Managing General Agents (MGAs) and insurance innovation go well together. A combination of resources, agility, and specialist knowledge sets MGAs apart from other players in insurance, whether carriers, wholesalers, or brokers. An MGA typically focuses on a sector or an industry and has deeper knowledge than a more generalist insurance carrier, facilitating innovation. At the same time, MGAs have underwriting and claims settlement capabilities that Brokers and agents do not have, allowing the MGA to push insurance innovation even further.

To empower insurance innovation, MGAs can:

- offer innovative insurance products;

- tap into new markets;

- innovate the way they interact with customers;

- innovate internal operations;

- build new innovative MGAs.

We will take a look at each of these possibilities to foster insurance innovation below.

Offering Innovative Insurance Products

An MGA that doesn’t know the demand of its customers, is unlikely to achieve insurance innovation successfully. Nowadays, there are considerable amounts of data on customer requirements and pain points, including for niche markets. Business intelligence and data analytics software solutions are available for non-technical business users, meaning that MGAs are not obliged to hire armies of data scientists to get insights out of their data.

MGAs can use their power and agility to keep up with industry trends such as pay-for-use solutions. For instance, even in the aviation sector, which is a niche market, manufacturers are already selling jet engines on a per-usage basis. MGAs can step up insurance innovation with usage-based insurance (UBI), using the device data collected via the Internet of Things (telematics via the IoT). A similar approach exists for automobiles. For example, the UK geolocation company Telefleet recently launched a new MGA, specialising in motor insurance and vehicle fleet risk based on telematics.

Tapping into New Markets

Insurance innovation has a large amount of untapped potential. In fact, the US insurance market alone generates more insurance revenue than any other country, yet still shows comparatively low rates of premiums per head of population. Another example of the potential of insurance innovation is the comparison by the insurer Swiss Re, which estimated that just 1% of losses were insured in the 2015 Nepalese earthquake, while 73% were insured in the earthquake in New Zealand in 2012.

Innovative MGAs also approach markets from other angles with offers based on micro-insurance and atomisation. In these cases, customers can purchase insurance on a per-item, per-use, and per-period basis. For example, an insurtech unicorn Zego from the UK has unlocked a level of insurance innovation by offering products for the gig economy. With these kind of novel solutions, Uber and Lyft drivers can purchase cover by the hour, Airbnb and Homestay renters by the night, and TaskRabbit and Askfortask jobbers by the day.

Insurance Innovation Through Customer Interactions

Blame Amazon (among other service leaders) for customer expectations continuing to rise in terms of choice, responsiveness, self-service, and overall quality of service. Yet again, innovative MGAs can turn such situations to their advantage. In India, L&T General Insurance Company offers property and casualty insurance to individuals and enterprises, but with a tweak. Given the widespread use of mobile phones (nearly 800 million in India at the last count), the company went mobile from the start, designing the ability to satisfy customers for their insurance entirely via mobile phones.

Innovative insurance companies have taken a lead from supply chains and retailing organisations by implementing an omnichannel model. Whether by mobile, web, phone or email, they offer the same customer experience with consistent policy pricing and management. Speed and quality of service can also be enhanced by the suitable use of chatbots and artificial intelligence. Insurance provider Lemonade has already made a name for itself through the use of AI for its chatbot Maya and claims bot AI Jim for high-speed automatic claims settlement.

Insurance Innovation Through Internal Operations

Insurance innovation is not necessarily about doing something fundamentally new. It can also be a novel approach that gets better results. This is the case for artificial intelligence. Initially seen as highly disruptive and even threatening, AI is increasingly considered to be a tool to help employees work better rather than to replace them. Software start-ups like Logical Glue in the UK have been developing explainable AI (XAI) that helps staff with recommendations about which insurance policies to offer to customers and explains the reasons behind it.

