Today’s insured who has experienced a loss usually turns first to their agent or broker for help. After all, the broker led the client through the complex insurance-buying process; therefore, he or she must be equally capable of handling the complexities—and potential problems—associated with settling a claim. At the very least, the insured expects that the broker can guide them through the process, providing sound advice along the way.

Why the brokers role in the claims handling process has been so limited?

Historically, in lieu of taking an active part in the claims settlement process, many brokers have operated merely as a liaison between the insured and the company adjusters. That role has usually been an informal one, with the broker following up with the carrier to expedite settlement while keeping the insured informed as the process unfolded.

Here are three main reasons why the role has been so limited in the claim process:

- Many brokers are unfamiliar with the details of the claims process. While they genuinely want to help a client settle a claim quickly and fairly, that task is usually left to the claims professionals, including accountants, engineers and other experts. The broker’s experience with claims is normally limited to occasional contact with insurance company adjusters. Also, some firms have a separate claims staff. In the event of a loss, the broker’s role is simply to put the client in touch with that staff.

- While he or she certainly does not want to alienate a client, it is assumed that a claim is being handled satisfactorily unless the broker hears otherwise. Therefore, most of the broker’s time is spent prospecting or developing new business, a task essential to his or her livelihood.

- Claims management software availability for brokers and agents. The main insurance claim software providers offer variety of features for the claims management process focusing on insurance companies. But insurance brokers need a simple tool to register the claims and follow up the process. That is why Insly is offering the easy-to-use claims management module to our clients to set up and manage their claims.

Whether personal or business related, the claims process is when a broker really proves their worth. The broker provides an integral service to ensure a smooth and successful outcome is achieved following an insured loss. Throughout the claims process, the insurance broker can handle everything for the client. But too often the insured finds that their broker, while an expert on the coverages, is not as skilled in the area of claims. In fact, some brokers never even become involved in any way in the claims process. That’s unfortunate, because that process presents a significant opportunity for the broker to help deliver a crucial service to their client—the indemnification and restoration promised when the policy is sold.

Is there any claims management software available for brokers and agents?

In the insurance marketplace, good brokers are always looking to differentiate themselves from the competition. Demonstrating a better-than-average understanding of the claims process can help a broker retain valued existing customers and impress new prospects.

Insly software has insurance claims management module

Many insurance brokers and agents have recognized that claims handling is very important to their clients and they place the highest emphasis on the claims service they provide. If you would like to provide consistent value-added service, Insly can help you with the insurance claims management software as part of your claims service.

Insly Claims Module helps you manage claims:

