Preparing an insurance proposal is a critical step in the broker sales process. By capturing client risk details and presenting cover options and recommendations, a well-written proposal ensures that clients understand all the details of an insurance product and enables them to make an informed decision before the policy is bound. It also helps to demonstrate the broker’s knowledge, expertise, and professionalism, while building trust with the customer.

While the exact details contained in an insurance proposal vary depending on the type of insurance (property, personal accident, motor, etc.), and the customer needs, every proposal should follow roughly the same structure and design. This ensures clarity for the customer streamlines proposal generation and workflow, ensures compliance with industry regulations, and consistency of branding and visual style.

Yet, for many brokers, preparing insurance proposals can be unnecessarily time-consuming, from the moment of application to producing the document itself. Many brokers must manually collect data, rekey information to request quotes in insurer templates, and then recreate the same proposal documents from scratch every time, meaning a lack of consistency. Others are working with templates that are difficult to use or outdated and don’t look as professional as they could, therefore impacting sales.

The latest technology, such as Insly’s BrokerFlow, has revolutionised the process of requesting quotes and preparing insurance proposals, meaning that it is now possible to customise proposal forms and automate the creation of insurance proposals. This greatly minimises the workload for brokers, while ensuring documents are as professional and consistent as possible.

What does an insurance proposal include?

Every proposal should contain roughly the following sections:

- A brief introduction: An overview of the provider, what the customer has requested, and how the proposal is responding to their request.

