purely salaried and not commission-based — who, upon request, will advise on insurance products, tariffs and services.

2. Lemonade

The startup that is itself an insurance carrier, Lemonade says its peer-to-peer technology will challenge the way insurance companies work. With the typical P2P insurance model, small groups of policyholders pay premiums into a claims pool. If there’s money left in the pool at the end of the policy period, members get a refund. Getting that simple model started requires a considerable amount of initial funding however.

Lemonade isn’t the first tech startup to take a shot at the insurance Goliath. Germany has friendsurance, the United Kingdom has Guevara and China has TongJuBao.

3. Kasko

Kasko provides a white-label option for instant insurance purchases on affiliate platforms. Kasko is a digital platform launching in Germany that connects insurance carriers at the point of sale and provides insurance cover as a secondary purchase.

4. FitSense

This company helps life and health insurers leverage data from wearables.

5. MassUp

This company uses APIs to connect insurers to retailers so people can quickly and easily add coverage to new purchases.

6. Worry + Peace

At a time when the broker model is under threat it is great to see a determined, passionate and customer centric approach.

7. HeyBrolly

HeyBrolly will start by providing a single place to hold, store, and organise multiple insurance policies. And then map the cover you have against your needs and identify the gaps and any duplication.

8. Everledger

Using the blockchain, Everledger is building an ethical trading platform based on trust and security.

9. Cuvva

Cuvva is a digital insurance platform for short-term motor cover. The on boarding process is simple and quick. Within minutes you can buy as little as one hour of cover.

What are your predictions of InsurTech for 2016?

Sources:

bankrate.com, Rick Huckstep in LinkedIn, insurancenetworking.com, dailyfintech.com, banknxt.com, techcrunch.com

Read more innovation news from our blog.