Flexible end-to-end software, built for insurance companies

As digitisation accelerates, insurers must constantly innovate to stay ahead. Meeting customer demands, maintaining profit margins, and managing compliance requires the best insurance software. Yet, many insurers still rely on legacy systems, which limit operational efficiency, customer experience and profitability.

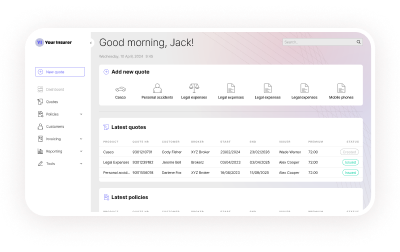

Insly’s insurance software solutions are built by insurance experts for insurers, with a flexible, modular approach that spans the insurance lifecycle. Insly can be implemented in a matter of weeks, and delivers fast ROI through streamlined workflows, business intelligence, and end-to-end reporting.

Discover how Insly’s insurance software platform can help your business build better products, increase profitability, and grow.

Build any non-life insurance product in weeks, rather than months, without writing code or involving developers.

Create a seamless broker, direct to customer, or embedded insurance workflow, optimising the sales cycle and maximising conversions.

Automate your entire accounting function to reduce manual processes and aid compliance. Generate reports on any data point in the system.

Our end-to-end claims management product suits any line of business and can be used standalone or integrated with other Insly modules.

Flexible and modular, Insly covers the entire insurance lifecycle allowing insurers to implement the elements they need and expand over time. Extensive user settings let you control data access, while open APIs mean easy integration with legacy systems.

Build a more connected and streamlined insurance organisation, and see fast results in terms of improved productivity, compliance, IT maintenance, and overall profitability. Free up your employees to focus on adding greater value, while improving data management, access, and reducing the chance of errors.

Emerging technologies such as artificial intelligence and robotic process automation are on the cusp of revolutionising the insurance industry, and insurers need to be ready. Insly’s insurance software platform helps you build the technology and data foundations to innovate quickly.

Our combination of set-up and insurance expertise means the Insly system can be tailored to your insurer’s needs in a matter of weeks. Free up your IT team, by reducing the need for lengthy development time or onboarding – and see the benefits for your bottom line.

Data is vital to writing better cover, aiding decision making and streamlining compliance. Insly’s insurance software platform allows real-time reporting and analysis of any data point in the system, improving business and customer visibility, empowering underwriters, and maximising profitability.

Insly’s insurance software can be seamlessly integrated with your existing systems, or with third parties, including brokers and MGAs, via open APIs. So, you get full data alignment and connectivity across the business, with no need to transfer or re-key data between systems.

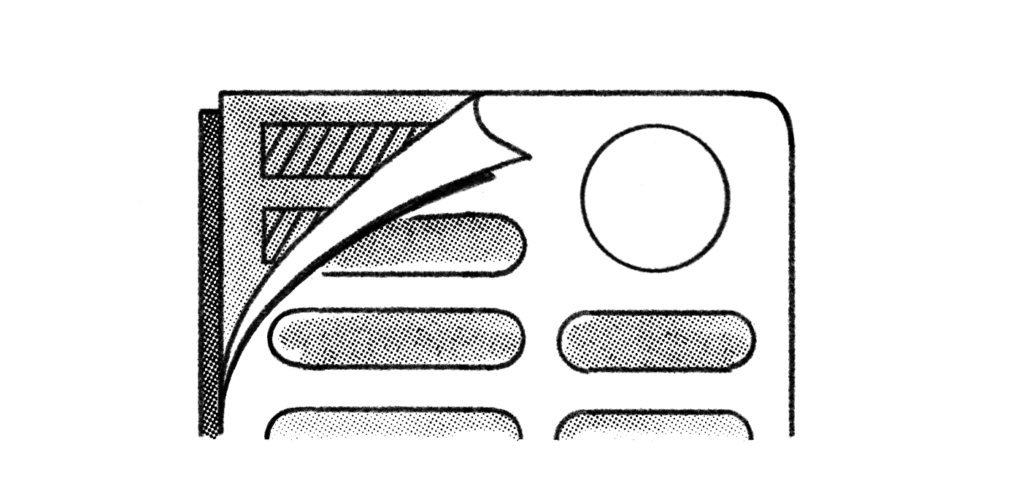

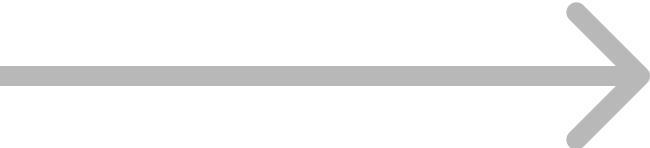

Make a plan and create your first product draft in a test environment in 2-3 weeks.

Add and combine key elements such as underwriting rules, templates and automations to create your ideal solution in 1-3 months

Your platform can be fully operational and ready to transform your business in 3+ months.