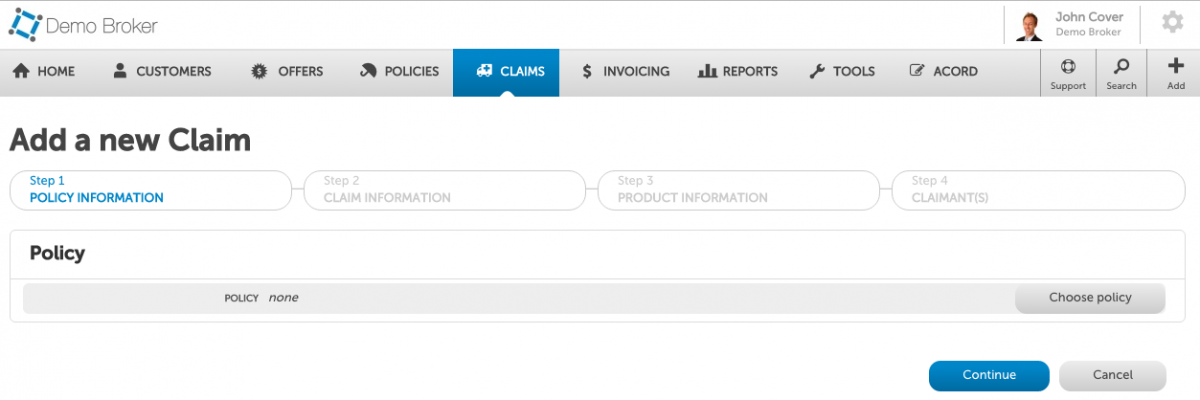

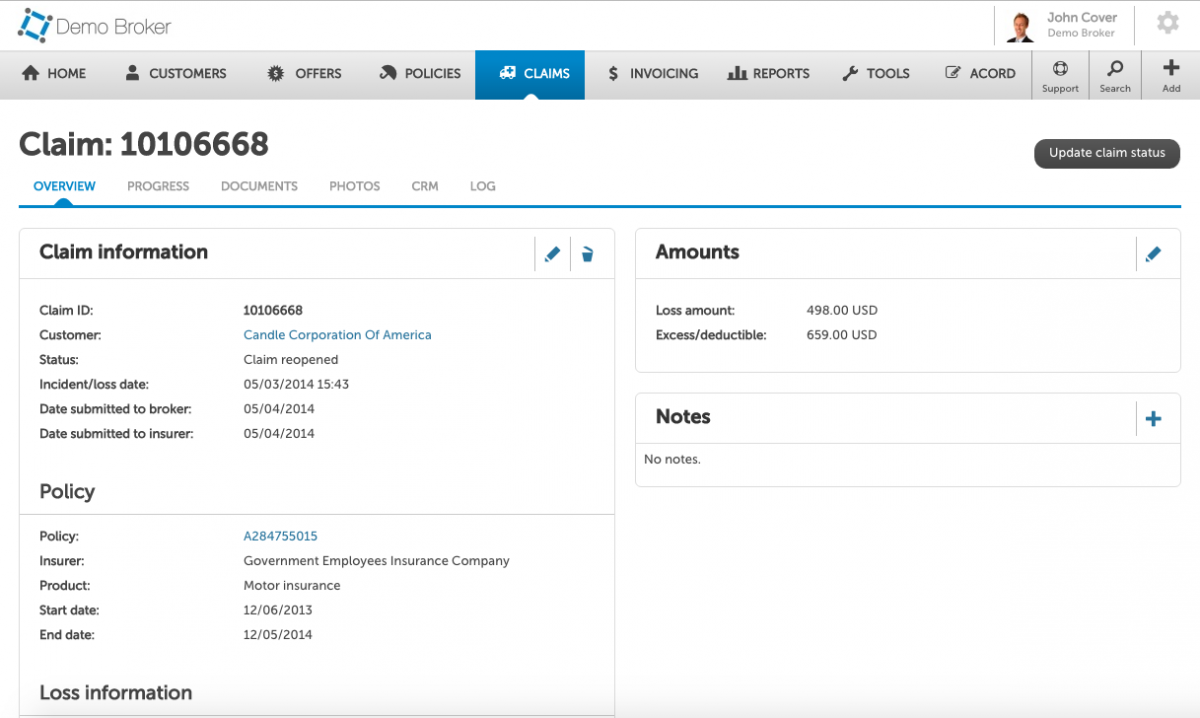

- linking the claims to the policies in the system

- uploading claim related documents to the system

- allowing you to define what claim info to collect (on product level and claimant level)

- managing the claim lifecycle by letting you define custom statuses

- possibility of creating diary tasks to remind you when a claim related action must be undertaken

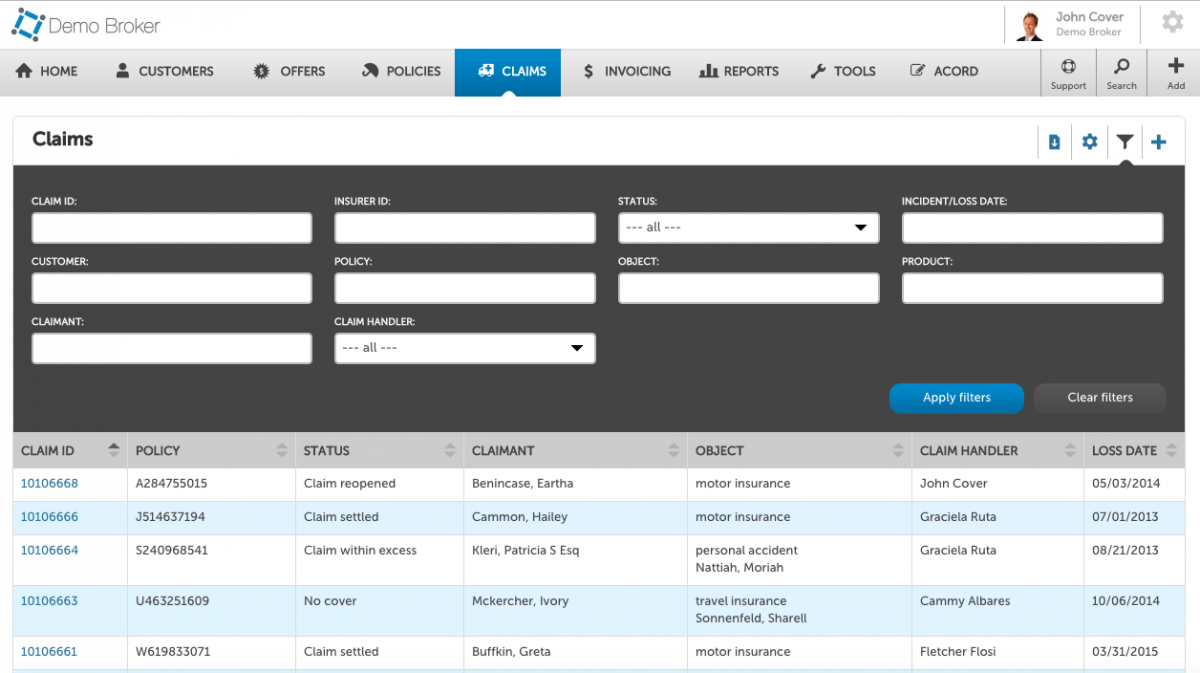

- searching for claims based on various criteria

How Insly Claims Module looks like?