- brokers, who take their cut from the gross premium paid

- insurers, who receive net premium in return for underwriting the risk.

The fees add up, and insurance turns out to be an expensive business, which isn’t exactly great news for many people who own insurance they don’t (or only rarely) use.

In today’s interconnected society, where more and more transactions are being carried out online, one can question the relevance of such old-style business approaches. Airbnb, usurping the biggest hotels by leveraging the power of a community to provide accommodation, and peer-to-peer lender Lending Club, cutting out the middle man to offer lower rates for borrowers, are just a couple of examples of companies capitalizing on the need for alternative solutions. They have one thing in common: they tap into a shared economy, uniting groups of consumers in order to achieve lower rates.

Tech’s peer-to-peer model is now transforming the £1,23tn insurance industry. Friendsurance is leading the way with its peer-to-peer insurance platform, where groups of friends come together to create their own insurance pool. A percentage of each person’s premium is set aside to cover the network’s smaller claims, with bigger claims covered by traditional insurance. If the claims don’t exceed the pool, individuals get their money back. The more friends there are in the pool, and the fewer claims there are, the more money you save.

Take personal-liability insurance, a must-have for most Germans, who are among the world’s best-insured people with an average of more than five policies each. German students pay around €55 ($71) annually to insure damages up to €10m. If five friends band together and none makes a claim, they will get about €24 back at the end of the year (the rest is kept to fund larger claims). Even with several small claims, there will probably be some cash returned.

Insuring in self-selecting groups can improve the quality of the risk. Friends tend to be more honest with each other, which makes fraud more unlikely. They are also less likely to put in for very small claims—a broken teapot, say—which generate a lot of costs for traditional insurers. And social insurance is viral: customers have an interest to spread the word and get other friends to join in.

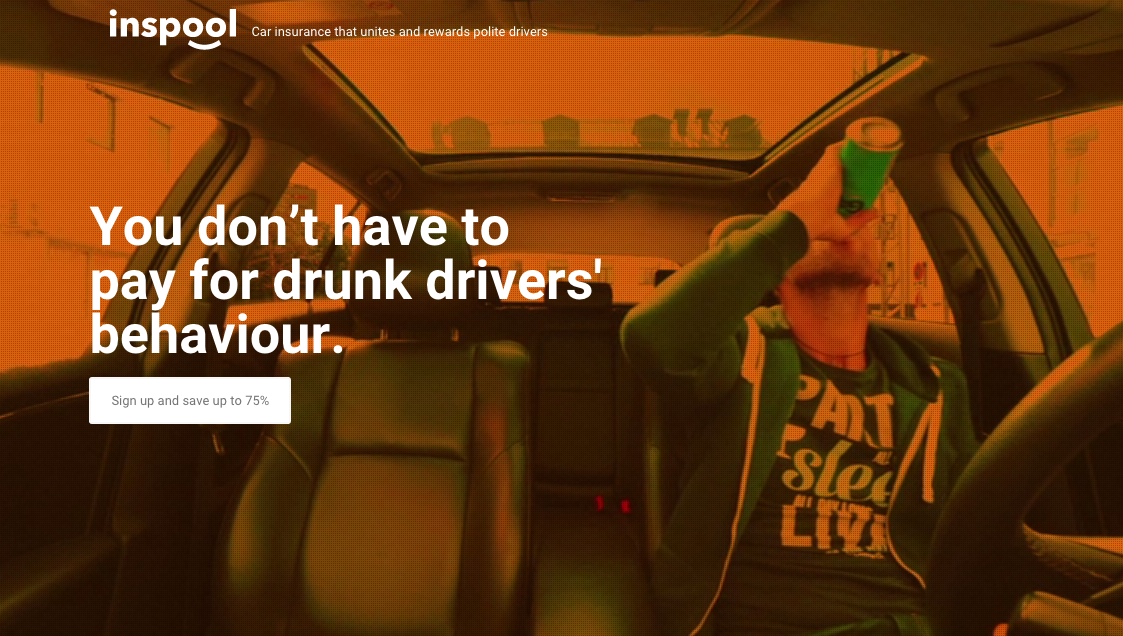

The other P2P platform, Inspool, says drivers are saving up to 75% of their premiums. Their vision is to change the insurance industry in the same way that peer-to-peer lending and crowdfunding are changing banking. The Inspool platform uses the power of social networks to let drivers connect with family and friends to form their own insurance groups. The group pools premiums together online and trusts each other to only claim when necessary and not to inflate claims. Together you can save up to 75% each year by not paying for bad drivers, fraudulent claims and inefficient insurance companies. Inspool is passionate about using technology to give consumers a better deal and believes that good honest drivers deserve reward not penalty. They aim to disrupt the traditional insurance world. In the future you won’t insure your car, you’ll inspool it.

Peer-to-peer insurance is quickly gaining traction, with the solution decreasing the likelihood of fraud (you wouldn’t lie to a friend, would you?). Most importantly, it saves you money. Perhaps it’s also the result of the fact that we’re naturally predisposed to be part of a support system. The P2P model doesn’t seem so new when we remind ourselves how things looked before insurance came along hundreds of years ago, when families and communities helped each other out when in need, and they still do. Peer-to-peer insurance simply restores this mutual support system and turns it into a business.

Traditional insurance companies can learn a lot from the new players in the fintech space when it comes to having a customer-centric approach and flexibility. In fact, they should be grateful for the new P2P model, which helps insurance companies in more ways than one: improved behavior reduces claims and processing costs, and receiving money back in claims-free cases increases customer satisfaction. It’s a win-win for everyone.

Sources: banknxt.com, inspool.com, friendsurance.com, economist.com