InsurTech can be described as “an insurance company, intermediary or insurance value chain segment specialist that utilises technology to either compete or provide valued added benefits to the insurance industry.”

The InsurTech landscape is growing at an incredible rate, with over $3.93bn invested globally. In the first nine months of 2015, more than three times as much venture capital funding was invested in InsurTech startups than in the whole of 2014.

This increase in financing and M&A activity in the InsurTech marketplace will have a major impact on existing players in the insurance market. The Floow3 for example, is a start-up InsurTech disrupting the car insurance and telematics industry by combining data science, technology and psychology specialists to help encourage low risk driving behaviour in ways insurers have not done before.

How should insurers develop digital capabilities?

In house digital investment

Celent states that global IT spend for traditional insurers is growing at a CAGR of 4%, with total expenditure in 2015 being $174.9bn and continued growth expected to reach $189.2bn in 2017.

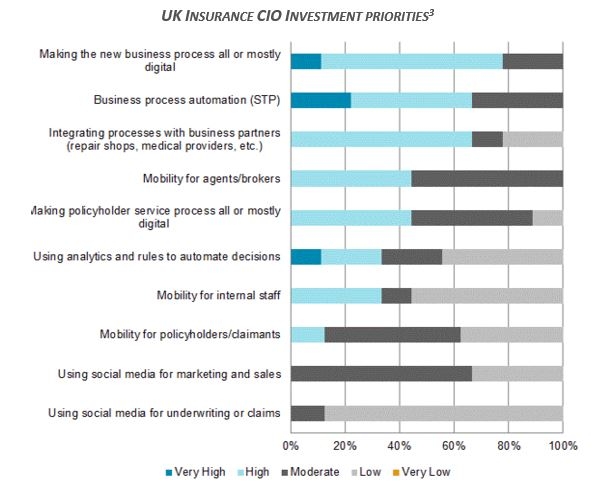

As the above research shows, CIO’s investment strategies are focusing primarily on digital initiatives for core business performance such as underwriting, operational efficiency, and distribution capabilities, with the upward trend in IT investment demonstrating commitment by insurers to digitise.

Acquisition:

Recent studies have shown that a large number of global insurers believe their industry peers will acquire innovative firms to boost their own digital capabilities. A large majority have either invested in InsurTech start-ups or are creating funds to do so. AXA Kamet is a great example of an organisation that has created a venture capital fund of €100m to focus on investing in InsurTech organisations.

The most common reason for interest by insurers in investing in InsurTech start-ups is that insurers can keep up with technological change and increase speed to market with new innovative products, without having to invest time in building specialist digital capabilities in house.

Partnership:

The argument for taking a partnership approach is a strong one. AXA has partnered with Google Nest for home insurance to capitalise on the Nest product features as a smart thermostat and smoke detector and Bupa have partnered with digital health provider Babylon for health insurance, utilising Babylon’s 24/7 video GP service and appointment booker. These partnerships have helped to diversify and innovate each insurer’s product offerings by incorporating additional digital competencies.

Conclusion: Is there a right approach?

Developing in house capabilities has advantages such as knowledge and control over existing system infrastructure, organisational strategy and creation of bespoke IT solutions, whilst avoiding post-merger integration issues. However, hiring and training employees or using external consultancies with the right digital skillset can be a costly investment.

Conversely, taking an acquisition approach will enable insurers to access digital capabilities, associated data, intellectual property and often existing customers that can be integrated into the organisation in a relatively short period of time. The opportunity cost of training and developing technical knowledge is avoided, allowing existing employees to focus on BAU work. However, it is well known that a number of M&A deals fail, especially due to cultural incompatibility. This is an important consideration, as the bureaucratic nature of a larger organisation often conflicts with the entrepreneurial culture of a start-up firm.

Finally, by taking a partnering approach, insurers can enjoy similar benefits to those undertaken through acquisition, requiring little financial investment, enabling faster innovation and increased speed to market than when compared to the in house digital investment approach. However, data ownership, data access and brand strategy are issues when taking this approach.

To conclude, there is no right or wrong approach to digital capability development. What is important, is that InsurTech firms are on the rise and insurer’s board of directors need to decide how to react, or they risk being disrupted out of their own market.

Read also: What are the InsurTech Trends for 2016?

About the author:

Original article is written by SIA Partners Fiancial Services. See more: Sia Partners blog.