The insurance industry – traditionally cautious, heavily regulated, and accustomed to incremental change—confronts a radical shift in the age of automation. With the rise of digitization and machine learning, insurance activities are becoming more automatable and the need to attract and retain employees with digital expertise is becoming more critical.

Workforce position-by-position changes

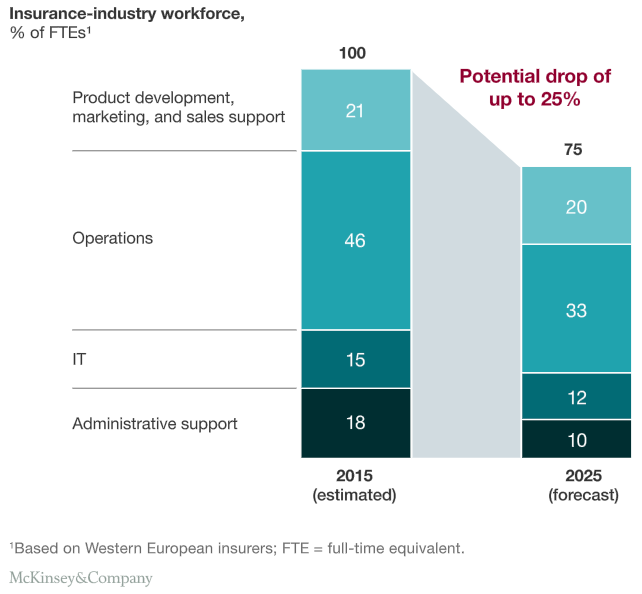

McKinsey Global Institute (MGI) has been studying the impact of automation on insurers. Drawing on the proprietary insurance-cost and full-time-equivalent (FTE) benchmarking database, they focused on Western European insurers, forecast the outcomes for about 20 discrete corporate functions, and aggregated the results. MGI work indicates that some roles will undoubtedly change markedly and that certain occupations are particularly prone to layoffs; positions in operations and administrative support are especially likely to be consolidated or replaced. The extent of the effect differs by market, product group, and capacity for automation.

Steeper declines will occur in more saturated markets, products with declining business volumes, and, of course, the more predictable and repeatable positions, including those in IT. Other roles, however, will experience a net gain in numbers, especially those concentrating on tasks with a higher value added. The broader corporate functions including these roles will lose jobs overall. But some positions will be engines of job creation—these include marketing and sales support for digital channels and newly created analytics teams tasked with detecting fraud, creating “next best” offers, and smart claims avoidance. To meet these challenges, insurers will need to source, develop, and retain workers with skills in areas such as advanced analytics and agile software development; experience in emerging and web-based technologies; and the ability to translate such capabilities into customer-minded and business-relevant conclusions and results.

Over the next ten years, up to 25 percent of full-time positions in the insurance industry may be consolidated or replaced.

On the contrary, given the magnitude of these changes and the looming future, it’s important that insurers begin to rethink their priorities right now. These should include retraining and redeploying the talent they currently have, identifying critical new skills to insource, and retuning value propositions in the war for new talent and capabilities. That competition will almost certainly increase as the digital transformation takes hold.