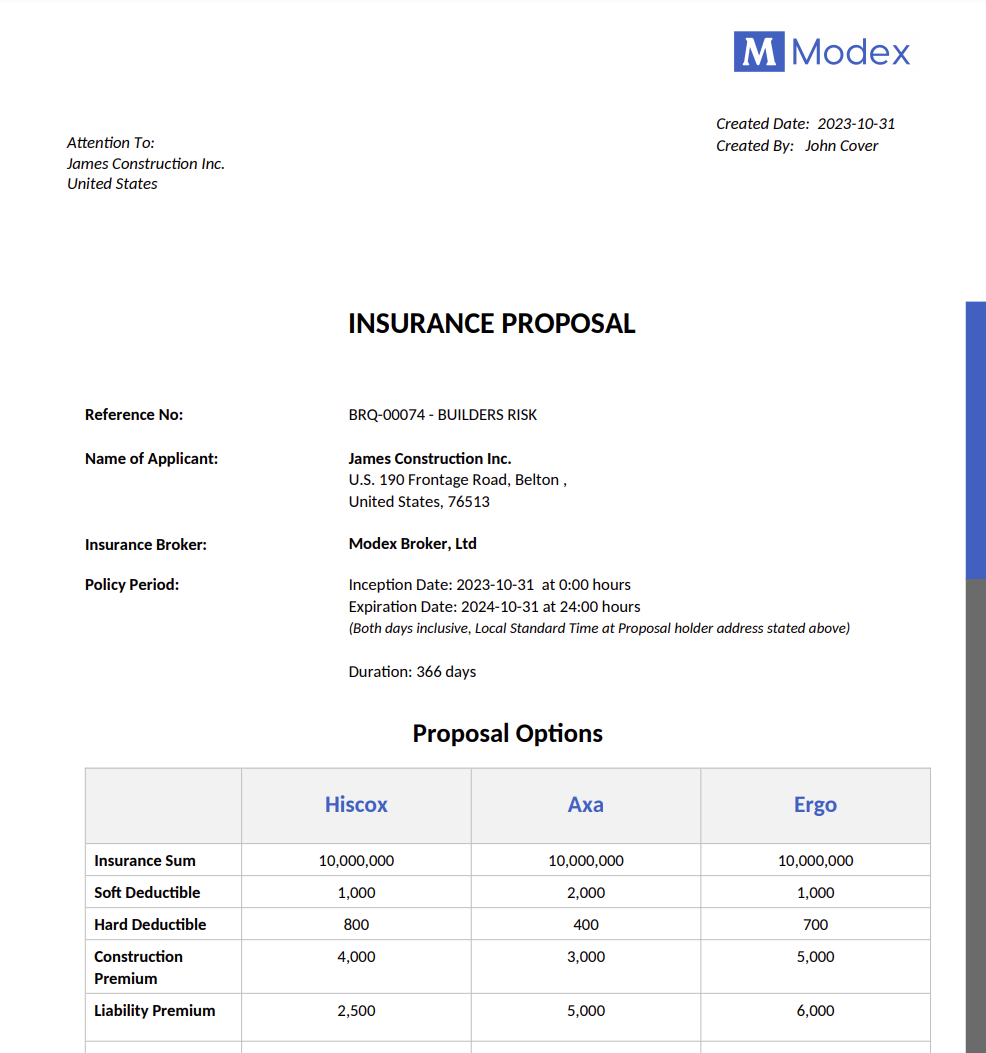

- Schedule: An outline, usually in table form, of the key areas of coverage, the value insured and the excess, where applicable.

- Description of the proposed coverage: Further detail on the areas of coverage, situations and items covered by the policy.

- Exclusions: A clear description of what isn’t covered by the policy.

- Terms and conditions: All the company’s legal information – the small print.

- Premium costs: How much will the customer have to pay and what are the payment options, e.g. one-off cost vs. monthly?

- Additional coverage: Information on add-ons that can be purchased. This provides an opportunity to upsell and cross-sell complementary policies.

- The offer expiration date: When is the insurance offer valid until, after which date, the customer would need to complete a new request?

- Commission percentage: In some countries, brokers must also disclose their commission percentage to their clients as part of the proposal document.

Insurance proposal template

Gone are the days when brokers had to write every proposal from scratch. Now, there are templates to work from, which mean that you don’t need to reinvent the wheel every time. If you’re looking for some inspiration of how to implement, update or overhaul your broker proposal templates, the following examples should provide some inspiration:

https://betterproposals.io/proposal-templates/insurance-proposal-template

https://www.proposify.com/proposal-templates/insurance-proposal-template

https://www.pandadoc.com/insurance-proposal-template/

How do I automate preparing an insurance proposal?

Templates are a great place to start, but to go a step further, the whole insurance proposal process can now be automated, to minimize the amount of broker input required, improving consistency and reducing the chance of errors. Broker proposal software, such as Brokerflow, covers three key steps:

- Application: The customer completes an application form (request for quote), which is either sent to the customer or hosted on the broker website. Information can also be extracted from third-party data sources to ease form filling, e.g., official company register, or car registration database.

- Request for proposal (RfP): From the completed application form, brokers can automatically generate a risk survey or insurance request form in the template that insurers require, streamlining the quote tendering process among insurance companies.

