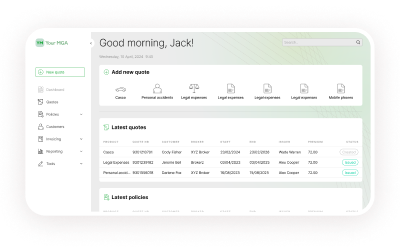

END-TO-END UNDERWRITING SOFTWARE

Replace outdated legacy systems with Insly’s modern, all-in-one underwriting software. Automate your entire workflow, from submission to bind, and empower your team with the data they need to write smarter policies.

70%

Faster submission processing

95%

Data Entry Automation

3x

More Quotes Delivered

40%

Reduction in Errors

Insly’s underwriting software brings all your essential tools into a single, cohesive system.

Instantly digitise broker submissions using AI and automatically route them based on predefined rules for risk level, urgency, and underwriter assignment, helping you respond faster and manage capacity more efficiently.

Support both high-volume personal lines and complex commercial risks with a scalable, flexible rating engine. Easily apply pricing logic, loadings, and discounts tailored to each product or risk profile.

Connect to any third-party data sources and compile all information into a single underwriting view. Offer underwriters a comprehensive overview at a glance, without needing to switch systems.

Generate quotes, binders, and policy documents instantly using pre-set templates. Automatically send them to brokers via email, keeping communication seamless and saving hours of manual admin.

Manage every stage of the policy journey in one system, from quote and bind to policy changes, renewals, and cancellations. Maintain consistency and accuracy without switching between tools.

Access live dashboards to monitor key underwriting metrics, submission volumes, quote-to-bind ratios, referral triggers, and profitability by product or broker. Spot trends and make data-backed decisions.

Let us walk you through a live demo tailored to your specific business needs. Discover how Insly can help you streamline operations, reduce costs, and scale your underwriting capacity.