Previous way of underwriting

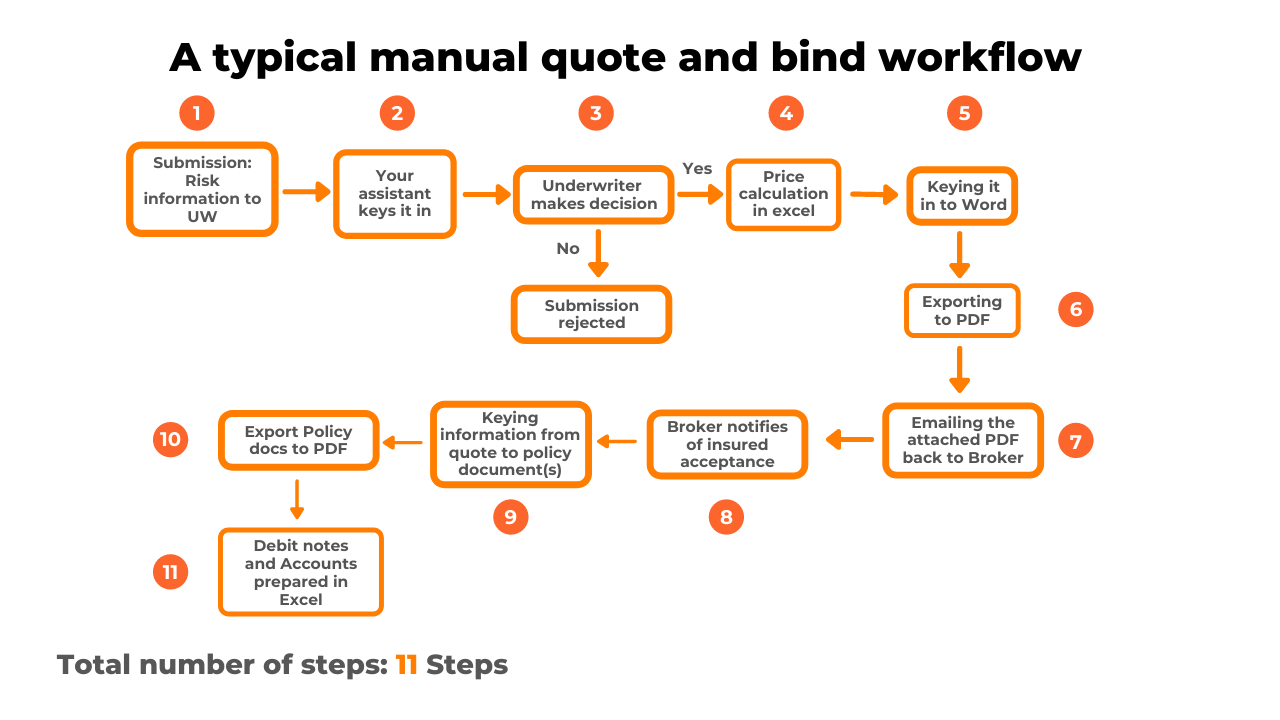

Back-and-forth e-mails from brokers, double-keying risk, policy, and price information, navigating between spreadsheets to calculate premiums – does that sound familiar? All of this is a common part of a commercial underwriter’s daily routine and their Quote and bind process.

A manual underwriting workflow absorbs a lot of time and has a higher risk of errors, since each stage of the quote and bind process depends on human intervention. Underwriting doesn’t necessarily have to be this complicated nor require underwriters to step in for each and every case.

Let’s break down how the commercial insurance policy quote and bind journey usually looks like and see if there are any alternatives.

Risk Submission

Previous way of underwriting

Brokers send risk information to the underwriter by e-mail. This can come in various formats, but the most extreme example would be a scanned file that you or your assistant needs to key before you can even start working on it.