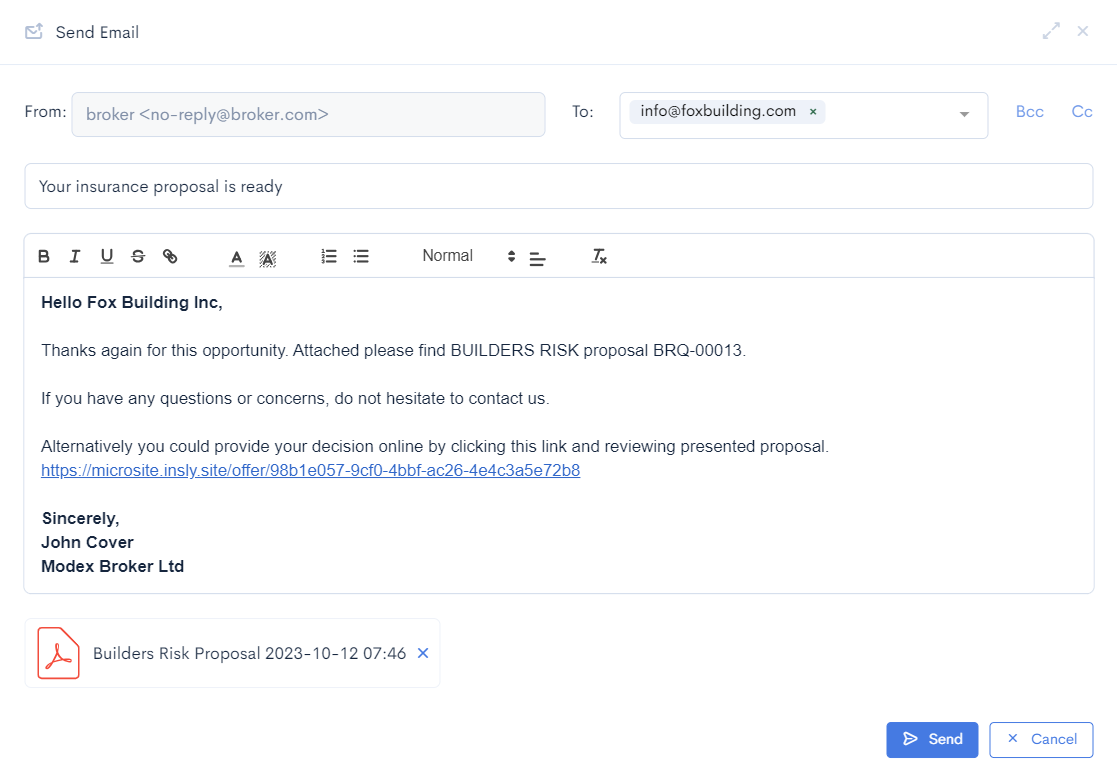

- Building a proposal: With conditions received from insurers, broker proposal software will then build a clear, aggregated and branded pdf proposal, incorporating all the insurer’s conditions and cover information required. This can then be shared with customers, by instant emailing this document together with an online link where they can preview the proposal online and accept, or request any adjustments.