Consumers are buying online

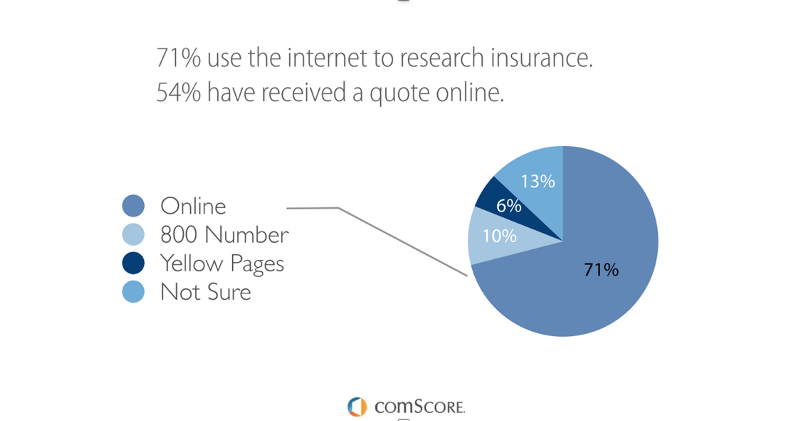

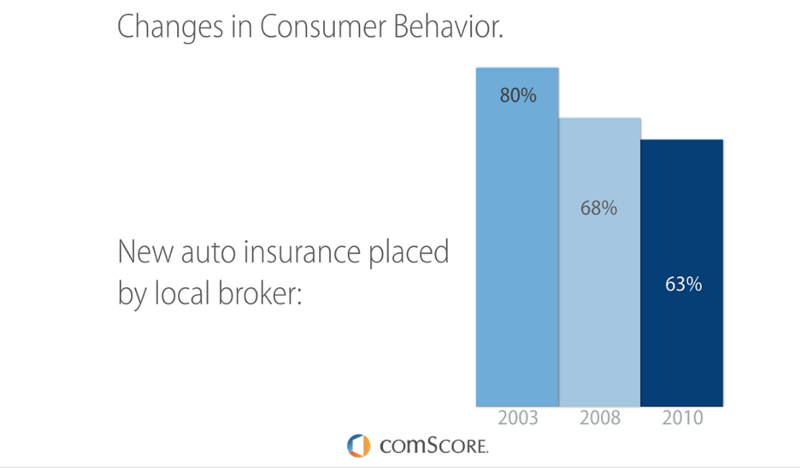

Consumer behavior has changed dramatically. Remember when insurance marketing meant taking out a yellow pages ad and hanging out at the Chamber? To say nothing of the short-lived innovative technologies like fax and voice broadcasting.

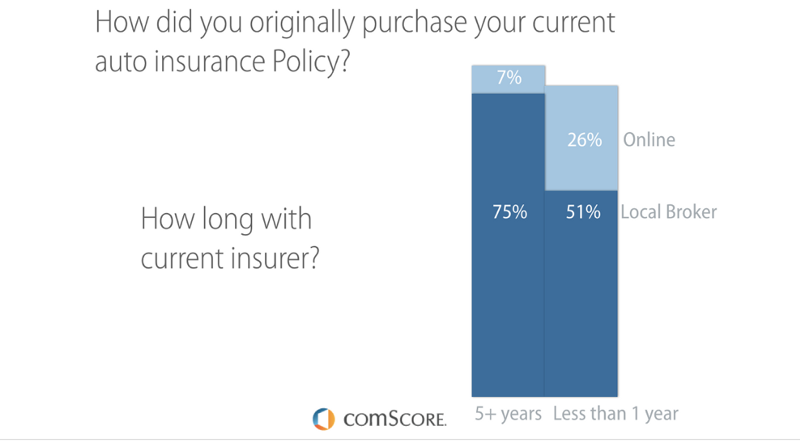

- Once upon a time, the agent-broker channel was the default way to buy insurance. Consumers have choices now. Now the venture capital community promises more, uniquely innovative competitors (as the new sub-industry of ‘insurtech’ has emerged). Insurtech startups will have major impact on the insurance market.

- More and more consumers are buying online.

- Having a local agent or broker used to be the #1 driver of customer satisfaction. Not so much anymore.

- Boards of insurance carriers are not ignorant of the gradual, consistent loss of channel market share. And they don’t seem to be willing to place all their bets on a channel that has been sluggish to adapt to new realities. CEO’s of longtime agent-only distribution systems are creating in-house competitors, diversifying their bets by competing directly against their traditional salesforce.