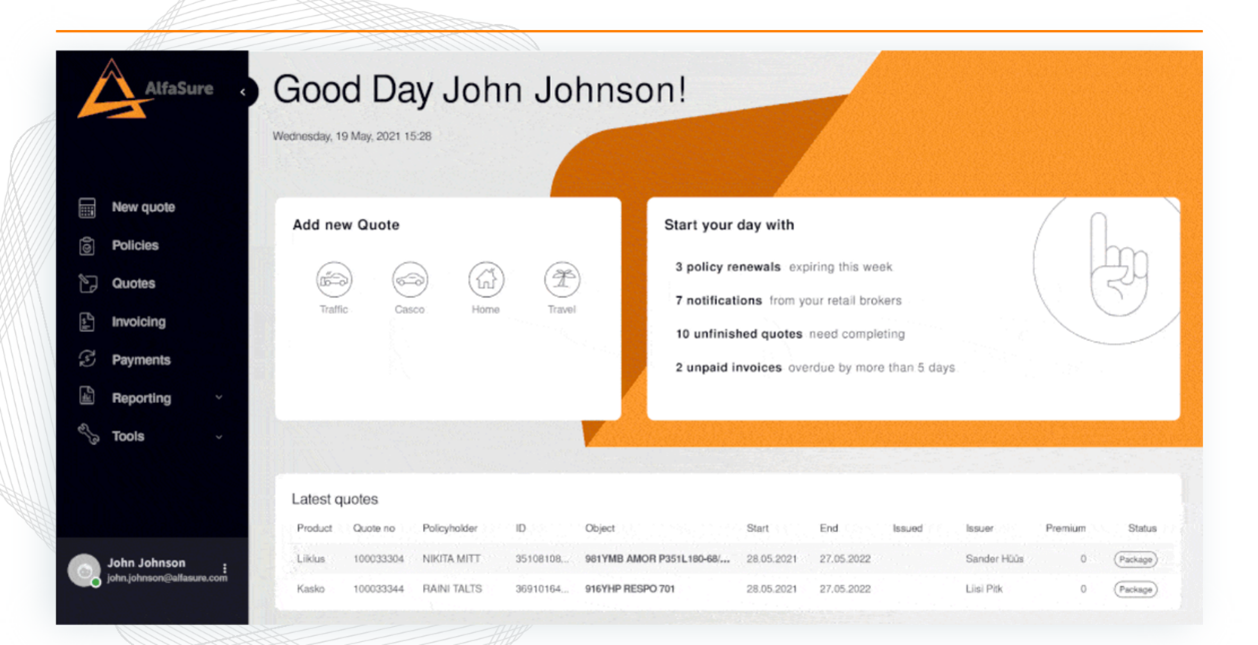

MGAs that deliver insurance innovation through products and markets also need flexible internal systems, such as Insly, that make it easy to define and launch new products and processes for managing and leveraging innovative ideas. Whether insurance innovation is disruptive or progressive, the agility of many MGAs allows them to transform their operations and move to new, more efficient operating models in an easier way compared to their larger carrier counterparts.

Building New Innovative MGAs

There is also a more radical way to innovate. MGA founders can change the way that MGAs are formed or integrated to take on new risks. Boxx Insurance, an insurtech MGA from Canada, offers its customers a cyber protection platform and risk evaluation tool in addition to selling cyber insurance. Buzzmove in the UK welcomes insurance innovation by providing its customers with removal services and associated insurance that it sources automatically through the API of its tech partner Insly.

Black Insurance from Estonia uses blockchain technology to connect brokers and MGAs directly with capital. Instead of looking to an institutional carrier to help finance the products, funds can be raised via initial coin offerings (ICO). Black Insurance sees insurance innovation in blockchain which acts as a way of rebuilding the existing Lloyds of London business model with considerably lower operational costs for all parties involved.

Conclusion

The proximity of MGAs to their customers makes them well-placed to implement insurance innovation and develop new products. They can also extend current activities into underserved areas or adapt characteristics such as granularity (article by article insurance) and term to reach new markets.

In some instances, MGAs can bring insurance innovation by using ideas in existence elsewhere. They will need to manage changes specific to the insurance sector such as possible replacement of carriers by pools of investors or even by customers themselves in peer-to-peer arrangements.

Technology will still be a means to an end and not the end itself. A customer-centric approach will continue to be vital in insurance innovation. MGAs that understand the difference and can apply the principles the right way should have a bright future ahead.

If you are an MGA looking for innovative approaches to do business, launching new products, or redesigning your internal processes, reach out to our team to get some good tips!