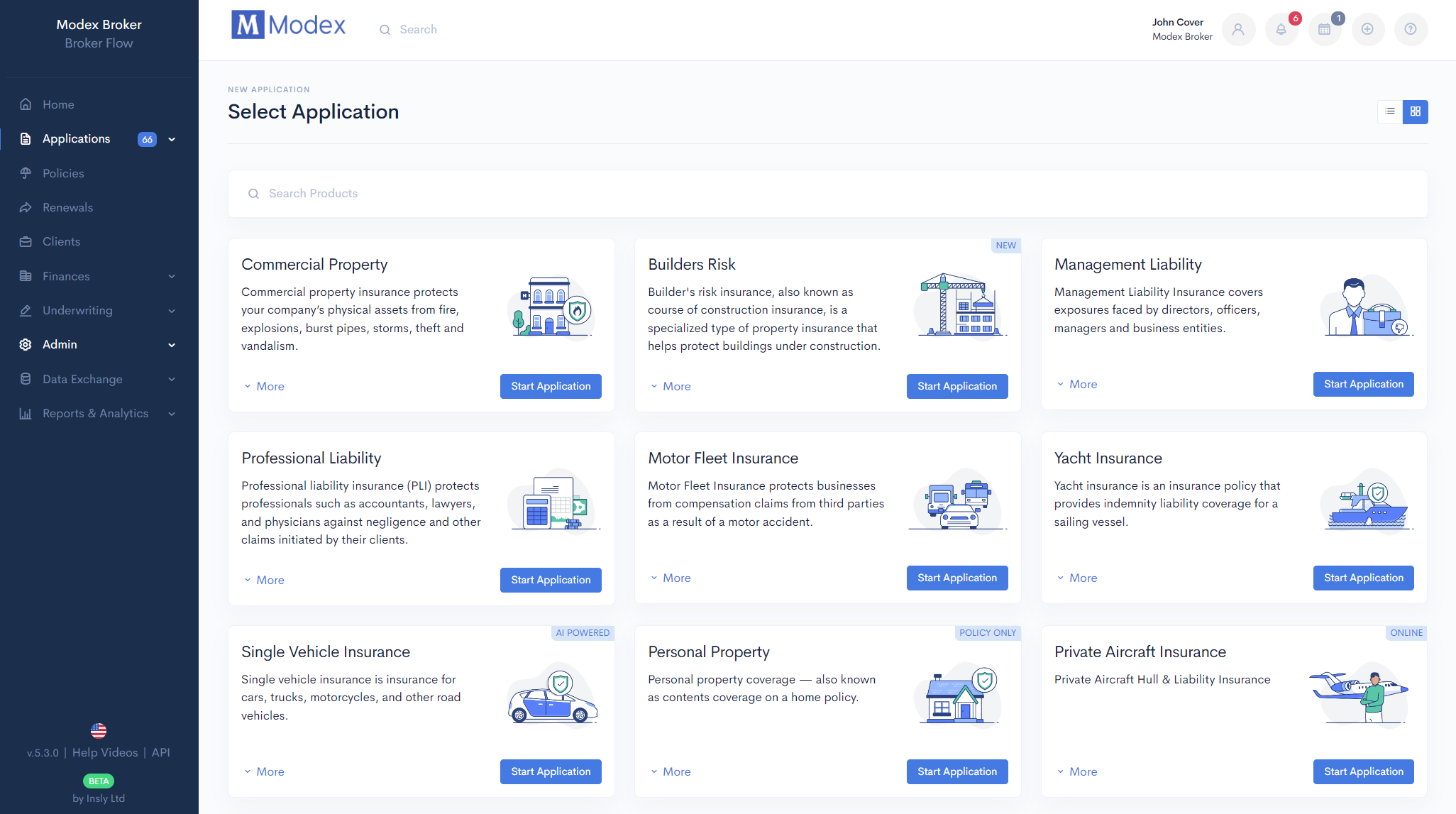

The broker selects the type of insurance that the customer wants to purchase.

