Our previous posts talked about integrations in insurance product building. This time, we’ll focus on how integrations help underwriting.

Through different integrations, Insurers and MGAs can enrich the data they work with to make more informed decisions. Data enrichment means merging third-party data from external sources to enhance information about your customers, risks you are insuring, and the rates you provide.

Almost every line of business can benefit from third-party data sources during underwriting stages. Yet, accessing this data is often a tedious manual process. Integrations allow you to pull data from various sources exactly when it’s needed. This means streamlined submissions, accurate rating, and better user experience for Underwriters and end customers.

Integrations for Underwriters

An Underwriter’s task is to assess the risk and decide whether and on which conditions to insure a person, property, or a business. To make these important decisions, Underwriters need information which is as accurate as possible. Integrations in the following fields can help Underwriters with that:

- data enrichment

- object-based risks

- property risks

- corporate risks

- rating engines.

Data Enrichment

Object-Based Lookups

Underwriters insuring physical assets such as vehicles, vessels, aircraft, etc. often use third-party databases to populate the detailed information they need to price the risk, check that the information they have matches official records, and also to push information back to the same databases about which assets are placed under insurance cover.

In a manual workflow, an Underwriter might log in to the external database directly, run the query for the object (vehicle, vessel, aircraft, etc.) they wish to search, and then manually update their underwriting file.

The alternative is to integrate the underwriting system into those databases to automate manual efforts.

Insly has good examples of integrations to motor insurance specific databases, such as the MIB in the UK or Transport Administration in Estonia. Amongst other things, these provide details on vehicle make, model, registry number, and VIN code to simplify data enrichment, verification, and ultimately, decision-making for Underwriters.

Similar integrations can be made for other types of insurance as well. The key is finding the right sources.

One of Insly’s partner in Canada uses a similar concept to boost their underwriting efficiency for aviation insurance. To insure the physical property of an aircraft, tens of data points are needed for each aircraft (e.g. manufacturer, model, number of engines, engine type, etc.). For our partner who may cover one to multiple aircraft under a given policy, this could mean hundreds of data points per policy. This would require a lot of work if done manually.

Via an integration into the Canadian Civil Aircraft Register database, the Underwriter only needs to insert aircraft registration numbers in Insly’s quote screen, push a button, and the majority of data points are populated automatically for all the aircraft entered.

Property Risk Databases

The same kind of integrations can help Underwriters in assessing property risks. Risks that specifically impact buildings and facilities, that destroy and damage property fall into this category. This includes risk events such as fires, adverse weather conditions, and even terrorist attacks.

Property risk databases tend to be more location-specific. Here are just a few examples:

- HazardHub in the US;

- Opta Information Intelligence in Canada;

- REalyse and UK FloodScore in the UK.

Not only are integrations useful in making Underwriters’ lives easier, they can also be used to improve customer experience for the consumer.

This is the case for OneClickCover who use Insly’s insurance software to simplify the customer journey. In the UK, customers had to answer up to 60 questions to get a quote, but OneClickCover turned it around and now virtually no questions are asked at all. This was achieved by smart use of property and occupants’ data to price the risk. Combined with a policy fulfilment ecosystem, policy documentation is delivered to the customer in 60 seconds.

Corporate Risk Databases

The world of commercial insurance is extremely diverse and highlighting data sources for all different risks would probably be the topic of a good white paper. Hence, we will just resort to some examples.

