Robotic process automation (RPA) in insurance refers to using rules-based software to handle repetitive and sometimes error-prone admin tasks for human workers. Some commonly used automation in insurance capabilities include collecting customer details, copying information across multiple systems, and performing background checks.

By leveraging RPA, MGAs have the power to transform processes to increase productivity, reduce costs and be more competitive in the market. Keep reading to learn more about the ways RPA can improve your operations.

The Benefits of RPA for Insurance MGAs

RPA streamlines day-to-day business processes that used to drain our time, morale, and energy. You can free up your team to resolve key issues and expectations by automating high-volume processes.

RPA is changing how insurers do business, bringing about numerous advantages, such as:

- Faster policy onboarding

- Increased data accuracy

- Rapid cost savings

- Investment protection

- Cross-selling opportunities

- Improved employee morale

- Higher customer satisfaction

Even as early as five years ago, studies showed an approximate 200% increase in financial service companies’ return on investment (ROI) within the first year of RPA deployment. More recently, studies show that RPA deployment can immediately reduce labour costs by up to 40%. However, it’s important to note that automated tools are designed to enhance rather than take away from an MGA’s core responsibilities.

Use Cases for RPA in the Insurance Industry

Some of the main areas where robotic process automation in insurance can enhance an MGA’s role include:

Underwriting

Underwriters typically need to analyse multiple data sources to determine risk and get clients the right policies and rates for their needs. However, underwriting RPA tools can collect essential customer data and present it on a central dashboard for faster decision-making.

For example, Insly’s Virtual Underwriting Assistant tool automatically pulls in information from Companies House, performs address, vehicle and vessel lookups, credit checks, etc. to help underwriters verify customer information without manually searching through databases.

Tasks like opening separate web pages may not seem time-wasting on the surface of things, but having relevant data pulled for you eliminates many possible distractions. Streamlining everyday tasks in this way keeps your team focused on doing their best work. It also minimises instances of human errors.

Registration form handling

Integrating RPA with optical character recognition (OCR) software enables insurers to verify signatures from quote submissions automatically and send the information to the appropriate workstreams. These automated processes increase data quality and accuracy while reducing admin backlogs.

Policy administration

RPA helps your brokers create more engaging experiences with policyholders. For insurance, Insly’s software can extract data, update systems, give instructions to human users and deliver confirmation. Technology like AI help brokers process B2C communication more efficiently, providing a more personalised customer experience overall.

Product innovation

RPA in the insurance industry is excellent for supporting new products and services like on-demand quotes, customer portals, and policy management apps. For example, using Insly’s tooling, our partners have already implemented 100s of new fully-automated insurance products, beating their competition in the market.

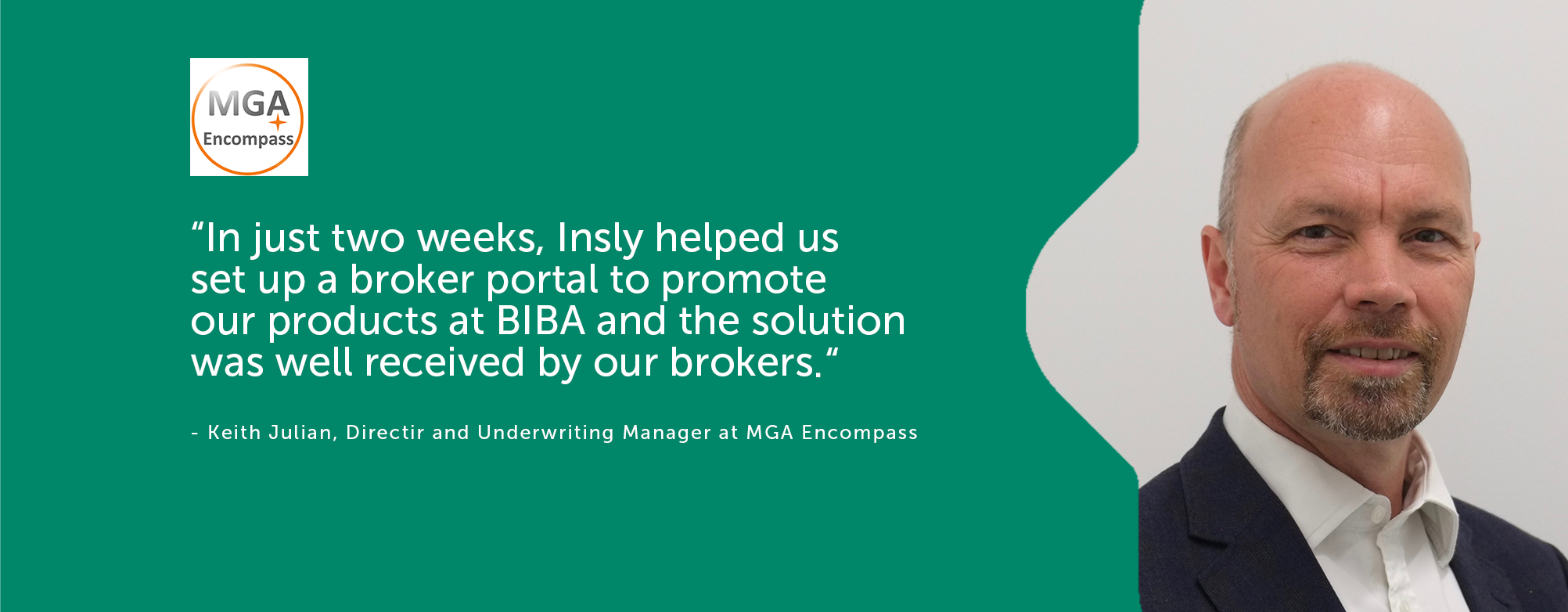

Head to our case studies page to see some real-life examples of Insly’s product innovation capabilities. MGA Encompass, for instance, built a fully-functioning property owner insurance solution in two weeks.

Automation in Insurance: How to Do It Right

Before you dive head-first into your RPA for insurance transformation project, here are a few things to keep in mind to help you get the most out of your customised solutions:

Define your needs

Before evaluating different software and platforms, it’s essential to define which aspects of your business are ripe for automation. For instance, what high-priority tasks can you automate to relieve pressure on your teams? How can you automate multiple functions across different business units, such as compiling written/paid/claim bordereau reports for your capacity provider? What capabilities do you need?

Determining your RPA requirements will help you find a solution that perfectly fits your firm.

Consider scaling options

When automating your insurance company, you might want to start out small. However, think about your scaling options well in advance to gain a competitive edge.

Expanding RPA to more processes across your company can help you leverage economies of scale and reap the full benefits of automation in insurance. You’ll also want a platform that you and your employees can manage easily on your own, so look for a platform with an intuitive user interface.

Check integration options and complementary capabilities

Since most RPA deployments involve multiple IT systems, it’s important to consider solutions with a modular setup that integrates with your existing workplace tools.

For instance, seek out RPA for insurance software that automatically updates your business’ accounting systems with all relevant financial customer transaction data.

Streamline Your MGA Workload with Insly’s RPA Insurance Platform

Insly has been working with insurers for over 20 years, providing a low-code SaaS solution that gives you the tools you need to take your insurance products to market quickly. All while ensuring all product designs integrate with your existing IT structure.

Please get in touch with the team today to find out more and get a demo of Insly’s excellent features.