We will take a closer look at how Insurers and MGAs can use the time saved, thanks to insurance software. Don’t forget to also check out our previous post, where we already suggested some ideas, such as designing and delivering better and personalised insurance products, entering new markets, as well as developing new distribution channels and partnerships.

Improve Internal Processes

Insurers and MGAs can take the additional time they get from implementing insurance software to improve their internal processes. Here are some examples.

- Enrich data to save time. There are multitudes of data companies who provide API services with highly risk-specific information, such as vehicle, vessel, or aircraft details, credit rating on companies, risk scores for properties, etc. The practical implication of adding an API integration to your underwriting system is that the Underwriter can see all the risk-specific information on one screen. In many cases, data entry is reduced as much of the risk data is pulled in from the integration rather than populated by hand.

- Rating engines with automatic referral rules. These can free up a significant amount of Underwriters’ time up to completely eliminating Underwriters from the quoting process. It may not work for complex insurance lines, where human underwriting expertise and creativity is needed, but one does not rule out the other. We would encourage Underwriting Officers to look at ways of automating parts of the process, even for complex products. Flexible platforms like Insly make this possible.

- Mid-term policy changes. This relates heavily to the previous point. If you are able to give full or partial control to your Brokers or customers, the compound time-saving can be massive, especially for products where MTAs occur frequently.

- Automatic renewals or renewal quotes. Again, it depends on the level of automation of your business, but any underwriting or quoting system worth its salt should have automation tools available.

- Document management. Documents are the medium of the industry. The importance of having good templates is widely recognised, and most companies have a tool for generating nice-looking documents dynamically. Unfortunately, we still see a lot of documentation travelling back and forth in e-mails between the customer, Broker, MGA, and Insurer. Removing e-mails from the equation and letting the customer or Broker upload required documents, which automatically link to your records, themselves can save a considerable amount of time for your staff.

A huge benefit that accompanies is increased transaction speed and, therefore, sales – instead of handling routine and more simplistic processes, you can focus on meaningful work and will have the capacity to handle more incoming quotes.

Improve Service Level

An area to improve, when you have additional time on your hands, is the service level you provide. What will help Insurers and MGAs gain a competitive edge and bring higher quality services to market?

First of all, reducing manual entry and errors by choosing the right insurance software. You might be familiar with double-keying data into different systems or spreadsheets to keep workflows running. If data is stored in spreadsheets, there are multiple places for data entry – input of numbers on one spreadsheet, premium calculation and invoice generation on another, etc. You should also keep in mind several types of users – your own employees, as well as Brokers. That leaves lots of room for error. Each human intervention increases the rate of mistakes.

Insurance software enables you to reduce the number of places for keying data. Thanks to connecting different parts of your insurance processes, you can rely on just a single entry – data is carried from submission to a bound policy. No more headaches, there is a 99,9% confidence of data being correct. So, insurance software that provides a single point of information entry is much less reliable on human error.

How does that improve the user experience? Well, people can buy insurance in a much faster way. Starting from getting a quote and receiving policy documents to communicating with insurance providers. Since the team on Insurers’ and MGAs’ side has more time for meaningful work, they can focus on building relationships and offering support throughout the whole process up to claims handling. End customers can also be more convinced of seeing fewer mistakes (if any at all) in their policy documentation.

Unlock New Opportunities with Business Insight

While having additional time, Insurers and MGAs can focus their efforts on unlocking new business opportunities. What’s the secret to it?