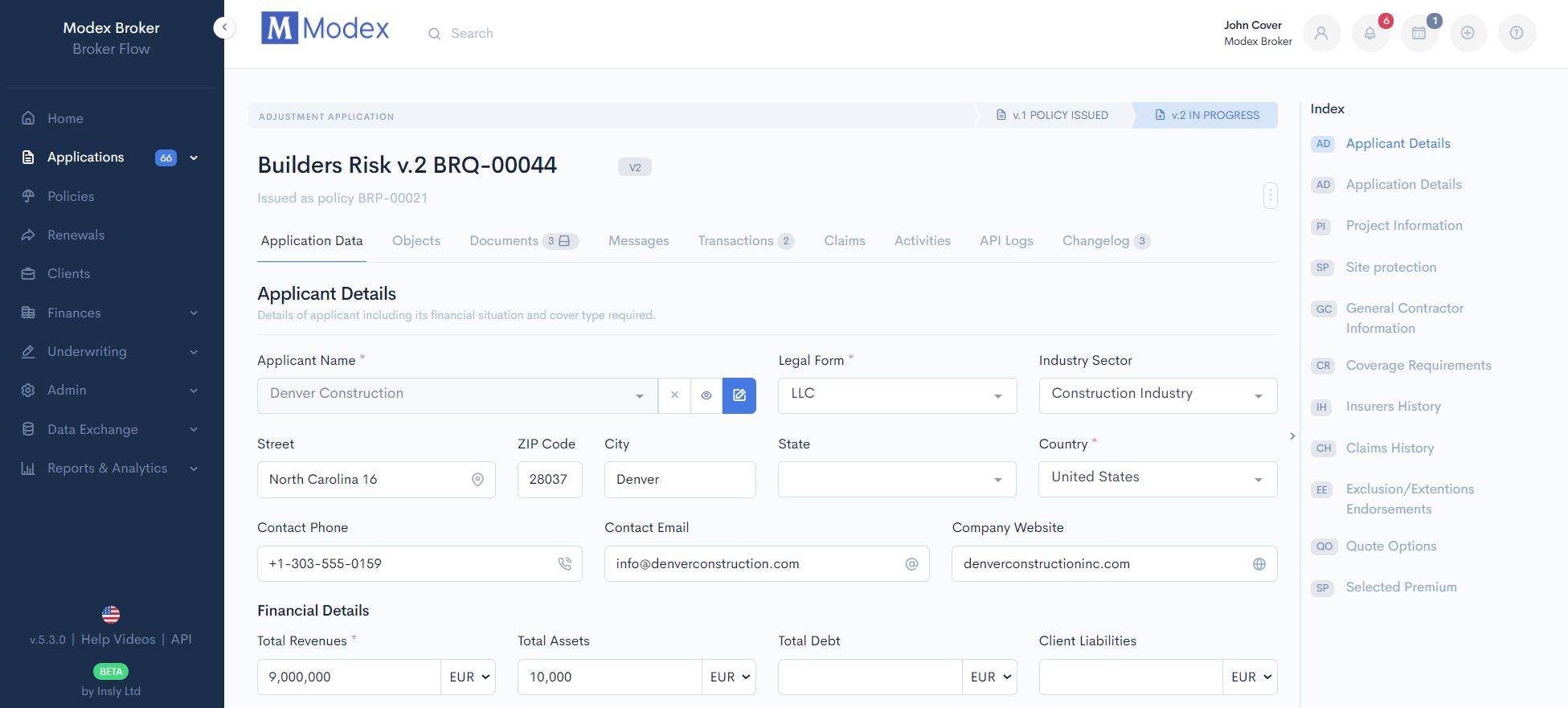

This screen enables the brokers to input the customer’s details directly into the system, which automatically populates Request for Proposal (RFP) documents for relevant insurers.

