Data is high in volume and variety when it comes to running an insurance business. From applications data to claims and accounting – all of it has to be managed. Often, this means investing in several systems and results in a headache of managing multiple databases.

If you’re looking to build a business that scales, your systems need to talk to each other. That’s where integrations come into play. They create a smooth information flow that enables Insurers and MGAs to provide better insurance products.

First, let’s focus on the role of integrations from an insurance product building perspective. Find out which integrations Insly have implemented, which are available, and how these simplify MGA Managers’ and Product Owners’ job.

Integrations that Help MGA Managers and Product Owners

APIs are key to making the life of MGA Managers and Product Owners much easier. Instead of manual workflows, APIs allow you to automatically exchange and display data. Various API integrations are available on Insly to ensure that information runs instantly between different systems, processes are more efficient, and data can be enriched by using external databases.

There are many integrations already implemented or available on Insly:

- seamless document generation;

- quick and automated rating;

- up-to-date document storage;

- secure access to the insurance platform;

- claims management;

- access other market rates;

- data enrichment.

Native Integrations

Seamless Document Generation

Integrations can be extremely helpful for policy document generation and help you automate manual tasks, such as policy numbering or composing quote/policy decks for the customer.

Policy decks for complex products tend to contain large amounts of information that needs to be ingested to the document dynamically.

For easier document generation, Insurers and MGAs can use Insly native integration to Carbone. This service lets you easily create professional looking insurance documents allowing for a high degree of dynamic content such as selectable covers, large variety of endorsements or special clauses etc.

Document templates can be set to generate in pdf, word, or other formats depending on your preference.

Quick and Automated Rating

Putting a price on risk is at the heart of any underwriting business.

Insly is equipped with a fully API-based Rating Engine. This means that you can implement your raters not only for internal use, but also allow your partners to access your rates directly over API.

Implementing a new rater on the module is very similar to designing an insurance product rater in Excel – in fact, you can even upload your rates from Excel, map them to the quote form, and have yourself a fully digitised process.

Declines, referral rules, and Underwriter notes can be set to trigger automatically.