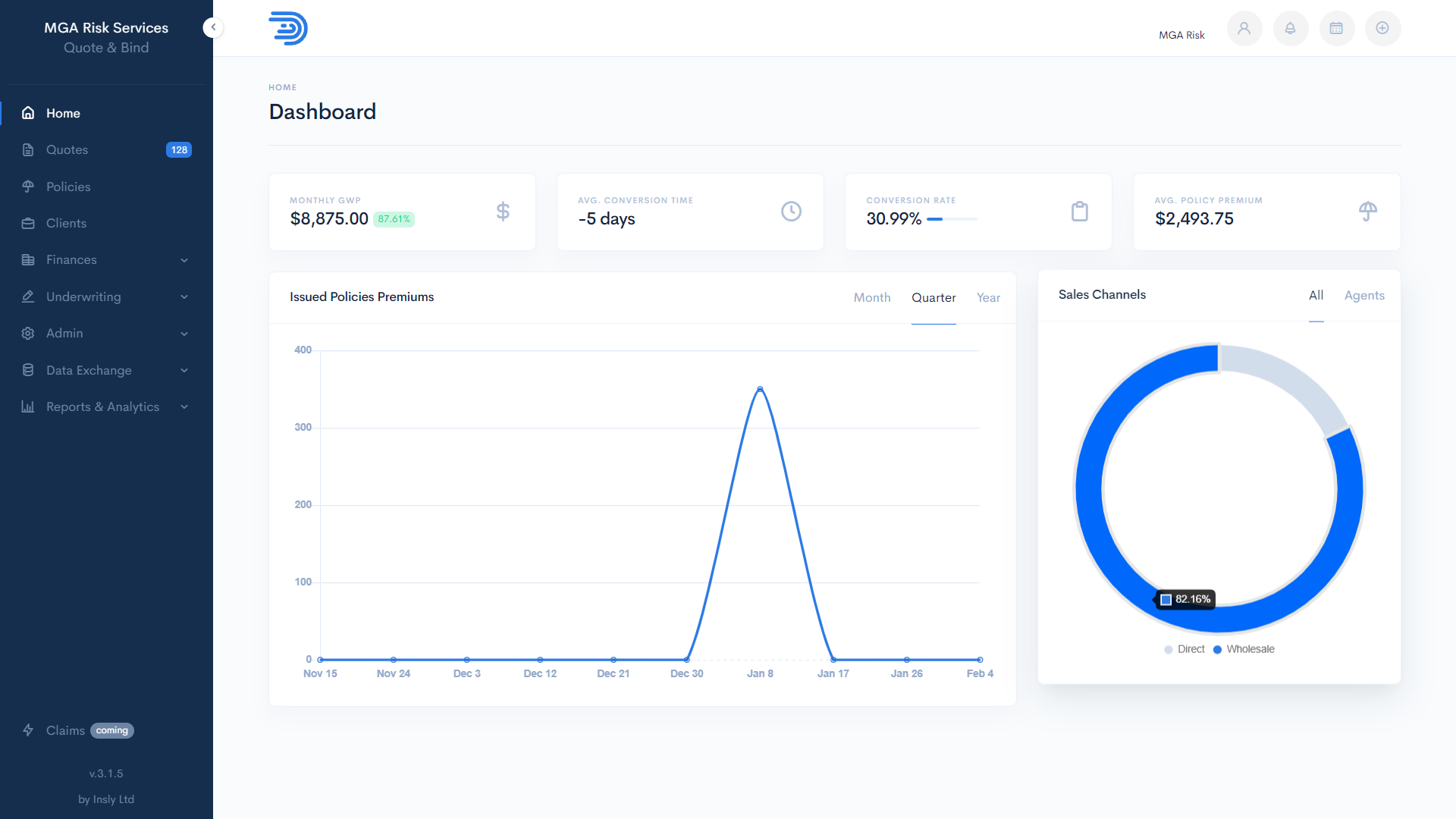

No doubt that improved data insight plays a crucial role here. Insurers and MGAs can achieve that by using business intelligence (BI) and reporting tools, which give a profound overview of the business status. For example, Insly enables integrations to well-known BI tools like Microsoft Power BI or Amazon QuickSight. These can provide better input for analysis and forecasting more accurate results as you are able to build your own reports and look at your data from any angle you need. Viewing your entire book in this way can help you better assess the risk portfolio and perhaps even unlock new opportunities.

Actually, using a single insurance platform, which acts as a glue between insurance processes from quote and bind to accounting, lays perfect grounds for this. That was the case for Insly’s customer Renovation Underwriting, which considered the most beneficial aspect of the insurance platform to be the seamless way it connects their quote and bind to the accounts and finance system. This has generated considerable savings for Renovation Underwriting and given them the confidence to scale up operations.

Comply with Regulations, Get More Capacity

For MGAs, having additional time on their hands can translate into improving Insurer relations and getting more capacity.

There are tough requirements and regulations set on reporting for MGAs. Complying with these assumes using insurance software that allows you to easily access necessary data and customise reports. According to Renovation Underwriting, which has been using Insly insurance software, key reports are a vital tool in accounting and financial reporting. Being able to produce accurate financial data at a click of a button is a must. The ability to see where they are with debtors and Insurer creditors at any specific period is essential in financial management and planning.

Creating, downloading and forwarding reports manually can be a 10-minute struggle, whereas you could turn it into a 20 second flow. Using insurance software that has proper reporting functionalities, different bordereaux can be created and sent in a couple of clicks. For example, Insly enables designing various types of reports – risk and payment bordereaux, broker statements, loss ratio reports, payments outstanding, etc.

Investing time in this allows you to meet the conditions of capacity providers and builds trust. Combined with MGAs’ ability to improve data capture, accuracy, and oversight, it can help you to get more capacity.

Better Professional Communication

When you have more time available, a good way to invest it is improving your team, customer, and partner relations. Better communication with your employees, Brokers, and Insurers can result in higher motivation and satisfaction, as well as stronger partnerships.

Spend More Time with Your Loved Ones 🙂

The cherry on top is that you can spend more time with your loved ones. We often find ourselves buried in work, but if you get some additional time, the most precious way of investing it is in healthy relationships.