Underwriters spend the majority of their time on quote and bind procedures. However, when you are handling these activities manually, much of the time is spent on repetitive processes that don’t add value to your company.

Tasks like emailing brokers with exchange risk information, opening spreadsheets and databases to calculate premiums, checking price information – the list goes on and on.

With that being said, some manual underwriting tasks are essential for managing business risk; checking and verifying information, for example, is key to minimising errors and eliminating fraud.

However, underwriters can benefit from tools that help ensure that they are only performing manual tasks that benefit their business’ bottom line while automating the rest.

In this post, we’ll list some tools that can help to improve underwriters’ ability to perform their role to the best of their abilities.

Risk submission

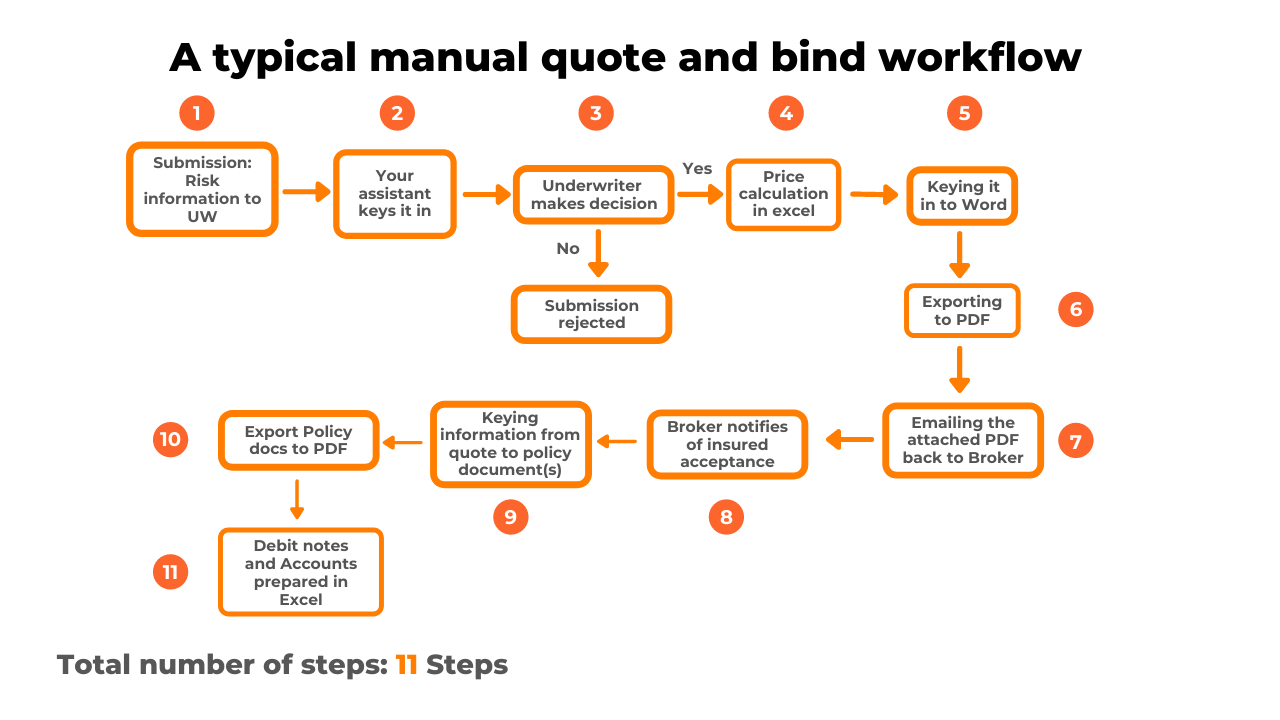

Manual underwriting method: Brokers submit risk information via email. From there, the underwriter may (in extreme cases) need to open a zip file containing information scanned from paper documents.