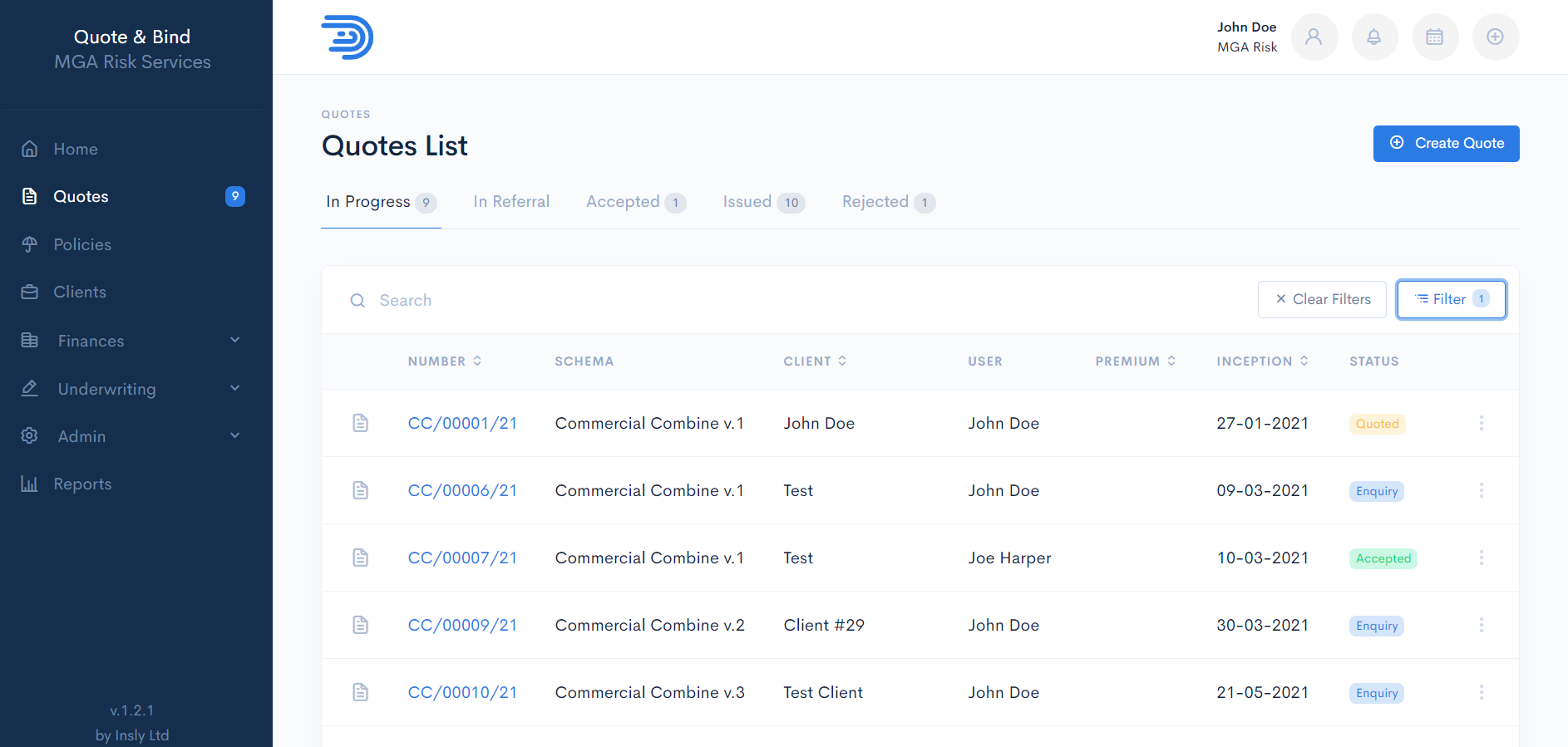

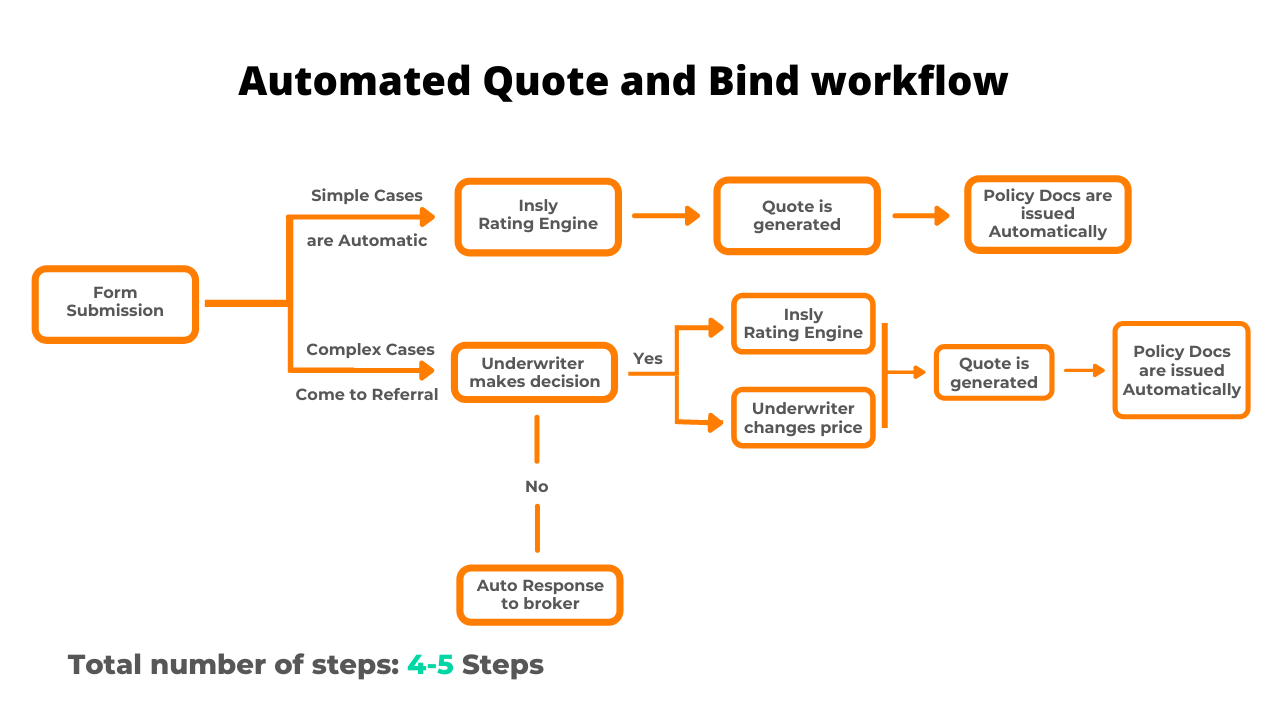

Automated Quote and Bind

For cookie-cutter cases, the broker fills in the submission in their broking system or your online portal and gets a quote right away. For more complex cases where an underwriter’s decision is needed, a referral rule is triggered and this lands on your dashboard.

Customer Background Check

Previous way of underwriting

To run the background search on the potential insured, you or your assistant must check it against the sanctions list, run a credit check, find the company’s SIC code, and come back with the “OK” a good 10 minutes later.

