Your products deserve to go-to-market, and IT should not be a blocker.

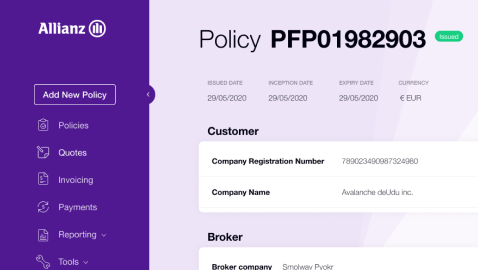

Every aspect of the product can be changed on the fly: forms, workflows, documents.

Build online or convert from excel – your rating engine is live in one day. Provide rating engine API access for your partners.

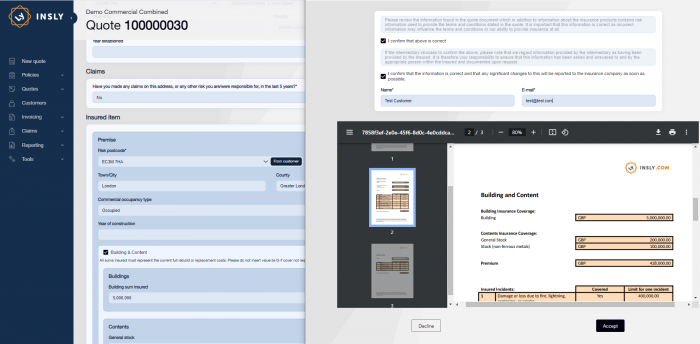

Generate professional looking documents in a click. Template changes are as easy as uploading a word document.

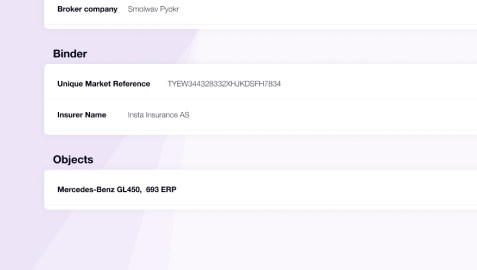

Give your staff the gift of extra time by taking your applications online. Give your brokers access with the click of a button. Let your most valuable partners access your products directly from their Policy Administration System and sell them on their website.

The entire policy system is exposed via APIs so you can create the perfect consumer experience.

Great underwriters manage great portfolios

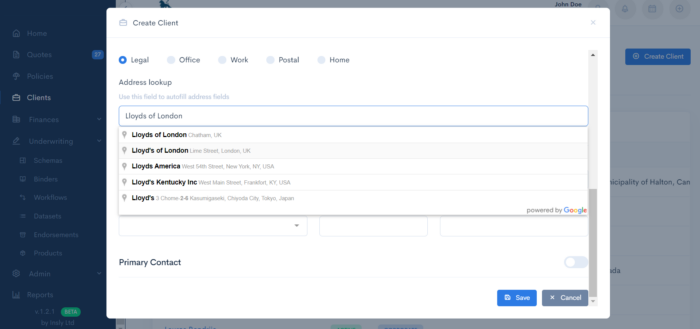

Place all decision-making aids right on the underwriter screen (quote submission + referrals + sanctions searches + address lookup — you name it).

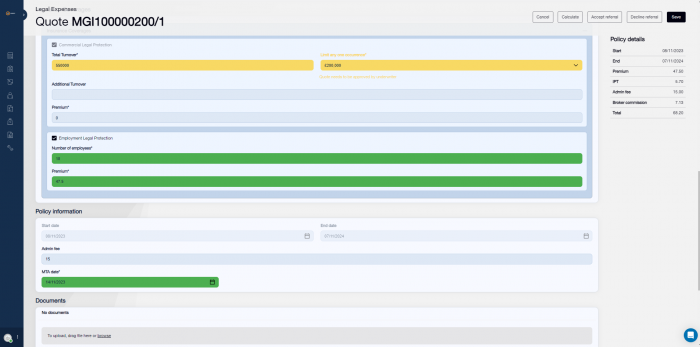

Customisable workflows with referral triggers mean you can take your hands off the simple cases and focus your time on adding customer value.

