Automated Underwriting for MGAs: 5 Reasons Why You Should Invest

Deciding between manual underwriting vs. automated underwriting is a significant challenge for MGAs. But the benefits of introducing an automated underwriting system are now undeniable. An effective underwriting function is critical to success as an MGA. Accurately deciding whether you can write a policy, and for how much, ensures that you won’t face excessive claims […]

Automate Underwriting: Guide to Measuring ROI

Automation has revolutionised insurance. Advanced solutions like automated underwriting software helps insurers streamline operations, increase productivity, reduce costs, and fuel growth. However, measuring the return on your automation investment requires a solid understanding of your processes, time saved, and so on. If you want to learn more about how automation improves your different underwriting KPIs […]

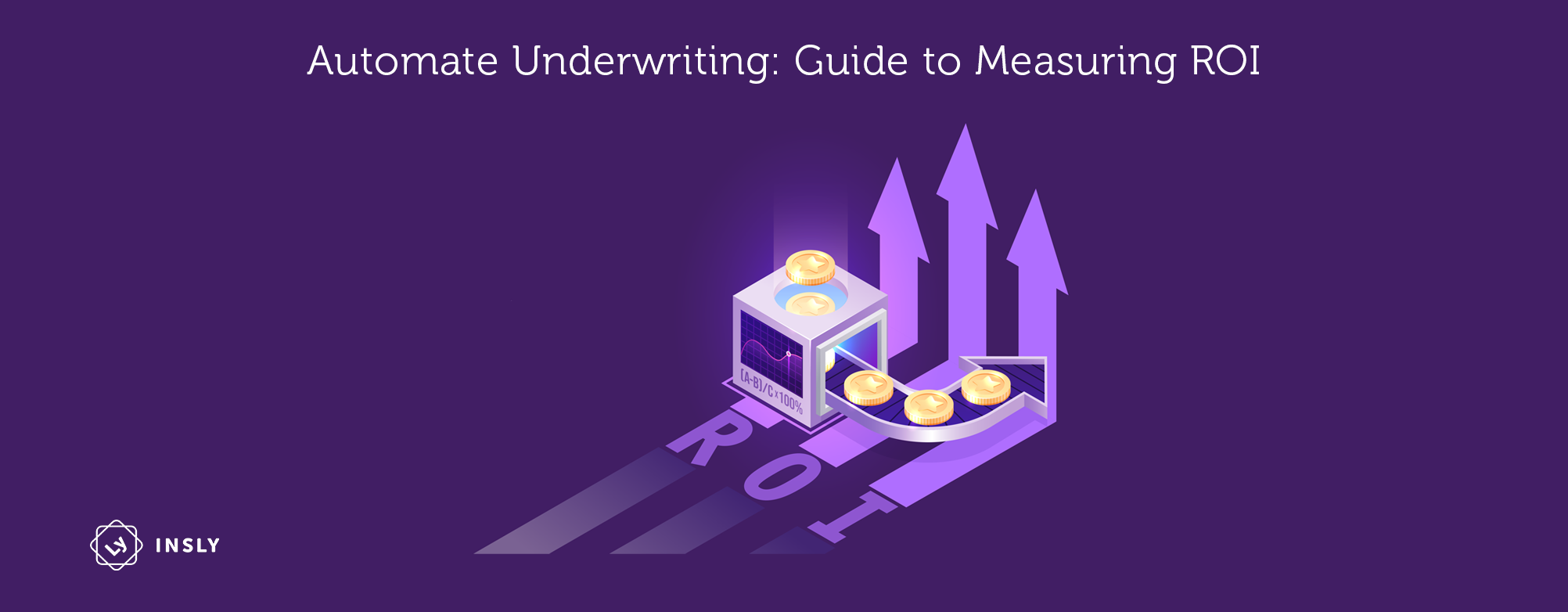

Insurance Underwriting Automation: How INSLY and MGA Encompass set up a Broker Portal for BIBA in Two Weeks

