As the insurance market is experiencing the digital revolution and customers are more and more demanding online, insurers and MGAs have no other way than to adapt. The main questions at their hands are how to launch new products quickly and implement changes fast and conveniently.

Market Shift Towards No-Code Software

The market is being reshaped around customer needs online, so insurers and MGAs need the right tools to back up their business. It’s not about running an e-shop where your customers can add a cover or two to the shopping cart, but building a coherent system that will capture your needs and help to serve customers the best way possible.

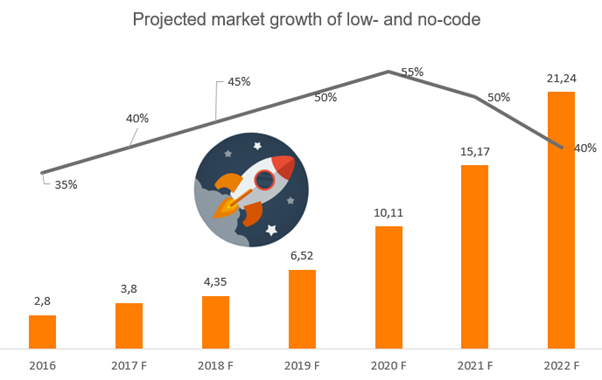

That is where the choice of insurance software is crucial. Legacy IT solutions have failed in meeting insurers’ needs for quick product launch and flexible change implementation. Due to this, insurance is facing a high tide of low-code and no-code solutions. Forrester predicts that the no-code development platform market will grow from $3.8 bn in 2017 to $21.2 bn in 2022. By 2025, it’s expected that at least 80% of development projects in insurance will involve low- and no-code technology.

Why No-Code Software Fits for Quick Product Launch

Besides facts and figures, how do these solutions actually support insurers and MGAs in quick product launch? No-code tools are meant for business and non-tech users, which is why they make almost anyone in your company able to design new insurance products. The golden ticket is their ease of use, no coding skills are required. In fact, ease of use was the most noted positive feature describing no-code development platforms based on customer reviews for all such development platforms companies.

The access no-code platforms enable to new product building is their main advantage. Having knowledge on your business and customer needs is enough to customise pre-built templates and create simple products. And not only do these platforms enable easy, but also quick product launch. One person can create a product workflow by dragging and dropping blocks – no complicated one-off development or long cycles. No-code software has the potential to reduce development time by 90%.

You get the opportunity to be more efficient by creating value for customers with more personalised on-demand products that are always up-to-date.

No-Code Software Is the Right Match for Flexible Changes

Speaking of change management, no-code insurance software is the right fit. No-code development platforms are built for change management at scale. If you need to make changes in your existing system, it takes only adding a new business logic or process, or a new design template to implement them. Instead of depending on the IT department and waiting for weeks to get your prayers answered, no-code software solves this in a few hours. For example, updating all your applications at once with new compliance standards, product conditions or branding requirements takes just one click.

As customers yearn for convenient online experience, this calls for integrating and unifying insurance processes. The trend is increased use of the internet to buy insurance products, and you need to be where your customer is. Products must be made available to customers at their convenience, including a simplified purchasing process. From insurers and MGAs’ perspective, this reflects, for example, in the use of social media as a distribution channel, but also in the growing implementation of SaaS solutions to enable insurance distribution across multiple channels.

Insurers need a solution that is able to encompass all channels, and transfer data between internal systems. No-code software is made for that. You don’t have to wrap your head around making changes in several places. When your insurance software is integrated into your other systems, which is really convenient with no-code, data moves across systems and single-entry of information is enough. This means up-to-date customer profile, convenient policy adjustments and a really personal approach – dynamically adding or removing selected covers or automatically implementing MTAs and endorsements. Changes can be made quickly throughout the customer journey from policy admin and claims to invoicing.

What Do MGAs Really Get from No-Code Software

The most important benefit is that no-code enables quick product launch and flexible change management. It’s important to tackle this problem right now, since overall business efficiency will increase the sooner you start using proper insurance software. You’ll get a competitive advantage, because launching and running products don’t require being an IT specialist and your employees can finally focus on meaningful work. Thanks to an integrated approach, change implementation is fast and convenient and your systems will play together as a fine-tuned orchestra.

You will also be able to serve your customers more personally. They will be more satisfied, since they sense that you put them first. You can adjust products according to customer needs and offer a convenient online customer journey.

If you are wondering where to begin or which software to choose, you can start from checking out a list of low- and no-code software providers for MGAs that we put together. You are more than welcome to reach out to us and ask for advice!

[/vc_column_text][/vc_column][/vc_row]