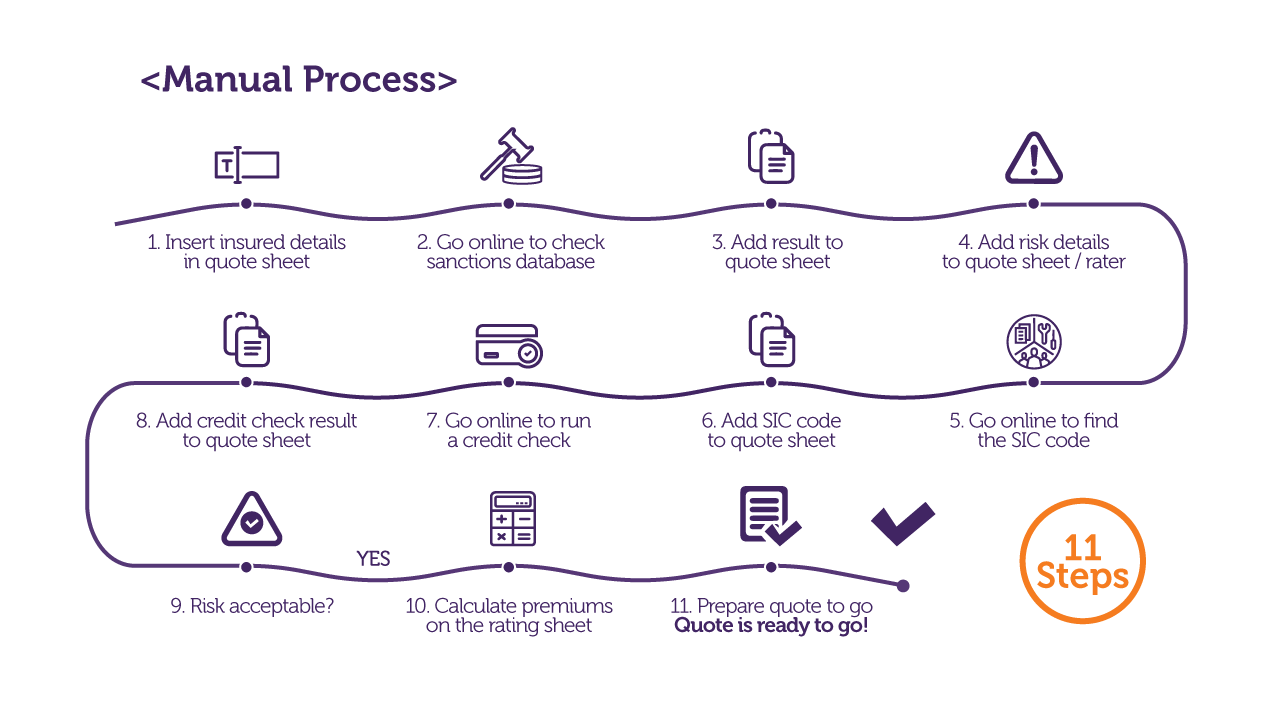

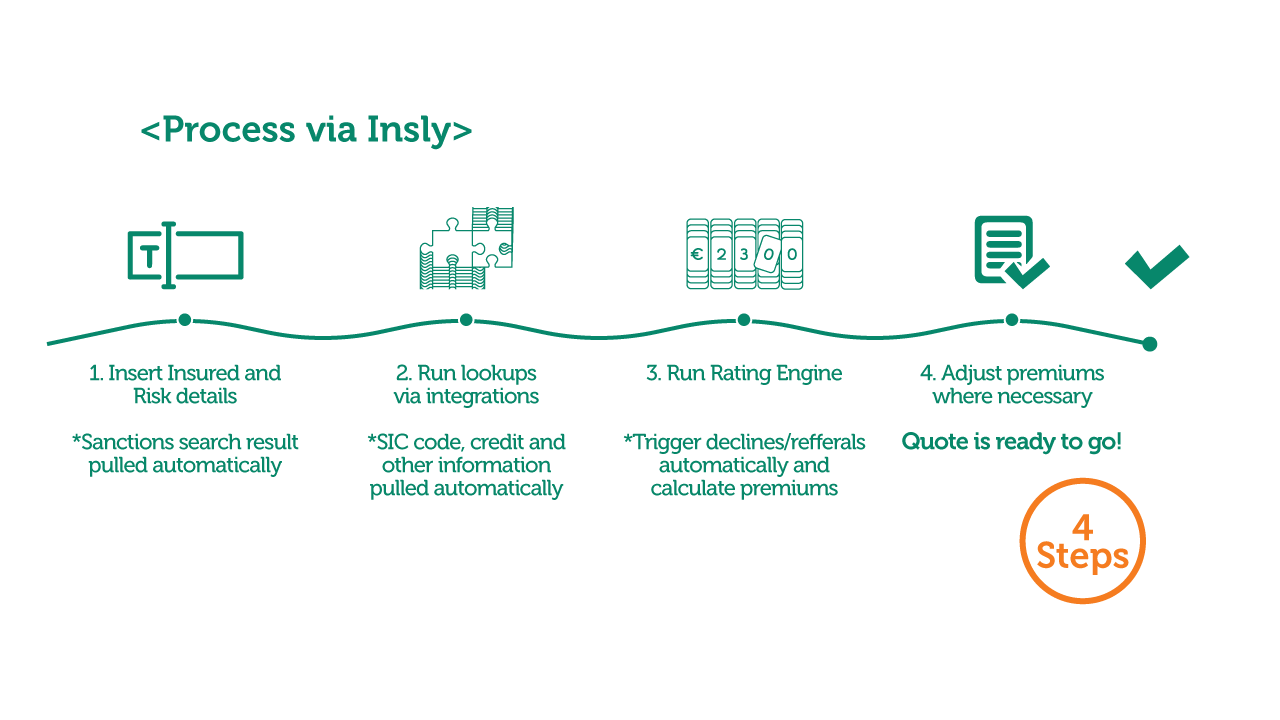

In a manual underwriting process, you might check the insured against the sanctions list, go online to find an SIC code, go to a third source to run a credit check, and after each lookup record all of that in your underwriting file. This adds up to a good bit of time, which could be spent doing wiser things.

Integrations allow you to access this information within a few clicks directly from your underwriting system.

The corporate risk integration we see most often is sanction search. As most of Insly’s partners use sanctionssearch.com to make sure the potential insured doesn’t have any ties to anti-money laundering, terrorism, or doesn’t belong to any sanctions list, we have made the lookup natively available to all Underwriters looking for sanctions search possibility.

For data related to a company’s finances, Underwriters can benefit from lookups like:

- Yahoo! Finance for financial data and reports;

- Sterling for business, bankruptcy, insolvency, and credit checks;

- LexisNexis for data from credit risks to financial crime compliance;

- Refinitiv or Sustainanalytics for sustainability and ESG research data.

Rating Engines

Rating does not necessarily need integration, but as an essential part of the quoting and underwriting process, it can be closely related as some of the data points required to calculate premiums or make decisions may be pulled via an integration. Let’s break this down a bit.

Rating is usually done in one of three ways:

- manually, often using an Excel rating sheet as a guide;

- by using a proprietary rating engine;

- by using Insurer or other party rating engine.

Rating engines store all the rules necessary for determining if a risk can be accepted and the rates and formulas required to calculate premiums.

Some platforms like Insly also have the capability to turn an Excel-based rater digital, so it can be used for web-based quoting via Broker or customer portals. For some real-life examples of MGA proprietary rating engines read more about how underwriting efficiency was improved through quick access to rates for Renovation Underwriting, OneClickCover, or Cactus.

Sometimes, instead of having your own rates, Insurer rates have to be used. Fortunately, more and more Insurers are making their rates accessible to partners via APIs, which any decent modern underwriting platform should be able to handle. In the case of Insly, it’s a matter of simple product configuration to change where (to which API endpoint) the request is sent when the calculate button is pushed. You might have some products with proprietary rating and some products with Insurer rates, but the user experience for the Underwriter or Broker will be equally seamless.

In our following post, we’ll talk about how integrations help Insurers and MGAs in insurance product distribution.