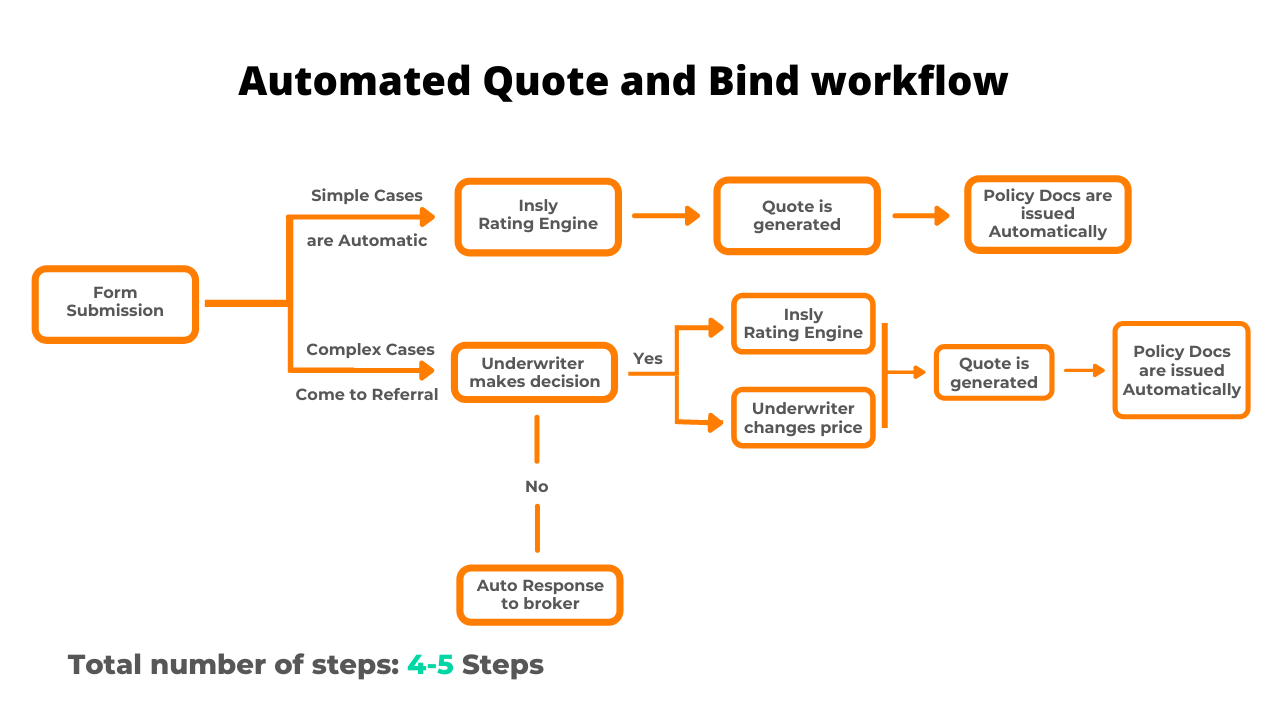

Automated quote and bind method: Insurance software tools like Insly can automate risk submission tasks for simple risk cases that require minimal underwriting input and deliver a quote moments after risk information is submitted online. Alternatively, automated quote and bind tools can send a referral notification to the underwriter for more complex cases, prompting them to take a closer look at a case.

Customer background checks

Manual underwriting method: Background checks are essential. Underwriters performing these tasks must log in and submit customer details on credit checking sites, and sanction databases and verify information against listings on sites like Companies House. These individual checks can take up to 30 minutes to complete if the underwriter (or their assistant) has to enter the same information multiple times.

Automated quote and bind method: Information entered in risk submission forms can be instantly checked against background-checking resources, with any errors or inconsistencies flagged for the underwriter to take note of. Modern insurance quote and bind software is API-native thus automatically updated by site developers, so underwriters can be assured that their sources are up-to-date and reliable.

Calculating premiums and producing quotes

Manual underwriting method: The underwriter will manually enter risk information into an Excel spreadsheet to calculate base premium costs. From there, they can add discounts and further conditions before entering the final calculation into a word doc, exporting the file to PDF, and attaching it to an email back to the broker. If there is an error in the pricing within the word doc, the underwriter needs to repeat the whole process again and send the updated PDF back to the broker, who then has to inform the customer that an error was made. These types of mistakes can harm a company’s reputation with customers.

Automated quote and bind method: Risk information is automatically entered into the underwriter’s rating engine, instantly bringing up the correct premium price. The onboarding team at Insly will take your Excel premium spreadsheets and configure them into your underwriting system to ensure that you can optimise this stage in the sales process seamlessly. In addition, the system will flag if there are any discounts or conditions that need to be applied to the final price. From there, the final quote will be automatically added to a document and PDF and sent directly to the broker.

Bonus benefit of an automated quote and bind tool: Connecting your quote and bind functions with document generation also eliminates common errors in document formatting, including spelling, business logo placement, spacing, etc. At Insly, we can help you configure your document generation tools to align with your brand colour scheme, company logo, font preferences, and more. Therefore, you can ensure that all of your customer information is correct and presented beautifully.

Which quote and bind method saves you more time and costs?

We may be biased, but we believe that Insly’s automated quote and bind toolkit saves underwriters a lot of time and eliminates any risk of human error in this crucial business area.

At the same time, we appreciate that some manual processes will need to remain – such as verifying information used in background checks and checking the premium price and policy conditions. However, for simple risk cases, our platform ensures you can complete the quote and bind process with little to no human intervention, freeing up time in your underwriter team’s day.

So, if you want to see Insly’s quote and bind automation tools in action, you can book a free demo with us here.