Over the course of last 18 month, we have been working together with the leading MGA-s from the London market to best accommodate their complex business processes on Insly software. Brick by brick, step by step, we have covered dozens of use cases with a range of new features. Today, we can present the outcome as a distinct new branch of Insly: the Insly MGA software.

In broad terms, the Insly MGA software is a full-featured, central broker network management platform. In addition to the standard Insly broker software features such as policy administration, CRM, bordereaux and more, it introduces a number of additions including (and not limited to):

- Multi-level user accounts/permissions system (retail broker, broker, MGA and more levels if needed)

- Customisable underwriting rules complete with internal and external referrals

- Sophisticated binder management with user-definable limits and coinsurance functionality

- Premium calculators

- Retail broker invoicing for MGA-s

- Various MGA-specific reports for accounting (cash book, sales day book, aged debt, purchase aged creditors report etc)

- MTA-s

All these features are built into the Insly MGA software, however, some require a certain amount of custom configuration and setup by our software engineers. Please contact us for details.

How does it help you?

How can an insurance wholesale intermediary such as an MGA, agent network or wholesale broker take its business forward? There are just about 3 dimensions: to increase the sale of its current products within the current broker network, introduce new products, or recruit new brokers. None of the above is exactly easy. However, growth in all these dimensions can benefit greatly from the Insly MGA software.

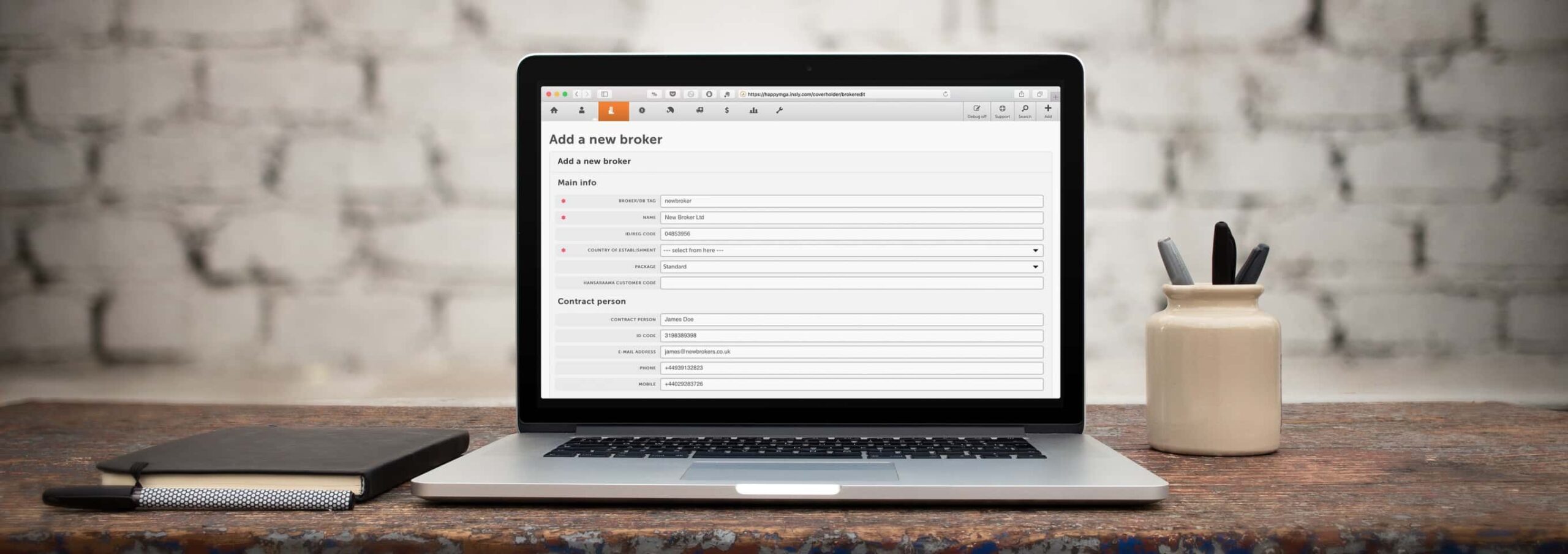

First, a good broker is lazy. Lazy in a good way – just wanting to sell, sell and sell, and not to pay attention to the complexities of software, reporting, referrals etc. Against this backdrop, an easy-to-use software platform that dictates and automates much of the sales process related formalities such as offers, policy issuance, document and invoice generation, and alike, might just be the final touch that bends the existing brokers your way, and helps to recruit more. And for you, adding a new broker to Insly MGA platform is just a few clicks away.

The Insly MGA software also brings unprecedented efficiencies to broker commissions management, including assigning commissions on a per-product and per-broker basis, and keeping tabs on the commission settlements.

Second, introducing and rolling out new products is hard. With Insly, we just define a new product together with the premium calculator, referral rules and other properties, and – BOOM! – the product is live for all the brokers you want to sell this product with. We’ve built around 50 products, many with industry leading UK MGA-s.

Third, Insly MGA software gives you great control over your brokers and portfolio. Reporting and bordereaux is a given. But just as an example of the capabilities, you will have a granular, customizable control over underwriting rules by defining which cases are automatically sent for referral to you, and whether to a junior or senior underwriter, and which ones are further referred to the carrier. These underwriting rules can be configured on a per-product basis.

Fourth, you will be more efficient. Most MGA-s have staff working specifically on insurer reporting / bordereaux. With Insly, the hard part of this work is done just once, when defining the bordereaux structure together with configuring the insurance product for Insly platform. From thereon, bordereaux are something an office assistant can do, with complex work being done by Insly, automatically.

Help brokers help you

Insly reporting capabilities enable you to keep your broker network informed about which products sell the best, and generate most of the commissions. Let’s face it – most brokers are not data analytics geeks, and often do not have a precise overview over their profit sweetspots.

By giving brokers access to Insly reporting section, they get to see what works for them and what does not, or you can create and email the reports yourself. This way, brokers spend their effort and focus on the products they are most able to sell to their particular customer base, and gives you better control over their sales focus by showing them the immediate effect of strategic commission hikes or reductions.

Last but not least – security

By now, it has surely came to your attention that spearfishing and ransomware attacks are a serious problem, harming many. The increasing sophistication of the attacks mean that even professionally guarded organisations are at peril, not to mention SME-s with no dedicated cyber security personnel, such as insurance brokers. It does not require much imagination to picture what would happen if an entire customer database together with transactions and policy data should leak, or the access to the data is lost.

In this new environment, any on-site data is at serious risk. This is one of the reasons why Insly MGA software lives entirely in the cloud – no data is stored at workstations. Thus, when the broker is targeted by a cyber attack, he can just swap his computer for an unharmed one, and he is back in business.

Next steps

Even though the Insly MGA software is highly standardized, giving you the reliability and comprehensive feature set vis a vis a bespoke option, we acknowledge that every MGA is different. To have your business benefit the most, we first go through an analysis phase where we map your specific requirements and find the best way to accommodate these on our software. Thus, please contact our sales department, and they will see you through the process of finding out if Insly is the best option for you, and implementing the software.