Automated Quote and Bind

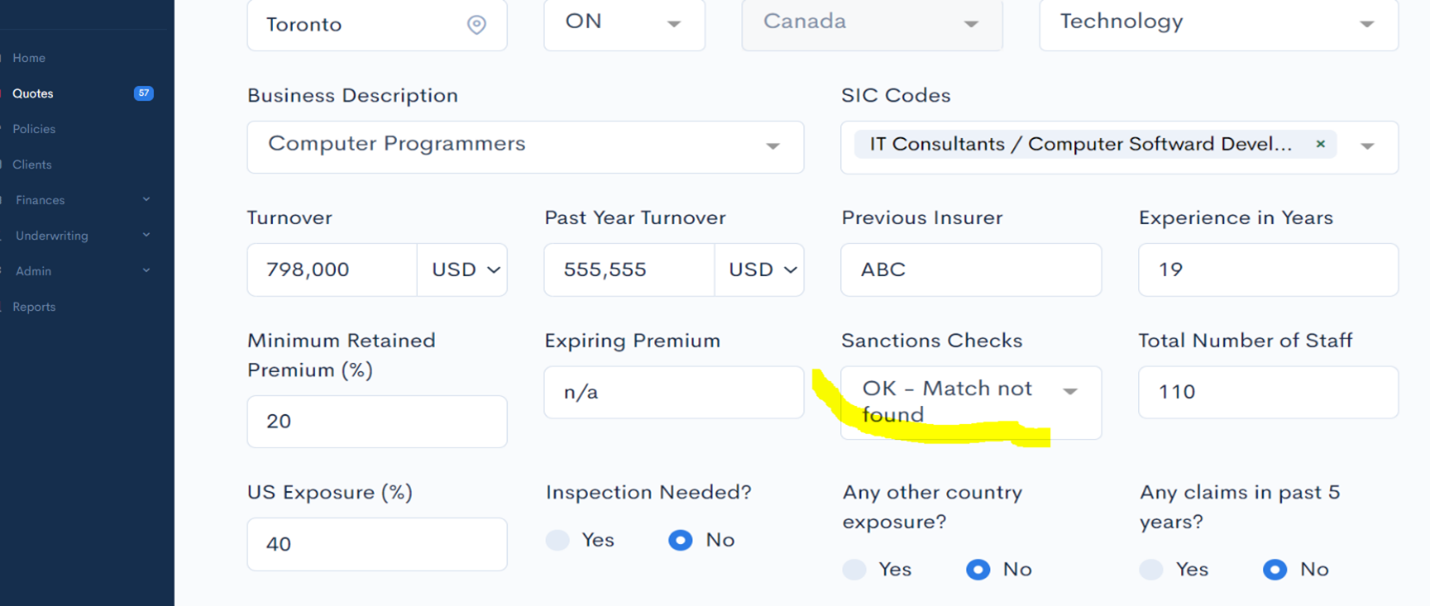

You open the quote on your dashboard and see the result of all the background checks. This is possible thanks to your underwriting system being connected to all necessary databases via APIs. The information you would normally double-check on the web is now seamlessly displayed in your system.

Book a demo

Calculating Premiums and Producing Quotes

Previous way of underwriting

For every submission you want to quote, your assistant takes relevant pieces from the broker submission and types them in the Excel rating spreadsheet to get the base premiums. You review the results, make loadings or discounts upon necessity and return the final figures to your assistant, who meticulously types them into the Word template. That is diligently exported into a PDF file and e-mailed to the broker. How many interactions did you already count?

That’s not all, because later that afternoon, you get a call from your broker who is amused by your prices that have become a little too good to be true. You check the PDF file from your client folder and realise that your assistant missed a “0” at the end of the price row. Your job is to fix the problem in the blink of an eye and send the broker a correct PDF. At the end of the day, you both have a good laugh about your amazing discount offers and you wish it wasn’t only a 500 quid policy.

Automated Quote and Bind

You open the quote that requires your attention on your dashboard and review the base premium calculated by the rating engine. Taking note of any red flags that show up on the form, you add the appropriate loading or discount, double-check that all is correct and push a button to confirm. The quote notice and documents are immediately sent to your broker and you move on to the next risk requiring your attention.

Which Way Will Prevail?

If you made it this far, you probably noticed a clear bias towards the alternative which is the portrait of an underwriter using an efficient, modern underwriting system like INSLY.

We recognize that not all insurance is created equal and more complex risks require human underwriter expertise. Even so, the routine parts of the process can lend itself to automation and problems like rekeying between multiple systems, simply put, should not exist.