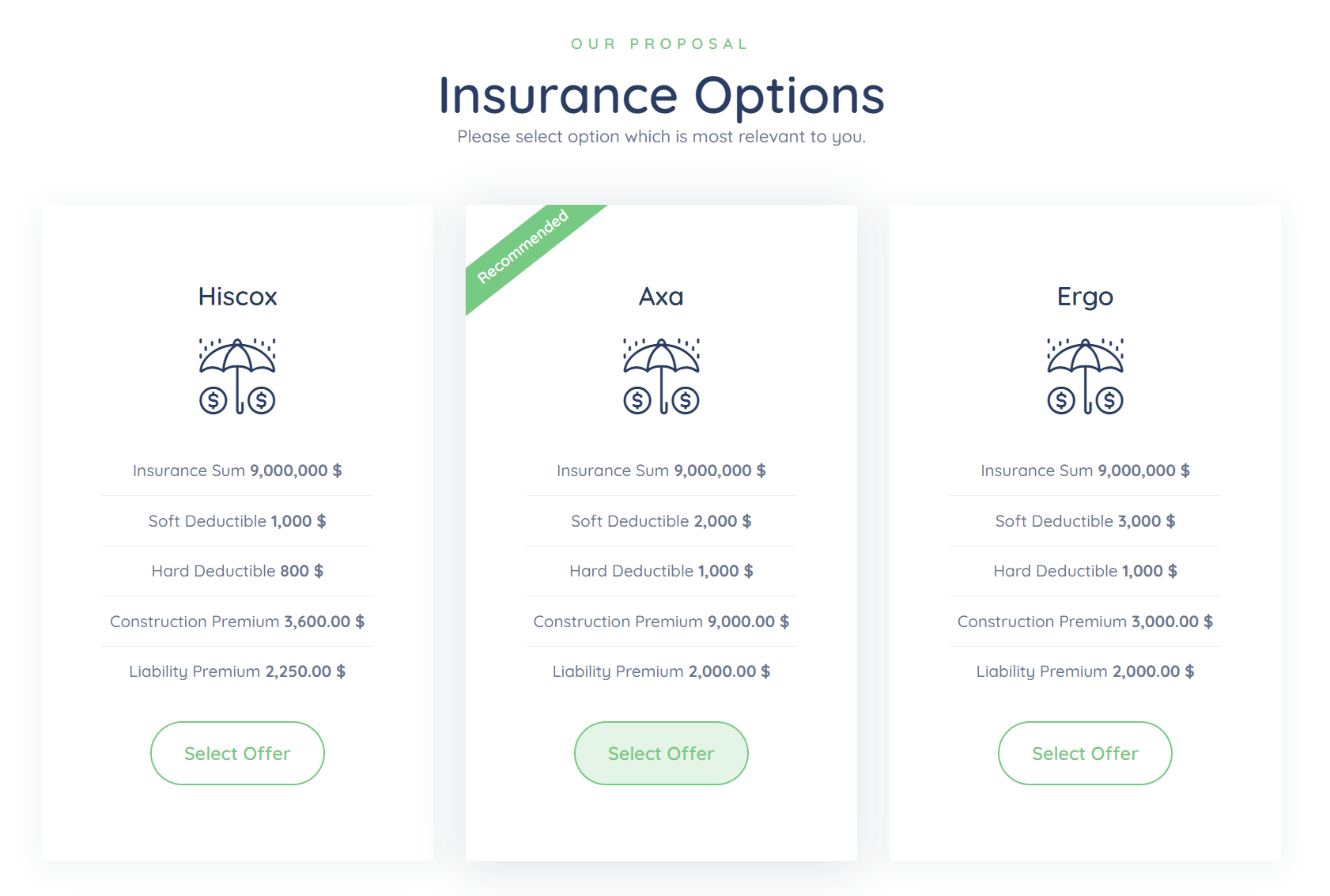

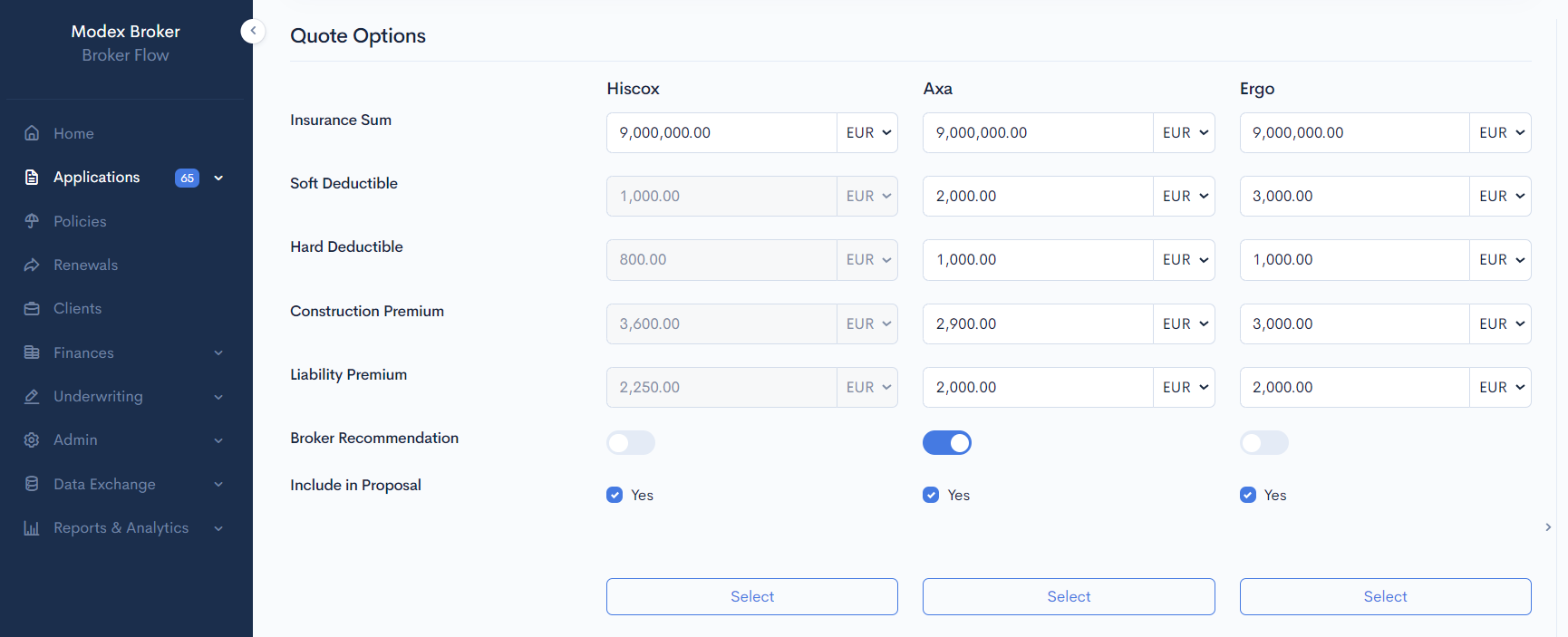

When insurers respond, the broker is prompted to choose the quote that best suits the needs of the customer.

The system automatically generates a branded proposal document, which can be automatically emailed to the customer for review.

Seamless implementation

Integrating broker proposal software into how you work has never been easier, thanks to Insly’s low code setup, which avoids the need for hands-on IT development. The platform integrates seamlessly with brokers’ other systems through in-built APIs, for seamless data transfer. Plus, as it is built specifically for brokers, it fits with their exact needs and workflows with minimal adjustments. So, you can focus on winning customers and growing your business.

To find out more about BrokerFlow or to arrange a demonstration, get in touch.