MGA Encompass – Specialist MGA for Property Damage and Liability Cover MGA Encompass was founded in 2015 and provides all-in-one cover for SMEs that need Property Damage and Liability insurance. The organisation offers coverage options for various industries, including contractors, warehousing, retailers, manufacturers, office, and property owners. So it must be able to create insurance […]

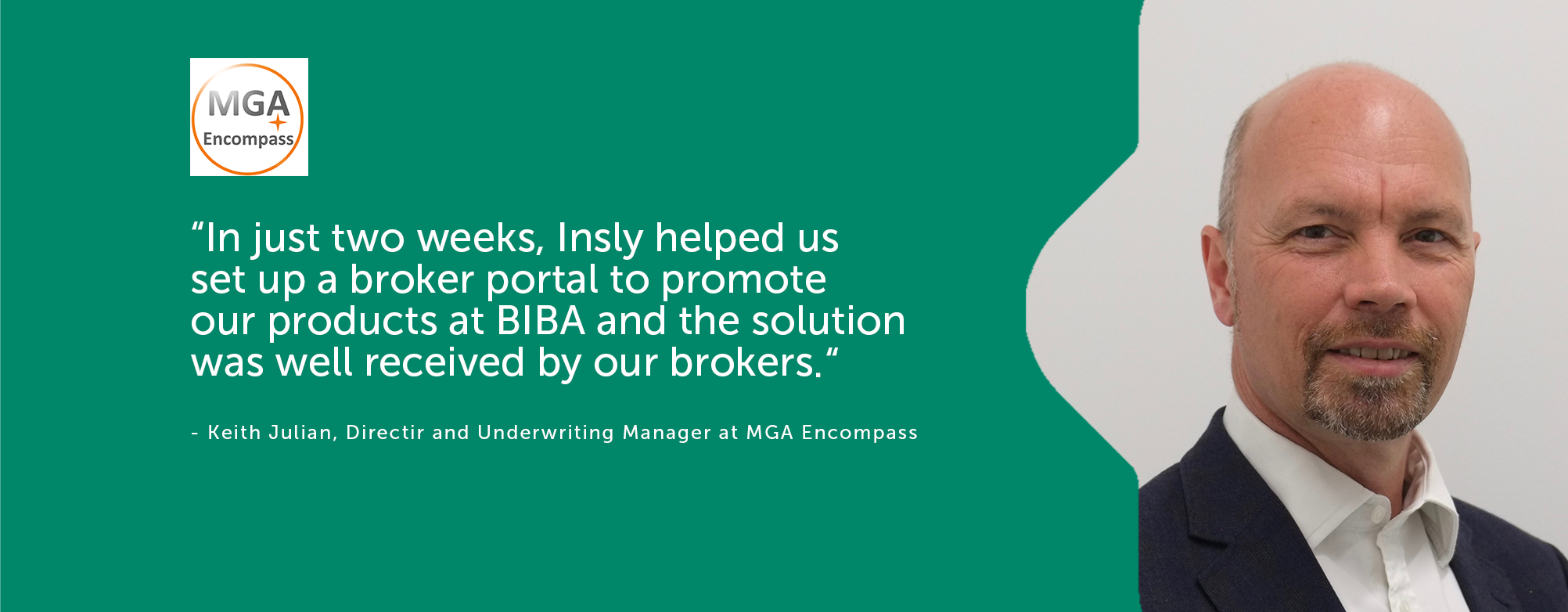

The Improved Way of Quote and Bind for Underwriters

Previous way of underwriting Back-and-forth e-mails from brokers, double-keying risk, policy, and price information, navigating between spreadsheets to calculate premiums – does that sound familiar? All of this is a common part of a commercial underwriter’s daily routine and their Quote and bind process. A manual underwriting workflow absorbs a lot of time and has […]

Rating Engines – Threat to Human Underwriters or the Ultimate Underwriting Aid?

Rating is a core success factor for insurers and MGAs, impacting directly their performance and business results. Rating can be done manually, using multiple spreadsheets and systems for data storing and calculations. This is laborious, error-prone, and extremely time-consuming. Insurers and MGAs can choose an alternative and use rating engines for efficient automated underwriting. Rating […]

MGAs

MGAs Insurer

Insurer Broker

Broker