Online insurance sales still holds vast opportunities, yet plunging in can be risky and costly. This article will discuss how a tech startup would approach the challenge of launching an insurance product to online sales.

In a number of developed countries, online insurance sales has become an industry standard for brokers dealing in retail insurance lines such as motor, and to a lesser degree, property, travel and other products.

While online sales is indeed efficient and delivers value to all involved parties, it no longer poses a competitive advantage on these markets. You’re selling motor insurance online in UK or US? Great. But you’re hardly the only one doing so. It’s going to be an uphill battle in a crowded marketplace.

Find opportunities where no one else is looking

Good news is that there are still plenty of opportunities in other markets where online sales is still the future instead of present:

- niche / specialty products (e.g. cover for boats, caravans, musical instruments etc);

- mass products in countries with little online insurance sales.

Looking at the dizzying growth of e-commerce and its ever greater penetration to all retail industries, including retail finance, and more specifically, insurance, it is clear that in a dozen years or so, most insurance lines are bought and serviced online, everywhere across the globe. We have published a recent analysis of this trend. Now is the time to get in early.

However, you will face certain challenges in these markets. There are probably only a few insurers providing online quoting, if any. Insurers are usually slow to contribute to the shift to online distribution. As insurance thought leader Rick Huckstep points out: “(Insurers) had a decade of the Internet being mainstream to truly change through innovation and it hasn’t happened.” It is thus likely that you need to build your own premium calculators for instant online quote-and-bind (something we do for our clients in Insly on a daily basis).

It makes matters worse if you’re operating in a country where people are not used to online business – there’s no certainty that they will go outside their comfort zone to benefit from your offering.

How to paint yourself into a corner

The traditional “old-school” way to take on such an opportunity would be to “build it first, and see if they come”. It would involve investing considerable funds to building the online quote-and-bind system, surely measured in at least tens of thousands of dollars. This is the starting point where you can go live and start to get actual market feedback to your insurance offering, website, and marketing initiatives.

You might well hit the one-in-a-thousand chance of everything being adequate right out of the gate, however, I won’t count on it. Most probably it will be a hit-and-miss for many months to come, and since you have just poured tens of thousands into an IT-system, you are not inclined to invest even more in updating it to match the market appetites you’re discovering, since the online business has all but drained you of money thus far.

For the same reasons, there will neither be much appetite for throwing money around in marketing. In short, you will have painted yourself into a corner, stuck with a hefty “down payment” and an online offering that is just not picking up.

The “lean startup” way

This same problem of how to start operating in a highly uncertain market is routinely faced by all tech startups. Most of how we address this problem, originates from arguably the most renowned startup book “The Lean Startup” by Eric Ries.

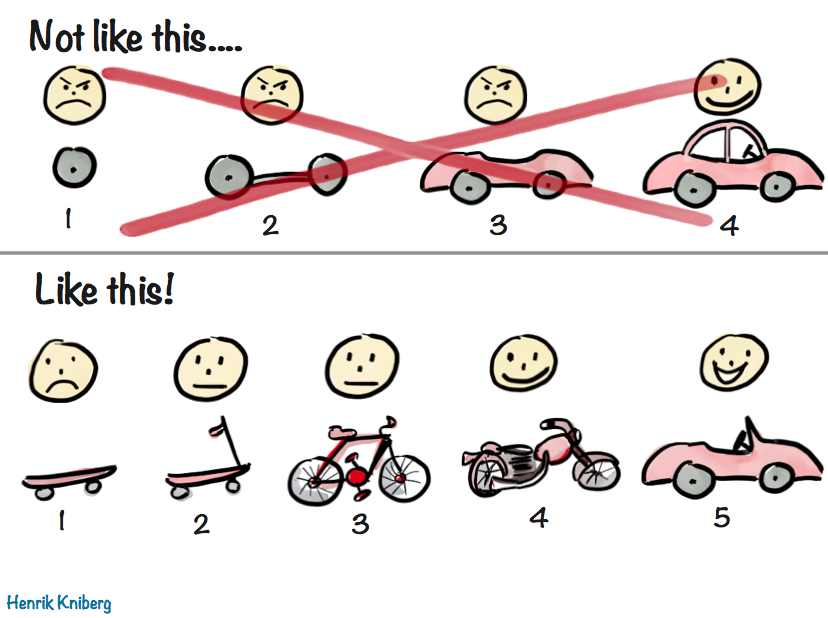

The lean startup approach suggests to move in tiny steps, launching a rudimental product as early as possible, and then develop it only step-by-step while learning from the market simultaneously. The main advantages are two-fold.