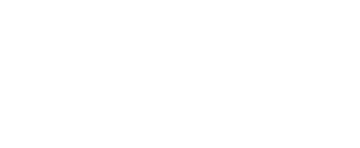

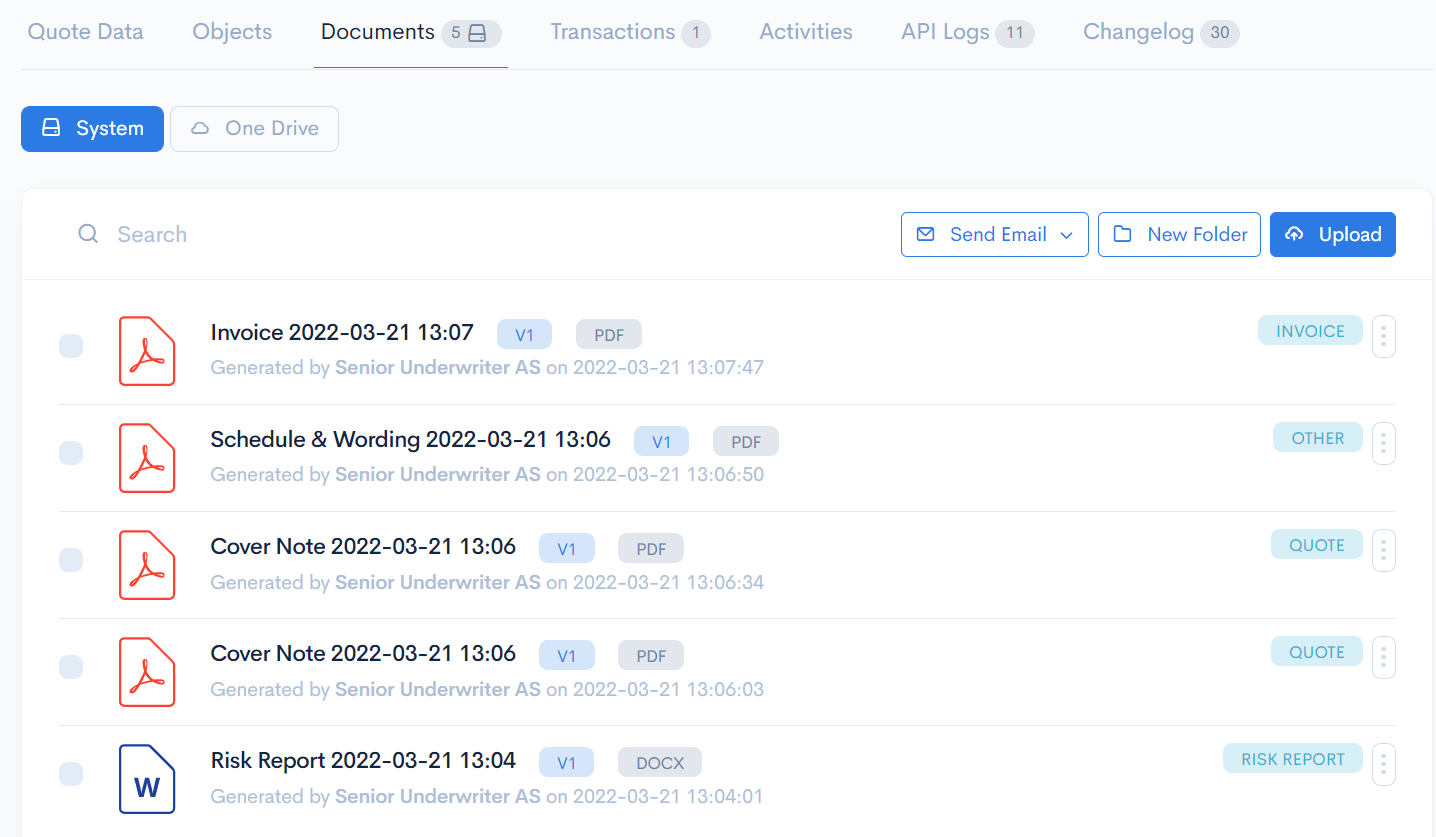

Up-to-Date Document Storage

No more back and forth between your email, underwriting system and client folders! To make document storage more convenient, Insly has built a two-way integration with Microsoft OneDrive. This way, when you add or change any files in your OneDrive client folder, it’s always updated in your underwriting system and vice versa.

Secure Access to the Insurance Platform

For increased security, we offer Google Authenticator integration for multi-factor authentication to log in to Insly insurance platform.

Available Integrations

Claims Management

To benefit Claim Handlers, Insly can offer integrations to various claims handling tools. You can continue using your claims management software and integrate it into Insly to use other functionalities of our insurance platform.

It’s actually common for Insurers and MGAs to use separate systems for claims handling for different business lines or in each of their branches, because linking the two is often too complex. This increases the costs of running, maintaining, and developing the systems. That’s why we will launch a brand-new claims management tool on Insly this May. Insly Claims will work seamlessly with our other modules (Product Builder, Underwriting, and Accounting), operate as a standalone claims handling system, or can be integrated into your existing stack.

Access Other Market Rates

Sometimes you need to present prices of more than one market, and many markets have online rating services available. This can be a win for MGA Product Managers as they only have to configure the underwriting platform to send data required to calculate prices and receive the results. The other party is responsible for rates management and updating.

Data Enrichment

There is a plethora of options when it comes to getting risk data and using it in your underwriting process. This is perhaps the biggest opportunity in terms of new insurance product design and innovation. Many Underwriters using Insly have made third party data sources a key component in their risk evaluation and pricing models.

In our following post, we’ll talk about how integrations help Insurers and MGAs in underwriting.

MGAs

MGAs Insurer

Insurer Broker

Broker