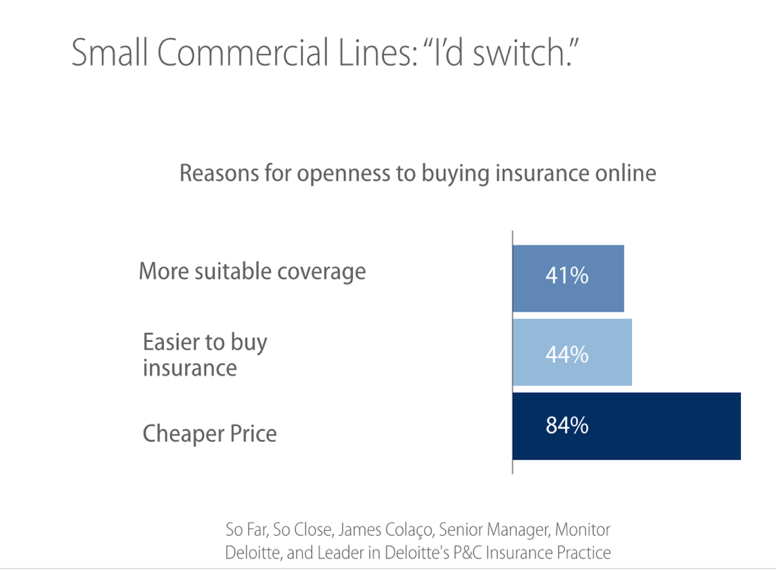

- And, it seems that we’re not just seeing changes in personal lines. Small commercial lines faces impending threats from emerging digital competitors.

- And middle market commercial lines? They may not be threatened by outside-of-channel competitors. They are already threatened by firms who are mastering connected technologies

This isn’t meant to dishearten. The hard work of strategy often requires the courage to develop a clear-eyed and unflinching analysis of what’s happening in the real world, so you can deploy your assets most wisely.

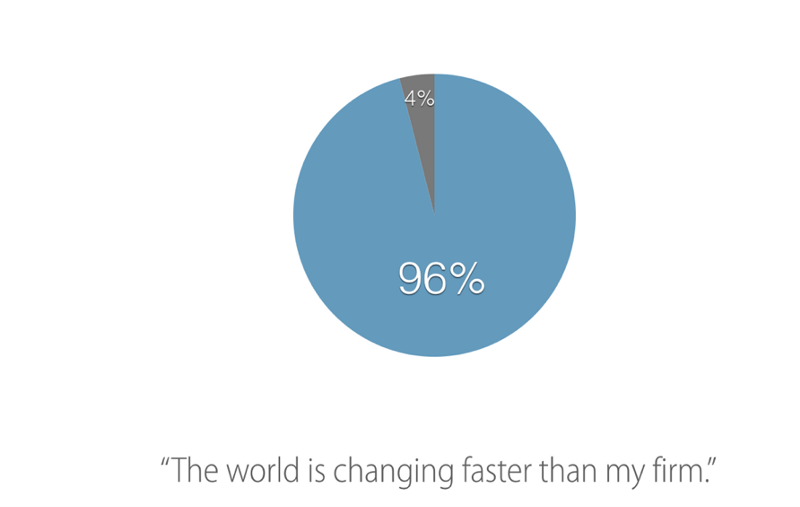

The world is changing faster

According to an industry wide survey MGI conducted, 96% of agents and brokers feel that “the world is changing faster” than their firm.

The responsible leader knows that in order to win, serve and retain the consumer, they must be present with the consumer.

‘New fangled’ digital technologies available to agents & brokers aren’t used to get ahead of the consumer. Today’s consumer is so far ahead of the agent-broker channel — in the everyday use of modern communication technologies — the challenge, there’s no need to jump ahead of the consumer.

The challenge is simply to be present with them. Today’s technology doesn’t just facilitate it. The consumer’s adoption of those technologies requires it.

As a coda to this point, we’re all familiar with the damage done to the travel agent industry by new technologies. What is less known is that those who survived sell three times more airline miles than the average pre-internet travel agent.

Sources: Agency Revolution, McKinsey. Image: Shutterstock

We recommend to read also:

Chatbot is the Future of Automated Insurance

Will InsurTech have a major impact on the insurance market?

The Future of the Insurance Broker in a Digital Age

What are the InsurTech Trends for 2016?

Insly is an insurance software that helps brokers and agents reduce the time they spend on quoting and general administration leaving them more freedom to do what they do best – sell insurance.