First, at no point are you invested far beyond your “horizon of knowledge”. Only when the basic rudimentary solution proves there’s some appetite for “that sort of thing”, will you take the next step in investing in the solution. Second, since you are developing the online solution together with market-based learning, you don’t waste resources developing something no one wants.

Step-by-step guide

How would it look like in the case of online insurance sales? Although your specific product lines or market could warrant a different approach, I have plotted a typical lean startup based strategy below, stage by stage.

Stage 1: Landing page

For this stage, you don’t even need the capability to actually sell any insurance products. Build a landing web page for your planned online insurance product, together with a form asking for visitor’s name and email address. Do small-scale online advertising on Google/Facebook (with $1 per visitor, already $300 can be sufficient to obtain a market insight). Now is the time to start tuning your marketing target groups and messages. When the form is filled out by a visitor, her input is recorded, and a message is displayed that you’ll let her know, once the sales starts. You can precisely measure the marketing expenditure for one prospective customer, and on top of it, you’ll get a database of interested customers.

Tools

- Landing page platform. There are many free or inexpensive landing page creation tools available. Many offer inline text editing and drag-and-drop design. You can try Landerapp.

- Advertising. You’ll want to advertise in channels that are simple to manage and provide precise targeting, and measurement of outcomes. Facebook Ads is by far the best starting option in many markets.

- Design. You might want to design your logo and some infographics or other visual assets to promote your offering. You can get “good enough” level design work at extremely low cost on “crowdsourcing” platforms such as Fiverr and Upwork. It’s a hit-and-miss, but try with several suppliers and you’ll find someone doing decent work.

Stage 2: Minimum Viable Product (MVP)

The cornerstone of the lean startup method, an MVP is the least expensive and tiniest product that still works. Once you have proven that customers want what you are about to offer, it’s time to start actual sales. Extend your landing page with a quoting form. When a customer fills in the form, create quotes manually, and send to her by email. Sure, it’s less convenient for customers than a full-fledged online transaction. But in the case of niche or new markets, customers don’t have the full online experience anywhere else, anyway.

Content Management System (CMS). In this stage, you’ll want a full-featured website with different content sections and a form building feature. Voog.com is a clean and secure option that doesn’t require IT skills. WordPress is more complex to install and maintain but provides more functionality through add-in plugins.

Stage 3: End-to-end online solution

In the earlier stages, you have validated that there is demand for your online offering, and learned how to make it more appealing to the customer. If everything went well, you might by now have more quote requests from your web page than you can handle. Now is the time to build a full online quote-and-buy experience, together with automatic generation and email delivery of documents, and a credit card payment gateway.

Tools

- Online sales system. The only universal online insurance sales system we know of is Insly CloudSales. Read about CloudSales here.

- Payment gateway. For accepting payments online, you’ll need a merchant account and a credit card payment gateway. Many suppliers provide both, together. Also, check if the supplier allows insurance premiums collection on their platform – some don’t. Braintree is a good candidate.

- Policy administration. You’ll also need a customer and policy management system for automatic processing and quote/bind. Insly is one of the most universal, affordable and easiest to adopt. Drop us a line and let’s discuss how we can help.

Next steps

Regardless of the market you operate in – if you’re selling retail, online distribution holds opportunities for you both in scaling up the business and achieving greater efficiency. It’s just the matter of finding the sweetspot and the way of getting there.

This is not something you will achieve by executing one great strategy in a single stroke of genius but rather an incremental journey of small-scale experimentation – one that is best served by the same lean approach practiced by every successful tech startup in the world.

Tip your toe in the water by presenting online clientele with different product propositions and see what sticks – and you’ll have a foundation for your online success.

Image: Henrik Kniberg