MTA-s and endorsements can be processed in their entirety by the requesting broker/customer, with customizable safeguards that give you control over this process.

Automatically assigned reminders mean renewal cases always reach the right person in time. Take it a step further and automate your renewal quotes or policy creation flows.

Document generation, upload and storing makes staying on top of things easy. OneDrive integration lets you seamlessly sync files back and forth with your Microsoft applications.

Update your quote/policy document templates by simply uploading a new file

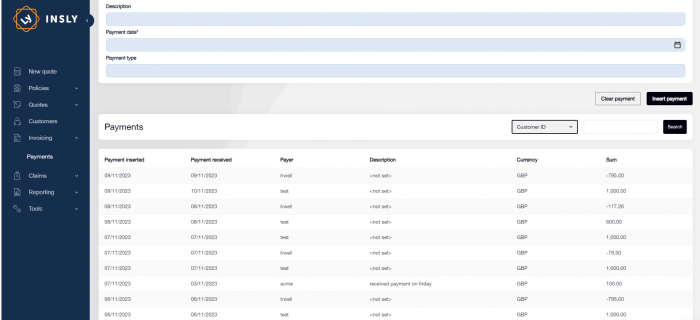

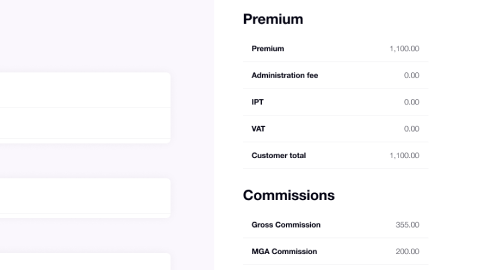

Insly’s double-entry ledger and premium accounting features help you make sure every cent is accounted for.

Create and send policy invoices automatically. Track premiums coming in and premiums moving out of your trust accounts.

Invoices, instalments and payments are tracked in multiple currencies.

Comply with your insurers’ data requirements and produce written/paid/claim bordereau with the click of a button. Send data to your insurer electronically in real-time or via a good old-fashioned excel bordereau

Thanks to the built-in double entry accounting ledger, rigorous accounting reports like P&L statements and Trial Balance are produced with ease.

Create custom business intelligence reports and dashboards from any kind of information you collect.

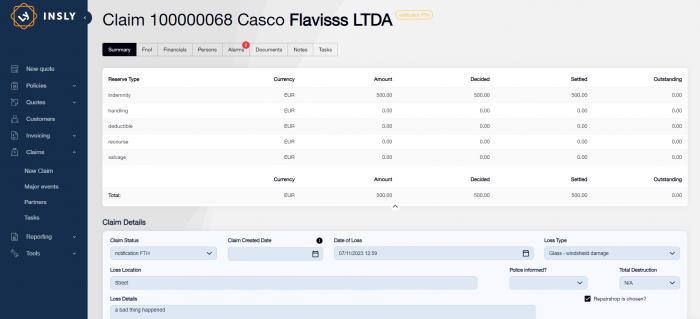

Decent claims handling means better conditions for all parties!

From fast & clear to a fully automated handling process.

For all types of users.

Customized reporting.

Less TPA services.

Faster process.

Fraud alarms.

See higher NPS scores and higher renewal rates for MGAs, Brokers and Insurance Companies.

Our MGA software applications are made for scale with a microservice architecture and designed to be flexible with an API first approach.

Plug in 3rd party data sources, such as Sanctions/Credit Checks, Property/vehicle/vessel lookups, and Google Maps location services so that the underwriter can view them all on one screen.

Need an underwriting platform to launch a new portfolio quickly, but don’t want to replace your entire backoffice accounting? INSLY can easily integrate to your accounts package.

There are many good reasons to develop your own applications. Our platform lets you integrate them for maximum flexibility